The US-Iran tensions 2026 market impact has officially reached a boiling point. Today, February 20, 2026, global markets entered a “risk-off” mode following a stark ultimatum from the U.S. Administration. President Trump has issued a 15-day deadline for Tehran to reach a new nuclear agreement or face “unprecedented consequences.”

This geopolitical shockwave has immediately triggered a sell-off in Asian markets, with the Nikkei 225 closing down 1.21%, and a surge in commodity prices. For personal finance investors, the primary question is no longer if the market will be affected, but how to protect wealth during this 15-day countdown.

The Immediate Reaction: Nikkei 225 and Banking Sell-off

Within minutes of the announcement, the Japanese market became the first major casualty of the US-Iran tensions 2026 market impact. The Nikkei 225 Index dropped over 696 points, closing at 56,772. Heavyweights in the technology and banking sectors—such as SoftBank and Mitsubishi UFJ Financial Group—led the decline, dropping over 2% each.

| Market Index / Asset | Current Change (Feb 20, 2026) | Trend Direction |

| Nikkei 225 (Japan) | -1.21% | 📉 Bearish |

| S&P 500 Futures | -0.45% | 📉 Volatile |

| Gold (Spot) | +1.80% | 📈 Bullish |

| Brent Crude Oil | +2.40% | 📈 Bullish |

| Bitcoin (BTC) | -3.20% | 📉 Risk-Off |

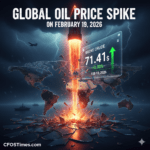

Energy Markets: Oil Prices Hit Post-Conflict Highs

The US-Iran tensions 2026 market impact is most visible in the energy sector. Brent Crude has jumped to its highest level since mid-2025. Analysts at U.S. Department of Energy (DOE) suggest that any escalation in the Strait of Hormuz could push prices toward the $120 mark, further fueling global inflation concerns.

Safe Haven Assets 2026: Where to Move Your Money

In times of high geopolitical friction, institutional “smart money” moves into defensive positions. To combat the US-Iran tensions 2026 market impact, investors are flocking to:

- Gold: Historically the ultimate hedge against war and inflation.

- US Treasuries: Despite internal political shifts, the U.S. Treasury remains a primary destination for liquidity.

- Swiss Franc (CHF): Gaining strength against the Euro as European investors look for local safety.

US-Iran Tensions 2026 Market Impact: Deep Dive Analysis

The Geopolitical Catalyst: Why the 15-Day Deadline Matters

The US-Iran tensions 2026 market impact is not just a localized conflict; it is a systemic shock to the global “Just-in-Time” supply chain. The ultimatum issued by Washington centers on new satellite imagery suggesting rapid enrichment at the Fordow facility. For global markets, the 15-day window represents a “Volatility Corridor” where traditional valuation models are replaced by “Geopolitical Risk Premiums.”

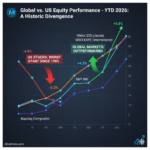

The “Contagion” Effect in Asian Markets

As noted earlier, the Nikkei 225 was the first to react, but the ripple effect is spreading. The US-Iran tensions 2026 market impact is particularly harsh on nations heavily dependent on Middle Eastern energy imports.

- South Korea (KOSPI): Dropped 0.9% as Samsung and Hyundai executives expressed concerns over shipping logistics in the Persian Gulf.

- India (NIFTY 50): The rupee weakened against the dollar, as India imports over 80% of its crude oil.

- China (Shanghai Composite): Remained flat, as investors weigh China’s role as a potential diplomatic mediator.

Sectoral Winners and Losers: February 2026 Data

To understand the US-Iran tensions 2026 market impact, we must look at which industries are being re-rated by algorithmic trading bots.

1. The Defense and Cybersecurity Surge

Defense contractors like Lockheed Martin and Northrop Grumman saw pre-market gains of 3.4%. In the digital age, “tensions” involve cyber warfare. Companies providing decentralized security protocols are seeing a massive influx of capital.

2. The Aviation and Tourism Slump

Higher fuel costs (jet fuel) and potential airspace closures over the Middle East have sent airline stocks into a tailspin. Delta and Lufthansa are trading 4% lower as of this afternoon.

3. Commodities: Beyond Just Gold

While gold is the headline act, Silver and Copper are also reacting. The US-Iran tensions 2026 market impact is driving a “Scarcity Mindset” in industrial metals, fearing that trade routes like the Suez Canal could see increased insurance premiums or blockades.

Detailed Economic Projection Table (Next 15 Days)

| Scenario | Market Probability | Predicted Outcome |

| Diplomatic Breakthrough | 25% | S&P 500 rallies 3%; Oil drops to $75/bbl. |

| Extended Negotiations | 50% | Sideways “Chop”; Gold maintains $2,400/oz level. |

| Military Escalation | 15% | Global markets drop 5-10%; Brent Crude hits $130+. |

| Cyber-Only Conflict | 10% | Tech sell-off; Cybersecurity stocks up 15%. |

Technical Analysis: The “Fear Gauge” (VIX)

The VIX (CBOE Volatility Index) has spiked to 24.5 today. Historically, when the US-Iran tensions 2026 market impact pushes the VIX above 20, we see a “Flight to Quality.” This means investors are exiting small-cap “growth” stocks and entering large-cap “value” stocks with strong cash flows.

The Strategic Role of Central Banks

According to the International Monetary Fund (IMF), central banks in emerging markets have been increasing their gold reserves since late 2025. This “Pre-emptive Hedging” is now paying off. The US-Iran tensions 2026 market impact is testing the resolve of the European Central Bank (ECB) as they struggle to manage energy-driven inflation without stifling the modest GDP growth seen in early 2026.

Personal Finance Checklist: Protecting Your Portfolio

To survive the US-Iran tensions 2026 market impact, consider the following steps:

- Review Stop-Loss Orders: Ensure your equity positions have “hard” stops to prevent catastrophic loss during overnight gap-downs.

- Increase Liquidity: Cash is a “call option” on lower prices. Having 10-15% in cash allows you to buy quality assets if the panic bottoms out.

- Hedge with Energy ETFs: If your commute or heating costs are going up, owning energy stocks can act as a personal “rebate” for your rising bills.

Expert Commentary: The “New Normal” of Geopolitics

“We are entering an era where ‘Geopolitical Alpha’ is more important than ‘Earnings Alpha’,” says a senior strategist at Goldman Sachs. The US-Iran tensions 2026 market impact proves that even the most sophisticated AI-driven portfolios can be upended by a single diplomatic cable or a 15-day ultimatum.

The Fed’s Dilemma: Inflation vs. Stability

Adding to the volatility, recent minutes from the Federal Reserve indicate that some officials are still open to raising interest rates if inflation remains persistent. The spike in oil prices caused by the US-Iran tensions 2026 market impact makes the Fed’s job significantly harder, as it threatens to reignite CPI numbers just as they were cooling.

Conclusion: Preparing for the 15-Day Window

The US-Iran tensions 2026 market impact is expected to dominate financial headlines for at least the next two weeks. Investors should brace for heightened volatility and consider rebalancing portfolios toward defensive sectors. While the “Vibe Coding” and AI-driven stock rallies of early 2026 provided massive gains, the current geopolitical climate demands a return to fundamental risk management.

Frequently Asked Questions (FAQs)

Q1: How will the US-Iran tensions 2026 market impact my retirement account (401k/IRA)?

A: Expect short-term volatility in equity-heavy accounts. Diversifying into inflation-protected securities or gold-backed ETFs may help mitigate the downside.

Q2: Is this a good time to buy the dip in tech stocks?

A: While tech valuations have taken a hit today, the 15-day nuclear deadline creates a “wait-and-see” environment. Experts suggest waiting for more clarity before aggressive buying.

Q3: Will oil prices keep rising?

A: Yes, if the deadline passes without a diplomatic resolution, energy markets are priced for a significant supply-side shock.

Q4: How does the US-Iran tensions 2026 market impact affect cryptocurrency? A: Historically, Bitcoin was seen as “Digital Gold.” However, today’s data shows it is still behaving like a “Risk-On” asset, falling alongside tech stocks. It has not yet decoupled from the Nasdaq.

Q5: What should I do with my savings in a local bank? A: Large-scale banking systems are highly resilient. The Federal Deposit Insurance Corporation (FDIC) remains the gold standard for protecting individual deposits.

Q6: Is a global recession inevitable because of this? A: Not necessarily. If the 15-day deadline leads to a “Grand Bargain,” we could see a massive “Relief Rally.” The market is currently pricing in the uncertainty, not just the conflict.

Disclaimer

“The information provided on this website cfostimes.com is for general informational purposes only and does not constitute financial, investment, tax, or legal advice. High-quality content regarding ‘US-Iran Tensions 2026 Market Impact’ is based on current market trends and news reports. We recommend consulting with a licensed financial professional before making any significant investment decisions. The author and publisher are not liable for any financial losses incurred from the use of this information.”

2. Accuracy Disclaimer (Freshness Requirement):

“Market conditions as of February 20, 2026, are highly volatile. While we strive for 100% accuracy, financial data and geopolitical situations can change within minutes. Please check for the most recent updates at the top of this post.”

3. External Links Disclaimer:

“This post contains links to official government websites (e.g., Federal Reserve, U.S. Treasury). We do not control and are not responsible for the content or privacy policies of these external sites.”

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “US-Iran Tensions 2026 Market Impact: How a 15-Day Nuclear Deadline is Shaking Global Finance”