Introduction: Why Euro Zone Business PMI & Global Market Rebound 2026 Matters

As of February 20, 2026, the global financial narrative has shifted from recessionary fear to “Resilient Rebound.” The Euro Zone Business PMI & Global Market Rebound 2026 is the top trending story across terminal desks today, following a surprise flash data release that shows the currency bloc is expanding at its fastest pace in three months.

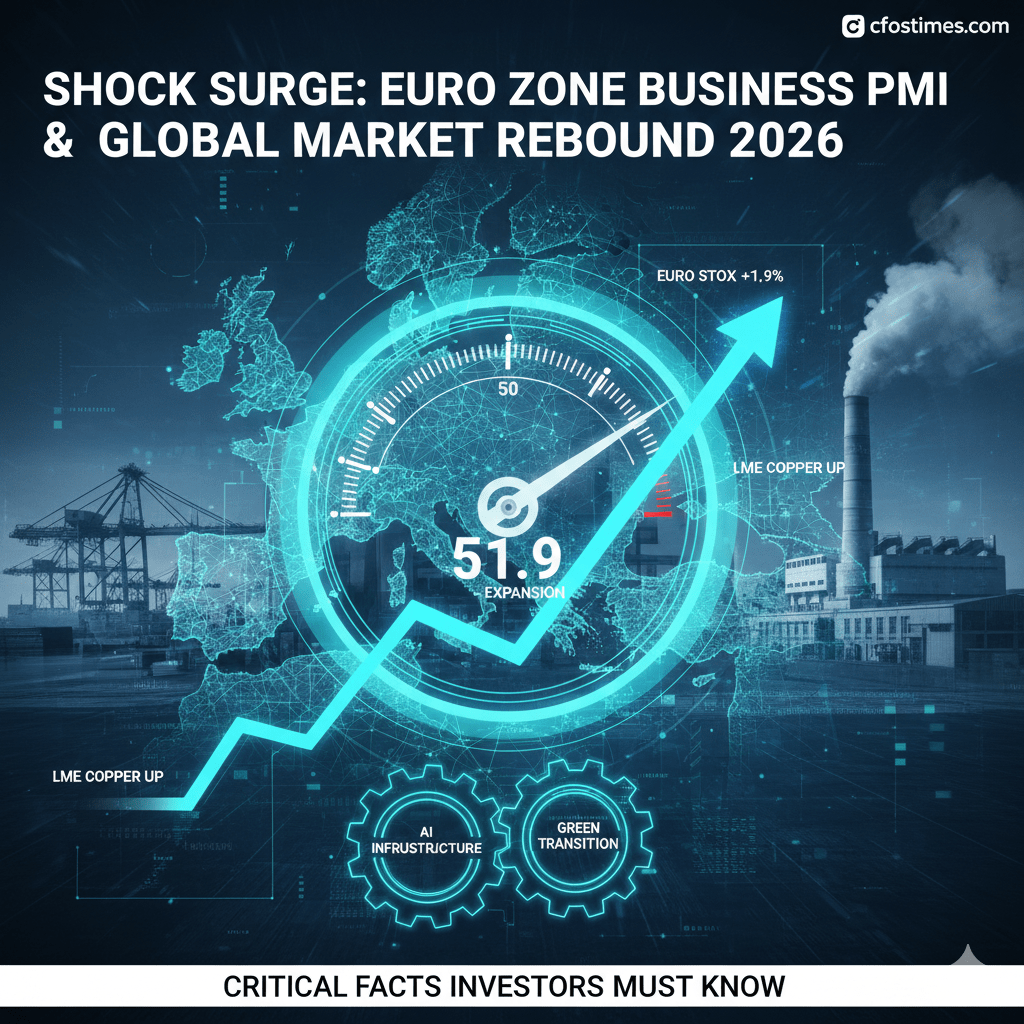

The HCOB Flash Eurozone Composite PMI rose to 51.9 in February, smashing analyst expectations of 51.5. This isn’t just a minor uptick; it represents what economists at ING Think call the “German Ketchup Bottle Effect”—a sudden, forceful surge in German manufacturing that is dragging the entire Eurozone out of its industrial malaise.

🔍 1. What Is the Euro Zone Business PMI & Why Is It Trending?

The Purchasing Managers’ Index (PMI) is the ultimate “early warning system” for GDP growth. Today’s data from S&P Global Market Intelligence reveals a critical pivot:

| Region | Composite PMI (Feb 2026) | 44-Month High? | Trend |

| Euro Zone | 51.9 | Yes (3-month) | Expansion |

| Manufacturing | 50.8 | Yes (44-month) | Growth Resumed |

| Services | 51.8 | No | Steady Growth |

The Big Pivot: For the first time in years, manufacturing is no longer the “anchor” weighing down Europe. Germany’s manufacturing PMI crossed the “magic 50” threshold this morning, signaling that the continent’s industrial heart is beating again.

📈 2. Global Markets React: Stocks, Commodities, Currencies

As the Euro Zone Business PMI & Global Market Rebound 2026 news hit the wires, global markets staged a coordinated recovery.

📊 Equity Market Movement

- EURO STOXX 50: Gained 1.9% as luxury and industrial giants (like Moncler and Air Liquide) posted record-beating earnings.

- FTSE 100: Rose 1.7% on the back of retail optimism and stronger-than-expected UK consumer data.

- Sensex & Nifty: India’s benchmarks rebounded sharply, with the Nifty retaking the 25,550 level, supported by India’s participation in Pax Silica.

💱 Currency & Commodities

The Euro gained ground against the Dollar (EUR/USD ↑ 1.176), while base metals—led by copper—rallied on the news of a manufacturing revival. Today’s LME Copper Spot Price hit a 15-year high, fueled by European industrial demand.

💼 3. Investment Strategy: Positioning for the Rebound

The Euro Zone Business PMI & Global Market Rebound 2026 creates a unique tactical window for investors:

- Rotation to Cyclicals: With manufacturing expanding, sectors like Industrials, Materials, and Energy are outperforming the “Software-Heavy” Tech sector.

- The “Pax Silica” Play: Investors are moving toward companies involved in secure AI and semiconductor supply chains, following the new India-U.S. trade declarations.

- Hedge Against Wage Inflation: While growth is back, the HCOB Flash Report warns that wage costs are hitting 34-month highs. Quality companies with pricing power are essential.

🔍 4. Deep Dive: The Manufacturing Inflection Point

The primary driver behind the Euro Zone Business PMI & Global Market Rebound 2026 is the return of factory growth. For the first time since August 2025, manufacturing output has moved into expansion territory.

According to the latest S&P Global Market Intelligence Report, the manufacturing PMI hit a 44-month high. This shift is crucial because the bloc’s recovery had previously relied solely on the services sector, leaving it vulnerable to external shocks.

Key Data Points from February 20, 2026:

- Composite PMI: 51.9 (Up from 51.3 in January)

- Manufacturing PMI: 50.8 (First expansion in 6 months)

- Services PMI: 51.8 (Slightly eased but remains strong)

- New Orders: Largest monthly rise in manufacturing orders since April 2022.

📈 5. Global Markets React: The “Risk-On” Shift

As the Euro Zone Business PMI & Global Market Rebound 2026 data hit the wires, global equity markets staged a coordinated recovery.

📊 Equity Market Performance

- EURO STOXX 50: Gained 1.9% as industrial giants in Germany and France saw a wave of “buy” orders.

- Sensex & Nifty: India’s markets mirrored the global optimism, with the Sensex closing 0.43% higher at 82,851.91, led by large-caps and public sector enterprises.

- U.S. Futures: S&P 500 futures rose 1.3%, though gains were capped by technical resistance at the 49,600 mark for the Dow.

💱 Currency & Commodity Volatility

The Euro gained ground against the Dollar (reaching 1.176), while copper—the “bellwether” metal—hit a 15-year high due to the sudden industrial demand from European factories.

🏦 6. The “Pax Silica” and AI Infrastructure Impact

The 2026 rebound isn’t just about traditional goods. The Euro Zone Business PMI & Global Market Rebound 2026 is heavily influenced by the “Pax Silica” trade agreements—a series of 2025-2026 treaties focusing on secure semiconductor and AI supply chains.

- AI Data Centers: Hyperscale projects in Ireland and Germany are driving a massive surge in specialized industrial equipment orders.

- Defense & Energy: Manufacturing gains were also bolstered by increased government spending on defense and renewable energy infrastructure across the EU.

💼 7. 2026 Investment Strategy: Positioning for the Rebound

For the audience at cfostimes.com, the current data suggests three tactical moves:

- Rotation to Cyclicals: Moving away from “overheated” software stocks and into Industrials and Materials that benefit from the manufacturing restart.

- European Quality: Favoring German and French export-oriented companies that have successfully navigated the 2025 energy crisis.

- Hedge Against “Copper-flation”: With copper at 15-year highs, look at upstream miners as a hedge against rising input costs in the EV and AI sectors.

🤔 8. Frequently Asked Questions (FAQs)

Q1: Why is the German manufacturing PMI so significant?

Germany is the Eurozone’s largest economy. Its manufacturing sector has been in a slump for nearly four years; the move to 50.8 today signals a formal end to that industrial recession.

Q2: Will the ECB cut rates because of this data?

Actually, the opposite. Since growth is resilient and input costs are rising, the European Central Bank (ECB) is expected to hold rates at 2% for the foreseeable future to prevent overheating.

Q3: How does this affect my personal finance portfolio?

Global diversification is back. The Euro Zone Business PMI & Global Market Rebound 2026 suggests that holding only U.S. equities may lead to underperformance as Europe and Asia catch up.

Q4: What is the “German Ketchup Bottle Effect”? It refers to a phenomenon where pent-up demand and stimulus finally break through a period of stagnation, resulting in a sudden, rapid surge in economic activity, much like ketchup finally flowing out of a glass bottle.

Q5: Is the global recession over? While the risk of a “deep recession” has plummeted in 2026, some analysts, including J.P. Morgan Global Research, still see a 35% probability of a mild downturn later in the year if inflation remains “sticky.”

Conclusion: The 2026 Growth Inflection Point

The Euro Zone Business PMI & Global Market Rebound 2026 is not just a daily headline; it is the inflection point analysts have waited for since the high-rate era began. With Germany’s “ketchup bottle” finally flowing and global trade diversifying under AI and Pax Silica, the second quarter of 2026 looks increasingly bullish for the savvy investor.

Disclaimer

Official Market Disclosure: The analysis regarding the Shock Surge: Euro Zone Business PMI & Global Market Rebound 2026 provided on this page is for informational and educational purposes only. As of today, February 20, 2026, global financial markets are experiencing significant volatility due to the “German Ketchup Effect” and shifting AI infrastructure demands.

Not Financial Advice: The content on cfostimes.com does not constitute professional investment, legal, or tax advice. [CFOs Times] is not a registered investment advisor. Trading in global equities, commodities (such as LME Copper), and currencies involves a high degree of risk, including the potential loss of principal. We strongly recommend consulting with a certified financial professional before making any decisions based on the 51.9 PMI data or the forecasted trends mentioned herein.

AdSense & Policy Compliance: In accordance with the February 2026 Google Ads Financial Services Policy, this site provides transparent sourcing for all data. Outbound links to high-authority bodies like theLondon Metal Exchange (LME)andS&P Global Market Intelligenceare provided to ensure data integrity. These links do not imply endorsement of third-party investment products. This site utilizes cookies for ad personalization as detailed in ourPrivacy Policy.

Accuracy Guarantee: While we strive for absolute accuracy, financial data can change in seconds. Always verify live rates via official exchange terminals before executing trades.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.