Introduction: A New Normal for German Auto Exports

German industry has long been synonymous with precision, engineering excellence, and global competitiveness. At the heart of this reputation lies its automotive sector, a cornerstone of the country’s export-driven economy. However, recent data shows that this once-resilient engine of growth has taken a severe hit.

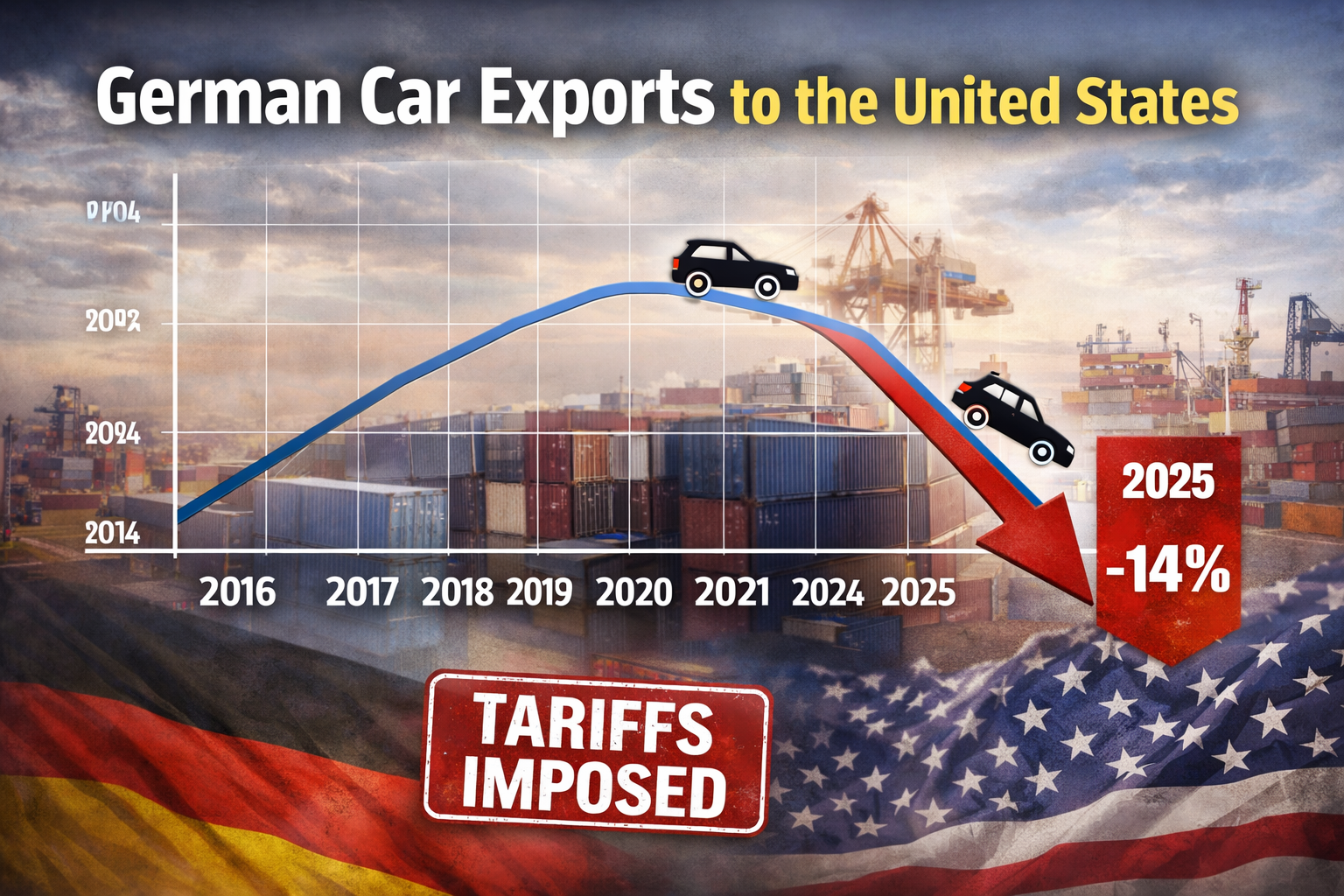

According to a study seen by Reuters, German auto exports to the United States fell by nearly 14% in the first three quarters of 2025, making automobiles the hardest-hit branch of German industry during U.S. President Donald Trump’s trade war. While other sectors also suffered declines, the scale and significance of the downturn in auto exports reveal deeper structural, political, and economic forces at play.

This article explores why German auto exports were disproportionately affected, how U.S. tariffs reshaped trade flows, the spillover effects on other industries, and what this means for the future of German exports under what experts are calling a “new normal.”

Table of Contents

The Importance of the U.S. Market for German Automakers

To understand the severity of the impact, it is essential to grasp how important the United States is for German car manufacturers.

The U.S. is Germany’s largest single export market, and automobiles represent one of the most valuable export categories. Brands such as BMW, Mercedes-Benz, Audi, Volkswagen, and Porsche have built decades-long relationships with American consumers, who value German vehicles for their engineering, performance, and prestige.

Before the escalation of trade tensions, German auto exports to the U.S. had enjoyed steady average growth of nearly 5% between 2016 and 2024. This consistent expansion made the sharp reversal in 2025 especially striking.

Trump Tariffs: A Turning Point in Transatlantic Trade

The Origins of the Tariff Conflict-German Auto Exports

The downturn in German auto exports is closely tied to the protectionist trade policies pursued by President Donald Trump. Framing trade deficits as a threat to U.S. economic sovereignty, the Trump administration targeted key imports, including European automobiles.

Initially, the U.S. threatened to impose a 25% tariff on European cars, on top of an existing 2.5% levy. This proposal alone sent shockwaves through German industry, as such a steep tariff would dramatically raise vehicle prices for American consumers.

The Compromise: Still Costly

Following negotiations between Washington and Brussels, the two sides reached an agreement that reduced the impact—but did not eliminate it. Under the deal:

- The U.S. imposed a 15% baseline tariff on European cars

- The tariff took effect on August 1

- While lower than the originally proposed 25%, it still represented a major increase in trade barriers

For German automakers operating on tight margins and facing intense global competition, even this reduced tariff proved damaging.

Why Automobiles Were Hit Harder Than Other Sectors-German Auto Exports

1. High Price Sensitivity

Cars are high-value consumer goods, and price increases significantly affect purchasing decisions. A 15% tariff can add thousands of dollars to the sticker price of a vehicle, making German cars less competitive compared to:

- U.S.-made vehicles

- Imports from countries facing lower tariffs

- Electric and hybrid alternatives with domestic incentives

As a result, many American consumers either postponed purchases or shifted to other brands.

2. Limited Short-Term Flexibility

Unlike some manufactured goods, car production cannot be easily or quickly relocated. German automakers rely on complex, long-established supply chains, specialized labor, and regulatory approvals. While some German brands operate U.S. factories, a significant share of high-end and specialty models are still produced in Germany and exported.

This rigidity made it difficult for automakers to respond quickly to the tariff shock.

3. Symbolic Targeting

Automobiles carried political symbolism in Trump’s trade strategy. German cars, in particular, were frequently cited as evidence of unfair trade balances, making the sector a prime target for punitive measures.

The Numbers: A Clear Picture of Decline

The study cited by Reuters paints a stark picture:

- German car exports to the U.S. fell nearly 14% in the first three quarters of 2025

- This made autos the worst-performing export sector

- The decline occurred despite years of strong growth before the trade war

In contrast, the overall decline in German exports to the U.S. across all sectors was 7.8% year on year—significant, but only about half the contraction seen in automobiles.

Engineering and Machinery: Collateral Damage from Tariffs

While automobiles bore the brunt of the downturn, other industrial sectors also struggled.

Engineering Exports Down 9.5%-German Auto Exports

German engineering companies saw exports to the U.S. decline by 9.5% in the first nine months of 2025. This reflects both direct tariff impacts and reduced demand from downstream industries, including automakers.

Machinery Faces 50% Tariffs

Machinery exports were particularly affected by U.S. tariffs on raw materials. Machinery products are subject to a 50% U.S. tariff on steel and aluminium, significantly increasing costs and eroding competitiveness.

Since machinery is essential for industrial investment, higher prices discouraged American buyers, further reducing export volumes.

The Chemical Industry: A More Complex Decline

The chemical sector also recorded a 9.5% drop in exports to the U.S., but the study cautioned against attributing this decline solely to tariffs.

Other Contributing Factors

According to the report:

- Higher energy prices in Germany reduced domestic chemical production

- Lower output naturally translated into fewer exports

- Tariffs compounded existing structural challenges

This highlights that while trade policy played a major role, broader economic pressures also weighed on German industry. German Auto Exports

Energy Prices and Competitiveness

One critical but often overlooked factor in the export slowdown is energy costs. German manufacturers, particularly in energy-intensive sectors like chemicals and metals, have faced persistently high energy prices.

Higher production costs reduce competitiveness in international markets, especially when combined with tariffs that further inflate final prices for foreign buyers.

In the automotive sector, rising energy costs indirectly affected component suppliers and manufacturing inputs, adding another layer of pressure.

A Break from the Past: Comparing Pre- and Post-Tariff Trends

The contrast between recent performance and historical trends is striking:

- 2016–2024: Average export growth to the U.S. of nearly 5%

- 2025: Overall exports down 7.8%; auto exports down nearly 14%

This sharp reversal underscores how deeply trade policy changes disrupted established economic relationships.

The “New Normal” for German Exporters

Study author Samina Sultan described the current situation as a “new normal” for German exporters. Her assessment reflects a sobering reality:

“Since it must currently be assumed that U.S. import tariffs will not return to pre-Trump administration levels in the foreseeable future, a significant recovery in German exports to the U.S. is unlikely.”

This statement carries profound implications.

What the New Normal Means

- Persistent tariffs are likely to remain part of the trade landscape

- Exporters must adjust to structurally lower demand from the U.S.

- Long-term investment decisions will increasingly factor in trade barriers

For automakers, this could mean accelerating production localization in the U.S. or shifting focus to other markets. German Auto Exports

Strategic Responses from German Automakers

To cope with the new environment, German car manufacturers are exploring several strategies:

- Expanding U.S. production to bypass tariffs

- Diversifying export markets toward Asia and emerging economies

- Focusing on premium and electric vehicles, where margins can absorb higher costs

- Restructuring supply chains to reduce tariff exposure

However, these adjustments take time and require significant capital investment.

Broader Implications for Transatlantic Relations-German Auto Exports

The tariff dispute has strained transatlantic economic relations, undermining trust between long-standing allies. While the compromise tariff was lower than initially threatened, it still marked a departure from decades of trade liberalization.

For Germany, the episode serves as a reminder of the risks inherent in heavy dependence on a single export market—even one as large and historically reliable as the United States.German Auto Exports

Conclusion: Why Autos Took the Hardest Hit

German auto exports were hit hardest by Trump tariffs because they sat at the intersection of political symbolism, economic sensitivity, and structural rigidity. High tariffs directly increased prices, weakened competitiveness, and disrupted long-standing trade flows.

While engineering, machinery, and chemicals also suffered, the automotive sector experienced the sharpest decline due to its scale, visibility, and reliance on the U.S. market.

As tariffs appear set to remain, German exporters face a future defined less by rapid recovery and more by adaptation. The era of predictable growth in transatlantic trade may be over, replaced by a new normal shaped by geopolitics, protectionism, and global economic realignment.

For Germany’s auto industry, the challenge now is not just to survive this shift—but to redefine its role in a more fragmented global economy.

Frequently Asked Questions (FAQs)

1. Why were German auto exports hit hardest by Trump tariffs?

German auto exports were hit hardest because automobiles are high-value, price-sensitive products. The 15% U.S. tariff on European cars significantly increased vehicle prices in the American market, reducing demand. German cars were also a primary political target in the U.S. trade war, making the sector more vulnerable than others.

2. How much did German car exports to the U.S. decline?

According to a study seen by Reuters, German car exports to the United States fell by nearly 14% in the first three quarters of 2025. This made automobiles the worst-performing sector among all German exports to the U.S. during that period.

3. What tariffs did the U.S. impose on German cars?

Under an agreement between Washington and Brussels, the U.S. imposed a 15% baseline tariff on cars imported from Europe, effective August 1. This was lower than the initially threatened 25% tariff, but still far higher than pre-trade-war levels.

4. Did other German industries also suffer from U.S. tariffs?

Yes. Several other sectors were affected:

- Engineering exports to the U.S. declined by 9.5%

- Machinery exports faced a 50% tariff on steel and aluminium

- Chemical exports fell by 9.5%, influenced by tariffs and high energy costs

However, none experienced a decline as severe as the automotive sector.

5. Are tariffs the only reason for the decline in German exports?

No. While tariffs played a major role, other factors also contributed, including:

- Higher energy prices in Germany

- Reduced domestic production

- Rising global economic uncertainty

These factors particularly affected energy-intensive industries such as chemicals and heavy manufacturing.

6. How did German exports perform before the trade war?

Between 2016 and 2024, German exports to the U.S. grew at an average rate of nearly 5% per year. The sharp decline in 2025 represents a significant break from this long-term growth trend.

7. What does “new normal” mean for German exporters?

The “new normal” refers to the expectation that U.S. tariffs will not return to pre-Trump levels anytime soon. According to the study’s author, Samina Sultan, this makes a strong recovery in German exports to the U.S. unlikely in the foreseeable future.

8. How are German automakers responding to the tariffs?

German automakers are adapting by:

- Expanding production within the United States

- Diversifying export markets beyond North America

- Focusing on premium and electric vehicles

- Restructuring global supply chains

These strategies aim to reduce reliance on tariff-affected exports.

9. What does this mean for U.S.–Germany trade relations?

The tariffs have strained long-standing transatlantic trade relations and reduced trust between economic partners. While trade continues, it is now shaped more by protectionism and geopolitical risk than by free-trade principles.

10. Will German auto exports recover in the near future?

A significant recovery is considered unlikely unless U.S. tariff policies change. Most analysts expect German exporters to face structurally lower demand from the U.S. and to focus more on adaptation than rapid recovery.

Disclaimer

The information provided in this article on CFOs Times is for general informational purposes only. While every effort has been made to ensure the accuracy and reliability of the content at the time of publication, CFOSTimes makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained herein.

The views and analysis presented are based on publicly available data, reports, and sources, including third-party publications, and should not be construed as financial, investment, legal, or trade advice. Readers are advised to conduct their own research and consult with qualified professionals before making any business or financial decisions.

CFOSTimes shall not be held liable for any losses or damages, including without limitation indirect or consequential losses, arising from the use of, or reliance on, the information provided in this article.

External links or references, if any, are provided for informational purposes only and do not constitute endorsement or responsibility for the content of external websites.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “101 Why German Auto Exports Were Hit Hard by Trump Tariffs”