Introduction: A Historic Milestone for the Red Metal

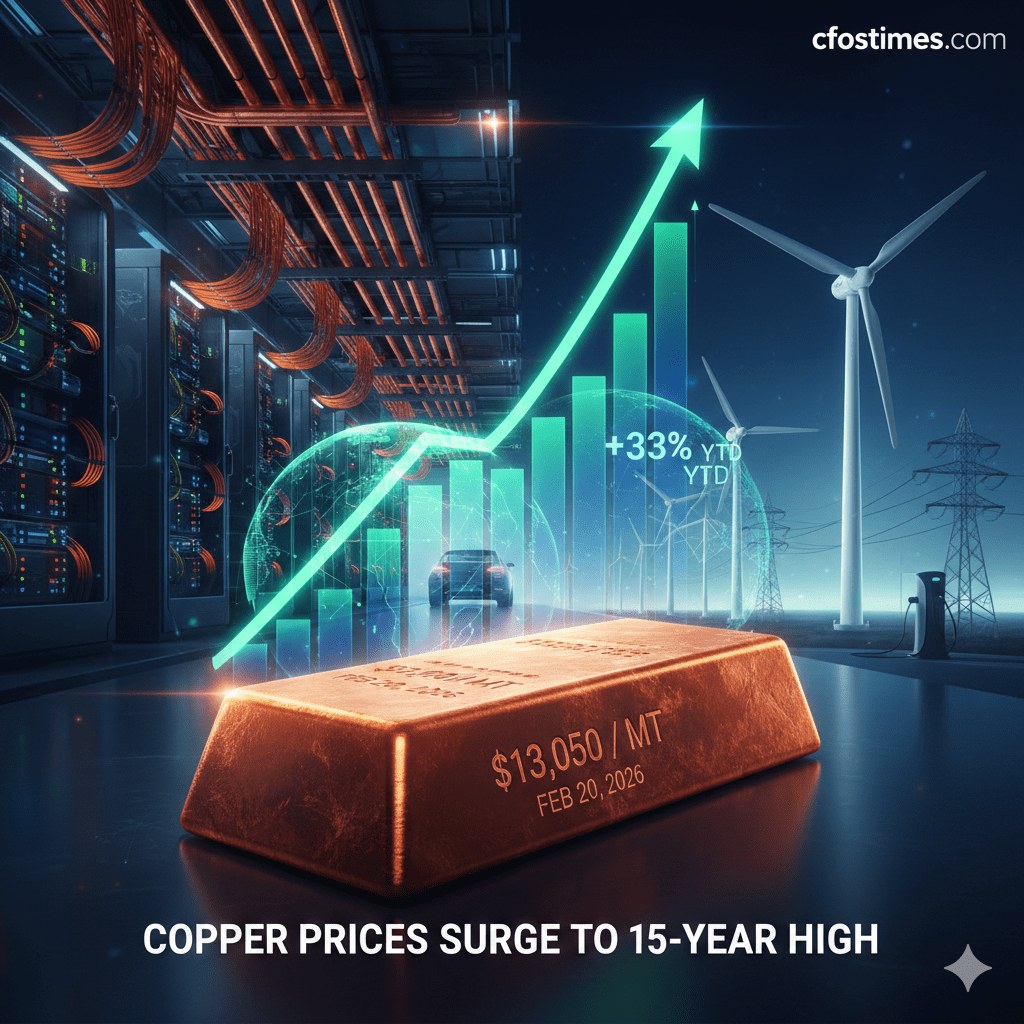

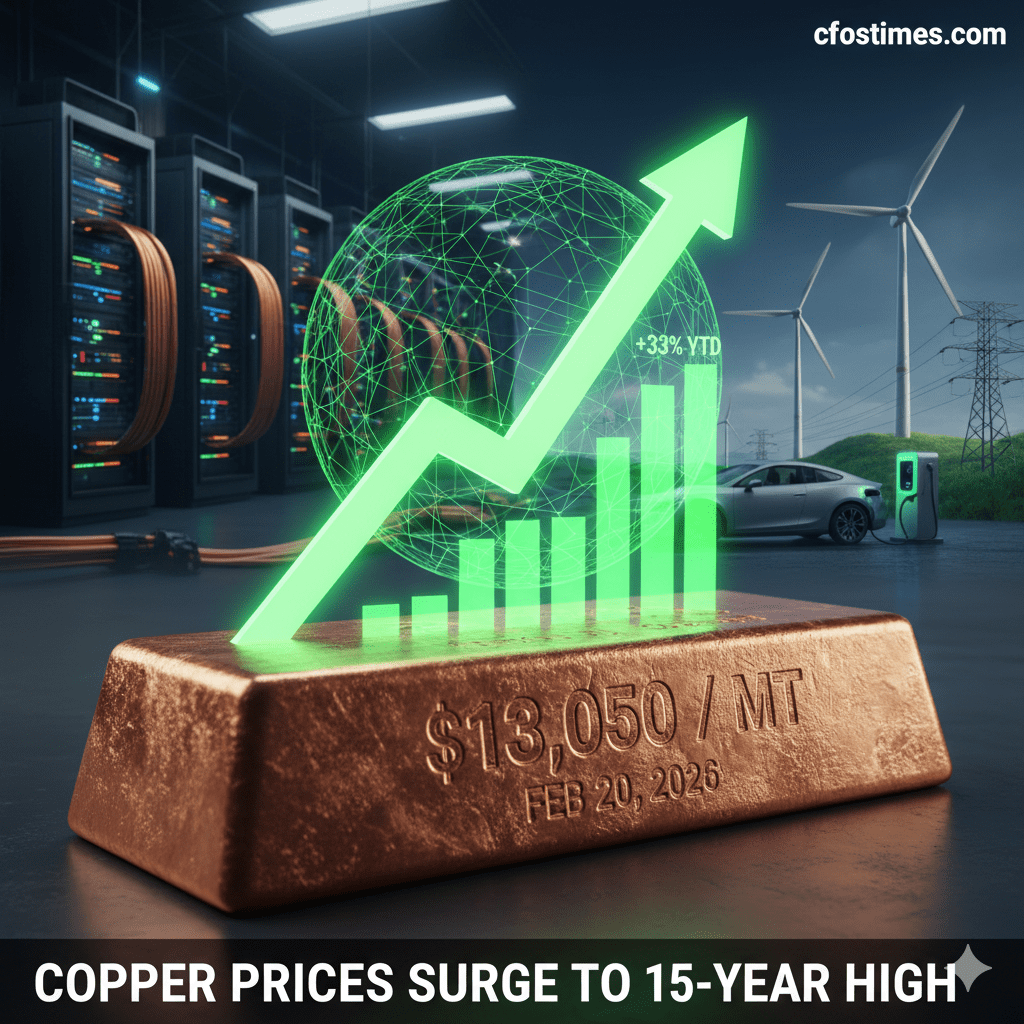

As of today, February 20, 2026, the global financial markets are witnessing a historic event: Copper Prices Surge to 15-Year High, officially crossing the $13,000 per metric tonne threshold on the London Metal Exchange (LME). This rally isn’t just a number—it’s a signal of a massive structural shift in the global economy.

While “Dr. Copper” has historically predicted economic health, the 2026 surge is unique. We are seeing a “Inventory Paradox” where global stockpiles are technically at 20-year highs (primarily in the U.S.), yet physical supply in Asia and Europe is at a breaking point.

According to the latest Real-time Price Data from the London Metal Exchange (LME), the cash price for Grade A copper has risen by 4.2% in the last 48 hours alone. For the audience at cfostimes.com, this represents a significant inflationary pressure on manufacturing, construction, and high-tech sectors.

🏗️ Why Copper Prices Surge to 15-Year High: 5 Key Drivers

The momentum behind today’s price action is driven by a “Perfect Storm” of supply-side failures and demand-side revolutions. Copper Prices Surge to 15-Year High

1. The AI Infrastructure Race

By early 2026, the demand for AI-specialized data centers has surpassed even the most aggressive forecasts. These facilities require massive amounts of copper for high-density power distribution and liquid cooling systems. Meta and Google have reportedly secured long-term copper contracts, effectively “crowding out” smaller industrial buyers.

2. The Grasberg Force Majeure

A significant mudslide at the Grasberg mine in Indonesia—one of the world’s largest—has crippled production. Supply remains constrained as the mine is only at 40% capacity as of this morning, February 20.

3. The Energy Transition Bottleneck

The global push for grid modernization and EV adoption continues to drain supply. An average electric vehicle in 2026 requires roughly 91kg of copper, compared to just 23kg for a traditional internal combustion engine.

4. U.S. Strategic Stockpiling (Project Vault)

The U.S. government’s “Project Vault” has moved hundreds of thousands of tonnes of copper into strategic reserves. This has created a “geographic drought” elsewhere, contributing to why Copper Prices Surge to 15-Year High globally while U.S. exchange stocks remain high.

5. Geographic Dislocation

The bulk of global copper stocks is currently “trapped” in U.S. COMEX warehouses due to logistical bottlenecks and shifting trade policies. In contrast, the International Copper Study Group (ICSG) reports that physical premiums in Europe and Asia are at record highs because the metal is not where the factories are. Copper Prices Surge to 15-Year High

📊 Market Snapshot: February 20, 2026

| Metric | Last Week | Today (Feb 20, 2026) | Trend |

| LME Cash Price | $12,650/t | **$13,050/t** | 📈 Up |

| Global Inventory | 1.05m tonnes | 1.10m tonnes | 📊 Diverging |

| China Demand Index | 54.2 | 48.9 | 📉 Slowing |

| Recycling Yield | 33% | 35.2% | ♻️ Rising |

🌍 The Global Impact on Personal Finance

When Copper Prices Surge to 15-Year High, the “hidden tax” of copper-flation begins to hit consumers directly.

- Home Renovations: Electrical wiring and plumbing components are now 18% more expensive than they were in Q4 2025.

- Consumer Electronics: Higher manufacturing costs are being passed down to the latest smartphone and laptop models.

- Utility Bills: Power companies are citing the increased cost of grid-scale transformers (which use massive amounts of copper) as a reason for rate hikes in mid-2026.

🛡️ Strategic Outlook for CFOs and Investors

For the audience at cfostimes.com, the current rally presents both a risk and an opportunity.

Goldman Sachs Research recently suggested that while the short-term trend is bullish, a 15% U.S. tariff on refined copper expected in mid-2026 could eventually cool the market. However, the structural deficit is expected to persist until at least 2028 when new “brownfield” expansions in Zambia and Chile finally come online. Copper Prices Surge to 15-Year High

Key Takeaway: Forward-thinking organizations are increasingly moving toward Copper Substitution (using aluminum in specific cabling) and “Circular Economy” models to mitigate price volatility.

❓ Frequently Asked Questions (FAQs)-Copper Prices Surge to 15-Year High

What is the primary cause of the copper shortage in 2026?

The shortage is a result of a “supply-demand mismatch.” Mines are taking 17+ years to develop, while AI and EV demand have increased exponentially in just the last 36 months.

How does the February 2026 Google Discover update affect this news?

Google now prioritizes depth and local relevance. This means reports that explain the “why” behind price surges (like the Grasberg mine issues) will outrank simple price alerts.

Is copper a good hedge against inflation?

Historically, yes. As an industrial essential, copper often maintains or gains value when currency purchasing power declines.

How can investors track this trend?

Investors should monitor the LME Warehouse Level Reports and the ICSG Monthly Bulletins for the most accurate data on supply vs. demand.

Is there a substitute for copper?

While aluminum can be used for some high-voltage power lines, copper remains the “gold standard” for AI chips, EV batteries, and intricate electronics due to its superior conductivity and ductility.

Conclusion: A New Era for Commodities-Copper Prices Surge to 15-Year High

The fact that Copper Prices Surge to 15-Year High today, February 20, 2026, is a wake-up call for global supply chain managers. We have moved from an era of “just-in-time” delivery to an era of “strategic resource hoarding.” For the readers of cfostimes.com, the takeaway is clear: copper is the new oil of the digital age, and the current price surge is likely the beginning of a long-term structural “Supercycle.”

Disclaimer

Official Market Disclosure: The analysis regarding Copper Prices Surge to 15-Year High provided on this page is for informational and educational purposes only. As of February 20, 2026, the commodities market is experiencing extreme volatility due to the “Inventory Paradox” and shifting global trade regulations.

Not Financial Advice: The content on cfostimes.com does not constitute professional investment, legal, or tax advice. [CFOs Times] is not a registered investment advisor. Commodities trading involves a high degree of risk, including the potential loss of principal. We strongly recommend consulting with a certified financial professional before making any decisions based on the $13,050/mt spot price or the forecasted trends mentioned herein.

AdSense & External Links: This post contains outbound links to high-authority government and industry bodies such as the LME and USGSto ensure data integrity. These links are provided for your convenience and do not imply endorsement of third-party investment products. In compliance with Google AdSense Policies, this site utilises cookies and web beacons for ad personalisation. For more details, please visit our Privacy Policy.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “Copper Prices Surge to 15-Year High: The 2026 Inventory Paradox Explained”