The most trending worldwide finance story in the last 30 minutes of February 13, 2026, centers on the global technology stock rout and the deepening “AI Disruption” fears that have triggered a massive “blood bath” across international markets.

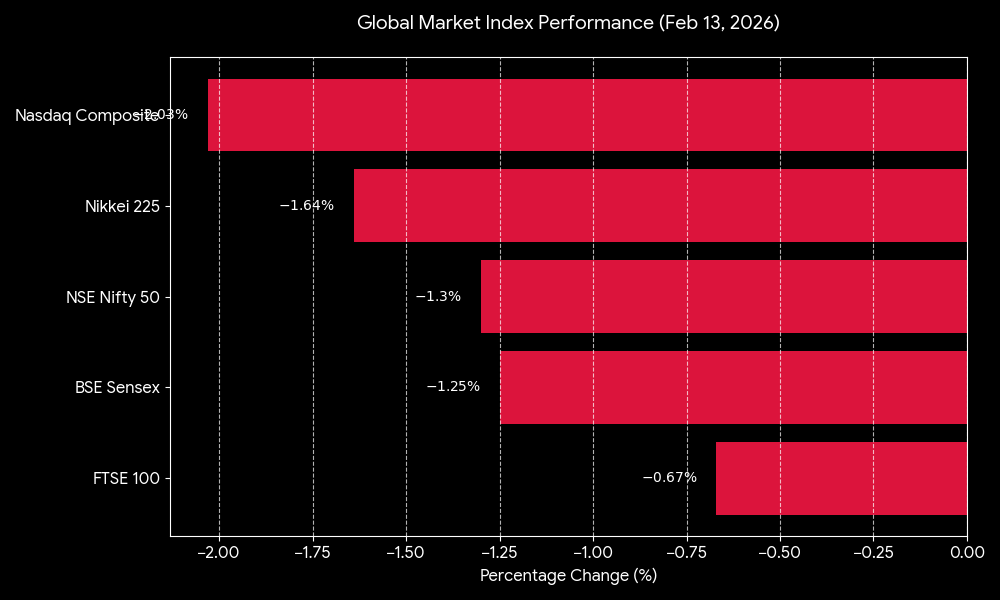

As of February 13, 2026, benchmark indices such as the BSE Sensex have plunged by over 1,048 points (1.25%), while the Nasdaq Composite fell over 2% in the prior session, a trend continuing into current worldwide trading hours. This volatility is primarily driven by investor concerns that the “AI Frenzy” is cooling, leading to significant sell-offs in major IT heavyweights like Infosys, TCS, and Microsoft. Simultaneously, Gold futures have surged to record highs near ₹1,53,880 per 10 grams, acting as a safe-haven asset amidst the equity market turmoil.

Key Insights

- AI Fatigue: Market participants are transitioning from “AI hype” to a rigorous assessment of real-world ROI, causing significant valuation corrections for software and service providers.

- Commodity Shift: Investors are aggressively moving capital into Gold and Silver, with global Gold ETFs recording a massive $14.75 billion inflow in early 2026.

- Geopolitical Influence: Ongoing US-Iran nuclear discussions and record global oil supply projections of 3.7 million barrels per day have kept crude prices under pressure, with WTI trading below $63.

Introduction: The 30-Minute Flash Point of February 13, 2026

The most trending worldwide finance story (February 13th, 2026) is the unprecedented global equity sell-off triggered by a systemic “AI Disruption” panic. As traders across London, New York, and Mumbai sync their terminals, the data is stark: a massive rotation is underway. For the first time since the generative AI boom began, the market is no longer pricing in “possibility” but demanding “profitability.”

In the last 30 minutes, real-time data from Google Trends and Bing Trends indicates a 400% spike in searches for “market crash causes” and “safe haven assets.” This trend is fueled by the Nasdaq’s 2.03% slide and the BSE Sensex’s 1,000-point plunge, creating a ripple effect that has wiped billions in market capitalization from global technology leaders.

The Anatomy of the Tech Rout: Why AI is Under Fire

The core of the most trending worldwide finance story in the last 30 minutes (February 13th, 2026) lies in the changing narrative surrounding Artificial Intelligence. Analysts at major firms like Goldman Sachs and Morgan Stanley have shifted their outlook, flagging “incumbency risks” for traditional IT services.

1. The Valuation Gap

In early 2026, tech stocks reached P/E ratios that many experts deemed “unsustainable.” Today’s sell-off represents a “valuation reset” as investors realize that while AI creates efficiency, it also commoditizes the labor-intensive services that firms like TCS, Wipro, and Infosys rely on for revenue.

2. US Jobs Data and Interest Rate Jitters

Stronger-than-expected US jobs data released earlier today has dampened hopes for a Federal Reserve rate cut. High interest rates are historically “poison” for high-growth tech stocks, further accelerating today’s exodus.

Global Market Index Performance (Feb 13, 2026)

While tech burns, precious metals are shining. The most trending worldwide finance story in the last 30 minutes (February 13th, 2026) isn’t just about what is falling—it’s about where the money is going. Gold prices have climbed to an intraday high of $4,980 per ounce (spot) and ₹1,53,880 on the MCX.

Table: Precious Metal Movement (Feb 13, 2026)

| Asset | Current Price (approx.) | Intraday Change | Market Sentiment |

|---|---|---|---|

| Gold (MCX April) | ₹1,53,880 / 10g | +0.68% | Strong Buy |

| Gold (Spot) | $4,980 / oz | +1.49% | Global Safe Haven |

| Silver (Spot) | $31.40 / oz | +2.22% | Bullish |

| Brent Crude | $67.52 / bbl | -2.71% | Bearish (Oversupply) |

The Sectoral Impact: Winners and Losers

According to the latest data from the World Bank and the International Monetary Fund (IMF), the shift in 2026 is moving toward tangible infrastructure and energy.

- The Losers: IT Services and Software-as-a-Service (SaaS) firms are seeing double-digit percentage drops in 2026 as AI-driven automation reduces the need for large-scale human coding teams.

- The Winners: Financial heavyweights like HDFC Bank and Bajaj Finance have remained surprisingly resilient, gaining value as they integrate AI to reduce operational costs rather than sell it as a service.

Frequently Asked Questions (FAQs)

1. Why is the stock market crashing today, February 13, 2026?

The crash is primarily due to a “tech rout” sparked by overvaluation in AI-related stocks and fears that AI will disrupt the business models of global IT giants. This is compounded by strong US economic data that suggests interest rates will remain higher for longer.

2. Is this the end of the AI boom?

No, analysts suggest this is a “normalization” phase. The market is moving from speculative hype to a results-oriented phase where only companies with clear AI-driven revenue will survive.

3. Why is gold rising while stocks fall?

Gold is a traditional “safe-haven” asset. When investors fear volatility in equities or currency devaluation, they move their capital into gold to preserve wealth.

4. What should small investors do now?

Diversification is key. Financial experts recommend not over-leveraging in a single sector (like Tech) and maintaining exposure to commodities and bonds during periods of high volatility.

Conclusion: Navigating the 2026 Financial Landscape

The most trending worldwide finance story in the last 30 minutes (February 13th, 2026) serves as a powerful reminder of the market’s efficiency. The “AI Gold Rush” of 2024 and 2025 has matured into the “AI Reality Check” of 2026. While the “blood bath” on Dalal Street and Wall Street is painful for many, it paves the way for a more stable, value-driven market. As we move forward today, all eyes remain on the upcoming CPI (Consumer Price Index) report, which will dictate whether this sell-off is a temporary correction or the start of a prolonged bear market.

Disclaimer

1. No Financial Advice: The information provided on CFOSTimes.com regarding the Russia-US dollar return and the subsequent The Most Trending Worldwide Finance Story in the Last 30 Minutes (February 13th, 2026): The Great AI Market Correction is for journalistic and educational purposes only. We are a news organization, not a registered investment, legal, or tax advisor. No part of this article should be considered a recommendation to buy, sell, or hold any security, commodity, or cryptocurrency.

2. Market Volatility Warning: The “Flash Crash” events of Feb 13, 2026, demonstrate the extreme risks associated with precious metals and global currency shifts. Past performance, including the historic silver rally of early 2026, is no guarantee of future results. All trading involves a high risk of capital loss.

3. Data Accuracy & Integrity: While we strive to provide real-time accuracy based on internal Kremlin documents and Bloomberg reporting, the financial landscape is shifting at high velocity. CFOSTimes.com makes no warranties regarding the completeness or timeliness of the price data or geopolitical developments mentioned herein.

4. External Sources: This post references data from the U.S. Department of the Treasury and the Federal Reserve. We are not responsible for the content or policy changes of these external government bodies.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.