Introduction to the Trump South Korea Auto Tariffs 25% Update

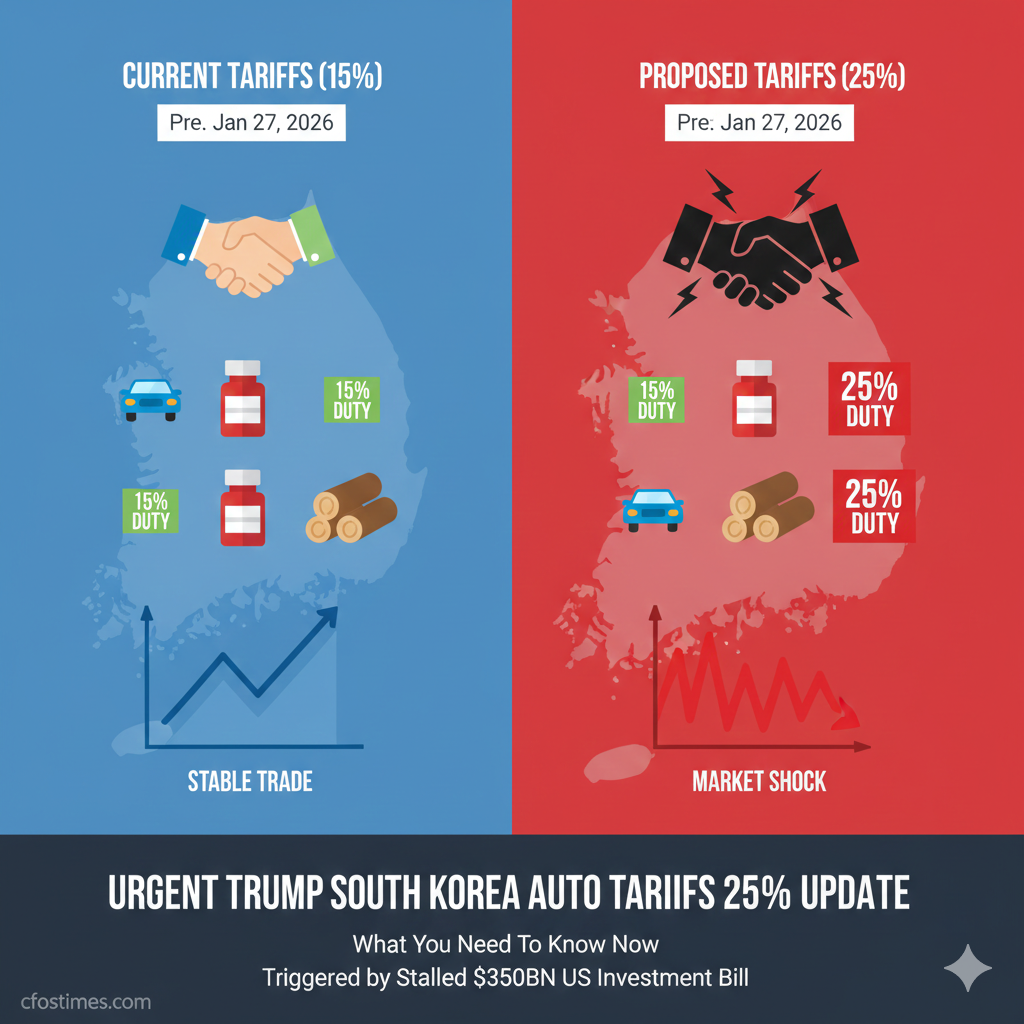

On Tuesday, January 27, 2026, the global automotive and financial sectors were sent into a state of high alert following a sudden Trump South Korea auto tariffs 25% update. In a late-night social media announcement, U.S. President Donald Trump declared his intention to raise reciprocal tariffs on South Korean imports—specifically targeting automobiles, pharmaceuticals, and lumber—from the current 15% back to a staggering 25%.

This move marks a dramatic reversal of the trade stability markets had anticipated for 2026. The White House justified the hike by citing the South Korean National Assembly’s failure to ratify a historic trade deal finalized in late 2025. This Trump South Korea auto tariffs 25% update has already triggered emergency meetings in Seoul and led to a sharp sell-off in major automotive shares on the Korea Exchange.

Table of Contents

1. Why Now? The Catalyst for the Trump South Korea Auto Tariffs 25% Update

The core of the Trump South Korea auto tariffs 25% update lies in the “Gyeongju Agreement,” a landmark framework established in July 2025. Under this pact, the U.S. lowered tariffs to 15% in exchange for a massive $350 billion investment pledge from South Korea into the American industrial base.

- Legislative Stalling: President Trump stated, “South Korea’s Legislature is not living up to its Deal with the United States,” specifically criticizing the delay in enacting the necessary bills to facilitate the investment.

- The $350 Billion Commitment: The promised funds include $200 billion in cash and $150 billion in shipbuilding and industrial cooperation. However, Seoul has struggled with the implementation, citing a weak won and concerns over currency outflows.

- Impatience in Washington: U.S. Commerce Secretary Howard Lutnick has reportedly grown frustrated with the pace of implementation, leading to this “reciprocity” warning.

2. Financial Market Reaction: Hyundai and Kia Stocks Under Siege

The impact of the Trump South Korea auto tariffs 25% update was felt immediately as markets opened in Seoul. Automotive exports represent nearly 27% of South Korea’s total shipments to the U.S., making the sector highly sensitive to any duty changes.

| Company | Initial Stock Drop (Jan 27) | Current Market Status |

| Hyundai Motor | -4.16% | High Volatility |

| Kia Corp | -5.19% | Significant Pressure |

| Hyundai Mobis | -5.16% | Supply Chain Uncertainty |

Investors are pricing in the risk that a return to 25% tariffs would erase the competitive parity South Korean automakers recently achieved with Japanese and European rivals, who currently enjoy a 15% rate.

3. Seoul’s Response: Blue House Emergency Measures

Following the Trump South Korea auto tariffs 25% update, the South Korean presidential office (Blue House) convened an emergency meeting of policy chiefs and related ministries to formulate a counter-strategy.

- Fact-Finding Mission: Industry Minister Kim Jung-kwan, currently in Canada for submarine sales talks, has been ordered to proceed directly to Washington D.C. for urgent consultations with Secretary Lutnick.

- Commitment to the Deal: The Blue House spokesperson, Kang Yu-jung, emphasized that Seoul remains fully committed to the investment package but noted that “administrative procedures” in the U.S. must be finalized before tariffs can actually rise.

- Legislative Acceleration: In response to the threat, the South Korean ruling party announced it would work with the opposition to speed up the passage of the five pending investment bills by the next session starting February 3.

4. Long-Term Implications of the Trump South Korea Auto Tariffs 25% Update

The Trump South Korea auto tariffs 25% update serves as a wake-up call for global trade partners in 2026. It highlights that “agreements in principle” are subject to immediate revision if domestic legislative timelines do not align with Washington’s expectations.

- Reshoring Acceleration: Analysts expect South Korean firms to accelerate their reshoring efforts, shifting more production to U.S.-based plants in Georgia and Alabama to mitigate tariff risks.

- Sectoral Contagion: Beyond autos, the mention of pharmaceuticals and lumber indicates a broader willingness to use sector-specific duties as leverage for geopolitical and economic demands.

- Market Uncertainty: As Josh Lipsky of the Atlantic Council noted, this update is a reminder that “markets were wrong to believe in tariff stability in 2026.”

Frequently Asked Questions (FAQs)

What does the Trump South Korea auto tariffs 25% update mean for U.S. consumers?

If the 25% tariff is enacted, the price of popular imported South Korean models (such as the Hyundai Tucson or Kia EV6) could rise significantly. However, vehicles manufactured at Hyundai’s U.S. plants remain unaffected.

Is the $350 billion investment still happening?

Yes. The South Korean government has reaffirmed its commitment, but the Trump South Korea auto tariffs 25% update indicates that the U.S. will use high tariffs as a “stick” until the legislative work is completed in Seoul.

When will the 25% tariffs actually start?

While the announcement has been made on social media, official administrative notices from the USTR have not yet been issued. South Korean officials are treating this as a critical “window of negotiation.”

Which industries are most at risk?

The automotive sector is the primary target, but the Trump South Korea auto tariffs 25% update also explicitly names the pharmaceutical and lumber industries as secondary targets for reciprocal duties.

Conclusion

The Trump South Korea auto tariffs 25% update has injected a fresh wave of volatility into the 2026 trade landscape. While the Blue House is attempting to respond with “composed and calm” diplomacy, the pressure on the South Korean National Assembly to act is now immense. As Minister Kim Jung-kwan prepares for his high-stakes meeting in Washington, the global business community remains on edge, waiting to see if this tariff threat is a final negotiating tactic or the beginning of a prolonged trade conflict.

Disclaimer:

The information on CFOs Times regarding the Trump South Korea auto tariffs 25% update is for general informational purposes only and is provided in good faith without any warranties regarding its accuracy or completeness. Users assume all risks associated with the use of the site and the information provided, and it does not constitute professional financial or legal advice; consultation with a certified financial advisor is recommended before making decisions based on this update.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “Trump South Korea Auto Tariffs 25% Update: A Critical Market Shift”