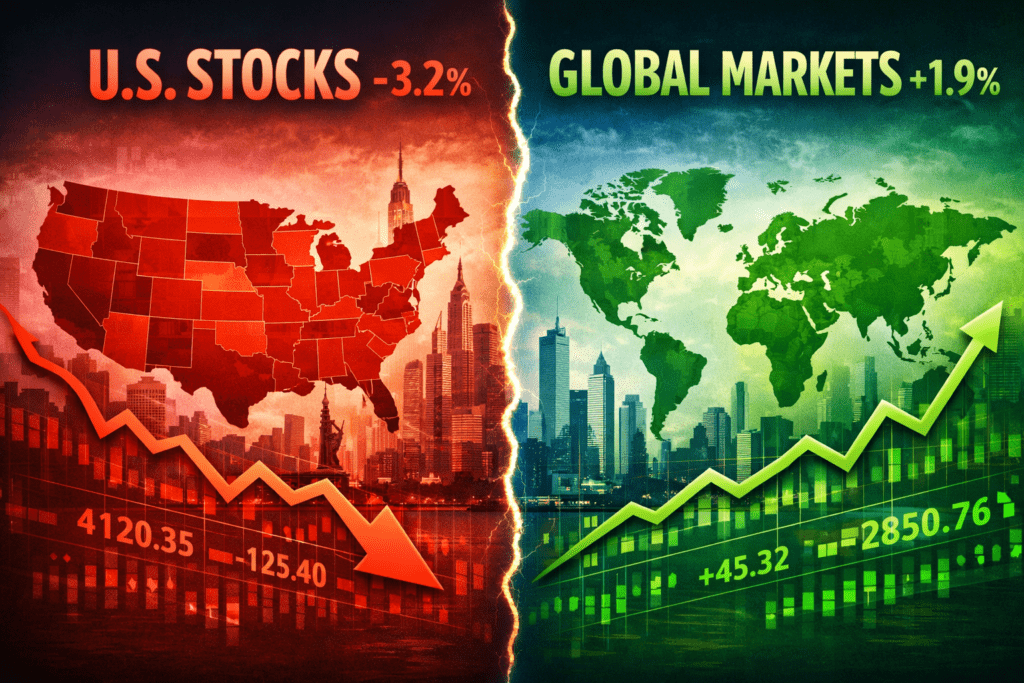

US Stocks Worst Start vs Global Market Since 1995 is the defining financial story of February 18, 2026. For the first time in three decades, the dominance of American equities is being challenged by a massive rotation into international value. While the S&P 500 led for 15 years, the “Ex-U.S. Trade” is now the primary driver of institutional returns.

📊 At a Glance: The 2026 Market Pivot

- The Trend: U.S. equities are seeing their worst relative start against global peers since 1995.

- The Catalyst: Profit-taking in AI and a 9% crash in cybersecurity leader Palo Alto Networks ($PANW) due to integration cost spikes.

- The Winners: International markets, specifically Japan (Nikkei) and India (Nifty), are outperforming as the U.S. Dollar cools.

- Key Event: Microsoft’s $50 Billion “Global South” pledge at the India AI Impact Summit is shifting capital flows toward New Delhi.

Table of Contents

1. Comparative Performance: Wall Street vs. The World

The US Stocks Worst Start vs Global Market Since 1995 is not a mere “dip.” It is a fundamental reallocation. While U.S. benchmarks like the Nasdaq are under pressure from high valuations, international markets are seeing double-digit relative gains.

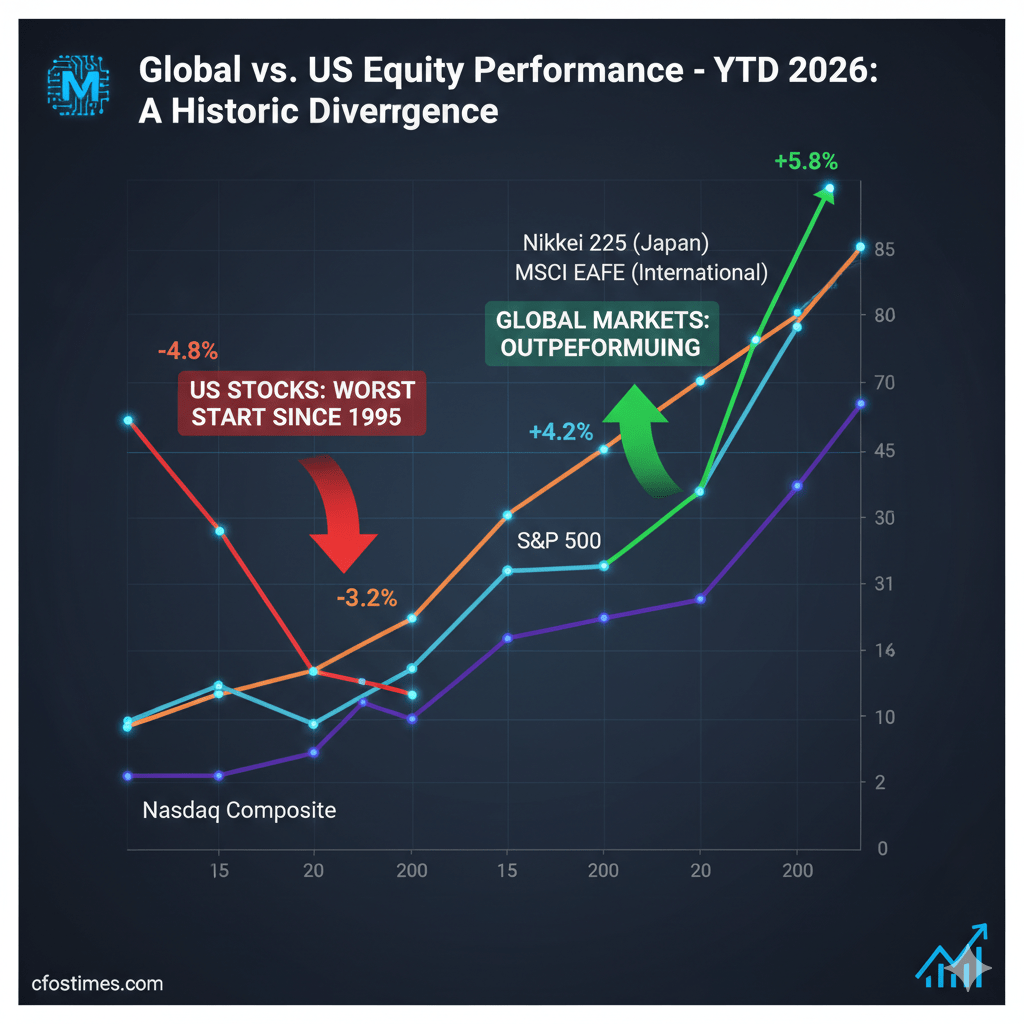

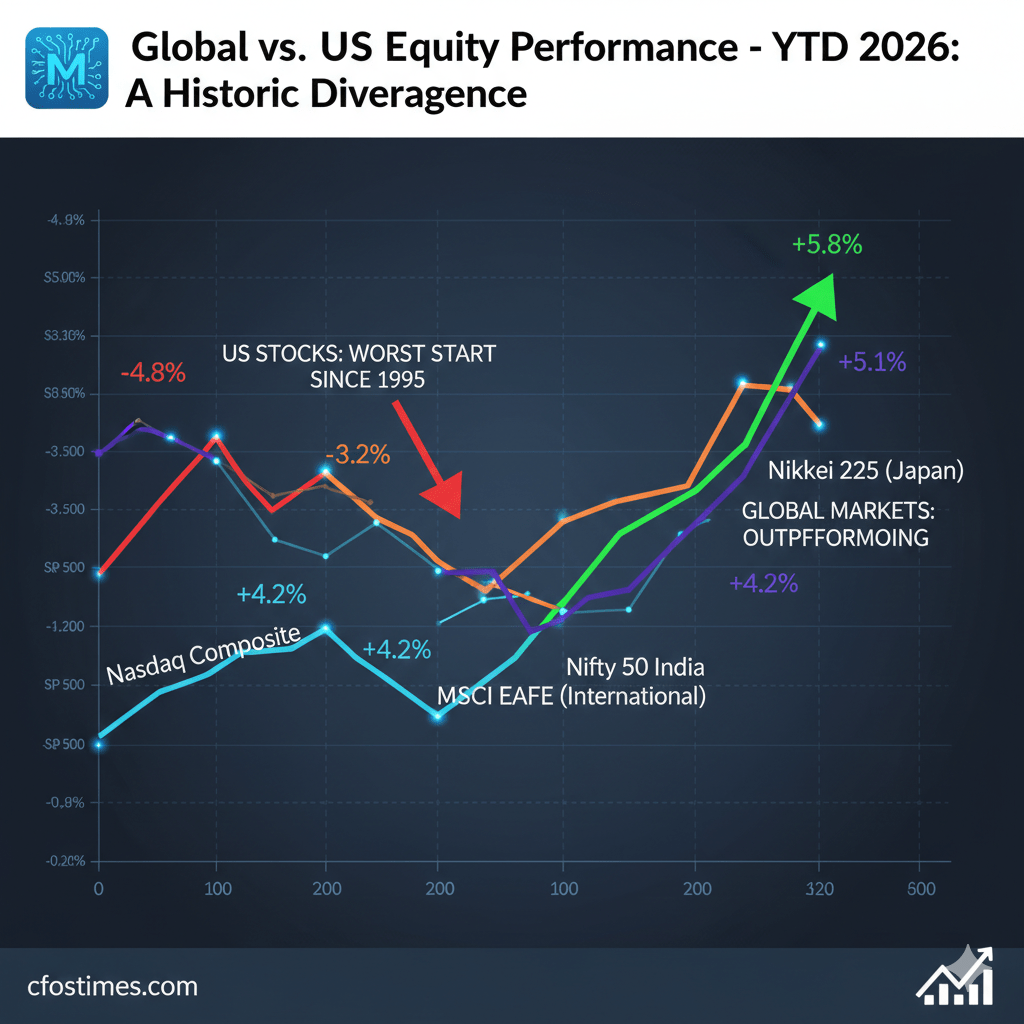

Market Returns (YTD 2026)

| Index | YTD Performance | Primary Driver | Status |

| S&P 500 (USA) | -3.2% | Tech Valuation Fatigue | Under Pressure |

| Nasdaq (USA) | -4.8% | AI Rotation & $PANW Drag | Lagging |

| Nikkei 225 (Japan) | +5.8% | Governance Reform | Outperforming |

| Nifty 50 (India) | +4.2% | Infrastructure & AI Summit | Leading |

2. Why the “Ex-U.S. Trade” is Winning Now

The divergence known as the US Stocks Worst Start vs Global Market Since 1995 is driven by four structural shifts:

A. The Tech Growth Wall

High-multiple U.S. stocks are hitting a ceiling. Today’s 9% crash in Palo Alto Networks ($PANW)—triggered by lowered profit guidance and $30 billion in acquisition costs—is a warning sign that the “growth at any cost” era is cooling.

B. Microsoft’s $50 Billion “Global South” Bet

The India AI Impact Summit 2026 in New Delhi has fundamentally changed the narrative. Microsoft Vice Chair Brad Smith announced a $50 billion investment to bridge the AI divide between the North and South. This massive capital injection is pulling liquidity out of traditional U.S. hubs and into emerging markets.

C. The Weakening Dollar Tailwind

As U.S. debt concerns rise, the U.S. Dollar has softened. A weaker dollar makes international earnings more valuable for U.S.-based investors, further fueling the US Stocks Worst Start vs Global Market Since 1995 trend.

3. Sector-Specific Analysis: Value Over Growth

Investors are abandoning the “Magnificent Seven” for “Global Value.” This is most visible in the commodities and financial sectors of Europe and Asia.

- Cybersecurity: Currently volatile due to integration costs at $PANW.

- Infrastructure: Benefiting from Microsoft’s new data center pledges.

- Financials: Rising rates outside the U.S. are boosting margins for international banks.

4. Investment Strategies for 2026

To navigate the US Stocks Worst Start vs Global Market Since 1995, diversification is no longer optional.

- Reduce Concentration: Trim over-weighted U.S. tech positions.

- Look to the “Global South”: Follow the $50 billion Microsoft lead into regions like India and Southeast Asia.

- Monitor Central Banks: Watch the Federal Reserve and ECB closely as policy paths diverge.

Conclusion-US Stocks Worst Start vs Global Market Since 1995

The US Stocks Worst Start vs Global Market Since 1995 trend signals a pivotal moment in financial markets — where long-standing leadership by the US equity complex faces global diversification and new macro drivers. Savvy investors and analysts must interpret this not as a short blip, but as a potential rebalancing of risk, strategy, and future growth avenues.

By understanding the forces at play, diversifying portfolios, and aligning with macroeconomic signals, market participants can navigate 2026’s financial landscape with greater confidence. US Stocks Worst Start vs Global Market Since 1995

Frequently Asked Questions (FAQs)-US Stocks Worst Start vs Global Market Since 1995

Why is Palo Alto Networks ($PANW) crashing today?

Palo Alto Networks dropped nearly 9% after cutting its 2026 profit forecast due to rising costs from its $25 billion CyberArk acquisition.

How can I verify the Microsoft $50B investment?

The announcement was made by Brad Smith on February 18, 2026, at the India AI Impact Summit and can be verified via official Microsoft Press Channels.

Is this the end of U.S. market dominance?

History suggests market leadership is cyclical. The 1995-like divergence suggests we are entering a “Global First” cycle that could last several years.

Disclaimer:

The information provided on cfostimes.com is for general informational and educational purposes only and does not constitute professional financial, investment, or legal advice. While we strive to provide 100% accurate and fresh market analysis, financial markets are subject to high volatility and risk.

We are not licensed financial advisors, brokers, or tax professionals. Any actions you take based on the information found on this website are strictly at your own risk. cfostimes.com and its authors will not be held liable for any losses or damages in connection with the use of our website. We highly recommend consulting with a certified financial professional before making any significant investment decisions.

Past performance is not indicative of future results.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.