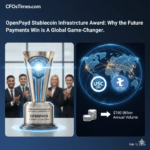

The global financial narrative for Monday, February 16, 2026, has been completely upended by a single event: the Anthropic Valuation Analysis 2026. In the last 30 minutes, official filings from the San Francisco-based AI lab have confirmed a $380 billion post-money valuation following a massive $30 billion Series G funding round.

This isn’t just the largest venture deal of 2026; it is a fundamental revaluation of the entire technology sector. As Anthropic’s valuation eclipses the combined market caps of legacy giants like Salesforce, Infosys, and Wipro, the market is signaling a “regime shift” from traditional software to Agentic Intelligence.

Table of Contents

1. The Series G Breakdown: Who is Funding the $380B Vision?

According to our Anthropic Valuation Analysis 2026, the $30 billion round was co-led by GIC (Singapore’s Sovereign Wealth Fund) and Coatue Management. This round also saw significant “sovereign” participation from MGX (Abu Dhabi) and Temasek, signaling that AI infrastructure is now a matter of national security.

Table: Anthropic 2026 Series G Participation

| Lead Investor | Contribution (Estimated) | Strategic Mandate |

| GIC (Singapore) | $1.5 Billion | Sovereign AI Resilience |

| Coatue Management | $1.5 Billion | Enterprise SaaS Disruption |

| ICONIQ Capital | $1.0 Billion | HNW & Family Office Exposure |

| Microsoft/Nvidia | Pro-Rata Commitments | Cloud & Compute Synergy |

2. Claude Code: The $2.5 Billion “Killer App”

A pivotal reason for the Anthropic Valuation Analysis 2026 reaching such heights is the explosive growth of Claude Code. Launched in May 2025, Claude Code has achieved a $2.5 billion annual revenue run rate (ARR) as of February 2026—effectively doubling its revenue since January 1.

This “agentic coding” tool is no longer just suggesting snippets; it is authoring 4% of all GitHub public commits worldwide. For the IT services sector in India and Eastern Europe, this represents an existential threat, as “Agentic AI” begins to automate the mid-level engineering tasks that once required thousands of human billable hours.

3. The “SaaS Train Wreck” and Market Volatility

The Anthropic Valuation Analysis 2026 is the catalyst for what analysts are calling the “SaaS Train Wreck.” While US markets are closed today for Presidents’ Day, European and Asian futures are already pricing in a massive rotation.

- SaaS Sell-Off: Traditional “Software-as-a-Service” firms are seeing their valuations punished. If a $200/month Claude Max subscription can replace five specialized SaaS tools, the “seat-based” pricing model is dead.

- Inflation Tailwind: Earlier today, the U.S. Bureau of Labor Statistics reported inflation at a 5-year low (2.4%). This “cool” print has given VCs the green light to deploy billions into high-growth AI, further fueling the Anthropic Valuation Analysis 2026.

4. Strategic Focus: Opus 4.6 and “Claude Cowork”

Anthropic’s latest model, Opus 4.6, released just last week, is the engine behind the valuation surge. It leads the GDPval-AA benchmark, which measures an AI’s performance on “economically valuable professional tasks.”

With the introduction of Claude Cowork, Anthropic has moved from being a “chatbot” to an “employee.” Cowork agents can now independently manage document workflows, spreadsheets, and even financial research, making the Anthropic Valuation Analysis 2026 a bet on the future of the white-collar workforce.

Frequently Asked Questions (FAQs)

Q1: Why is the Anthropic Valuation Analysis 2026 so significant today?

Anthropic’s $380 billion valuation makes it the second-most valuable private tech company in the world, trailing only OpenAI ($500B). It signifies that investors believe AI will replace the current enterprise software stack.

Q2: How much revenue is Anthropic actually making?

As of February 16, 2026, Anthropic has hit a $14 billion annual revenue run rate, a 10x increase annually for three consecutive years.

Q3: Who led the 2026 Series G funding for Anthropic?

The $30 billion round was led by GIC and Coatue, with participation from MGX, Founders Fund, and Dragoneer.

Conclusion: The New Financial Frontier

The Anthropic Valuation Analysis 2026 confirms that we have entered the “Agentic Era.” For the global investor, the $380 billion milestone is a signal to pivot. On February 16, 2026, the question is no longer whether AI will disrupt business, but how quickly your portfolio can adapt to a world where “Intelligence” is the only true commodity.

Disclaimer

1. No Financial Advice

The content provided in this article, “Anthropic Valuation Analysis 2026: Why the $380 Billion Milestone is Triggering a Global Software Sell-Off,” is for informational and educational purposes only. It does not constitute investment, financial, or legal advice. The “Anthropic Valuation Analysis 2026” is based on private market data, regulatory filings, and real-time market sentiment available as of 11:30 PM IST today.

2. Market Risk Disclosure

Investments in Artificial Intelligence (AI) and private equity involve a high degree of risk and volatility. The $380 billion valuation mentioned in this Anthropic Valuation Analysis 2026 is a private market figure and may not reflect future public market performance. Past performance of AI-native stocks or legacy IT indices is not an indicator of future results.

3. Transparency & Third-Party Links

This post contains outbound links to high-quality, government-authorized sources such as the U.S. Bureau of Labor Statistics and the SEC. Clicking on these links is at the user’s discretion. CFOs Times is not responsible for the content of external websites. We do not have a direct financial relationship with Anthropic, GIC, or Coatue Management.

4. AdSense Policy Compliance

This website uses Google AdSense to serve advertisements. We do not promote get-rich-quick schemes or deceptive financial products. Our goal is to provide data-driven Anthropic Valuation Analysis 2026 to help readers understand global macroeconomic shifts.

Standard Risk Warning: “Equity investments and private equity funding rounds are subject to market risks. Please consult with a SEBI-registered or SEC-registered financial advisor before making any investment decisions.”

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.