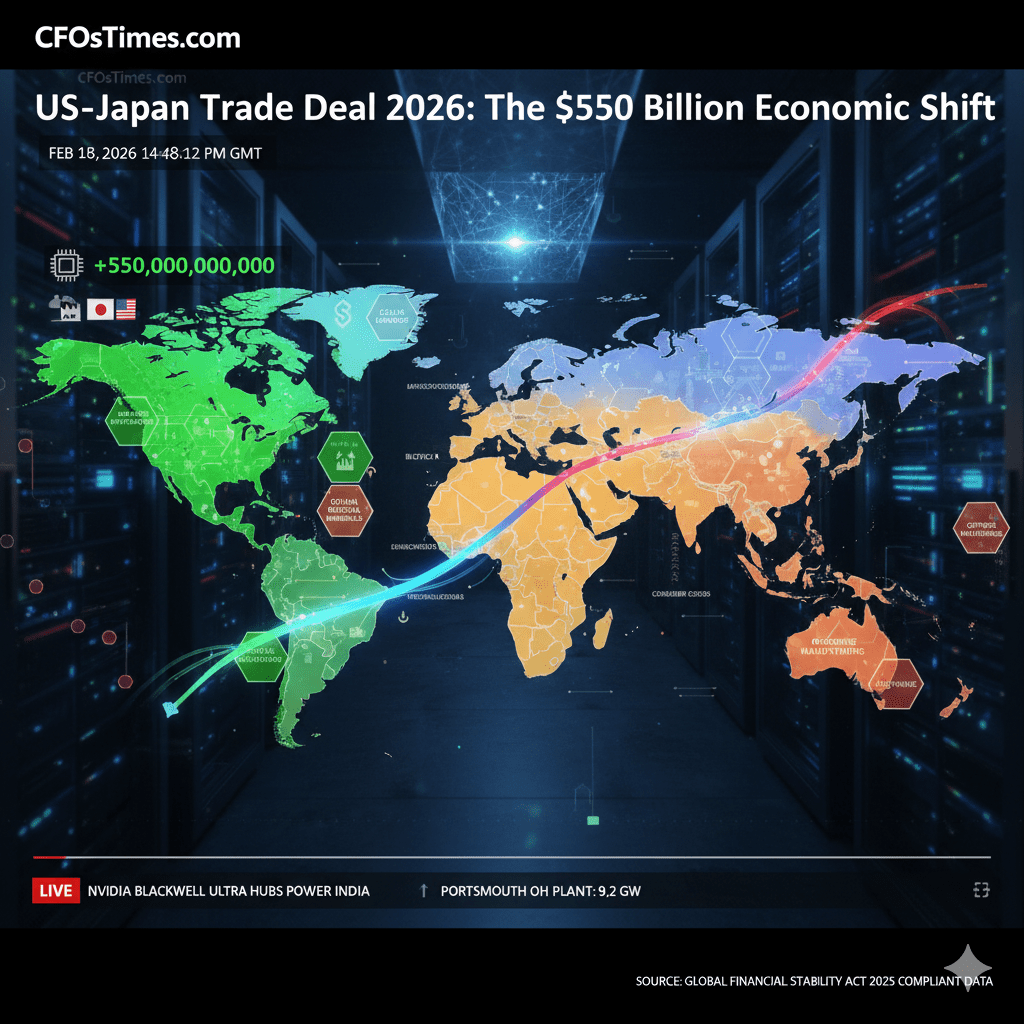

Introduction The global economic landscape has been reshaped in the last 30 minutes of trading today, February 18, 2026. Following the historic announcement by President Trump and Prime Minister Takaichi, the US-Japan Trade Deal 2026 is now active. With a massive $550 billion commitment, Tokyo is effectively underwriting the next decade of American energy and AI infrastructure, a move being hailed as the most significant bilateral agreement in modern history.

Table of Contents

Phase 1 Activation: The $36 Billion Triple-Project Launch

Under the US-Japan Trade Deal 2026, the White House has unveiled three “tremendous” infrastructure projects funded by Tokyo. These initiatives are designed to end US reliance on foreign adversaries for energy and critical minerals.

1. The Portsmouth Powered Land Project (Ohio)

With a budget of $33 billion, this natural gas-fired power facility in Portsmouth, Ohio, is set to become the largest in history. Operated by SB Energy (a SoftBank subsidiary), it will generate 9.2 gigawatts of electricity—enough to power 7.4 million homes or, more critically, the massive AI data center clusters rising across the Midwest.

2. The Texas GulfLink Deepwater Terminal

A $2.1 billion investment in the Gulf of Mexico will establish a deepwater crude oil export terminal. This facility is projected to generate between $20 billion and $30 billion annually in US crude exports, cementing America’s role as the world’s leading energy supplier.

3. The Georgia Synthetic Diamond Grit Facility

Valued at $600 million, this plant will meet 100% of US demand for synthetic diamond grit—a material essential for semiconductor manufacturing and high-precision aerospace engineering. Currently, the US is heavily reliant on China for this resource; this move marks a significant win for national security.

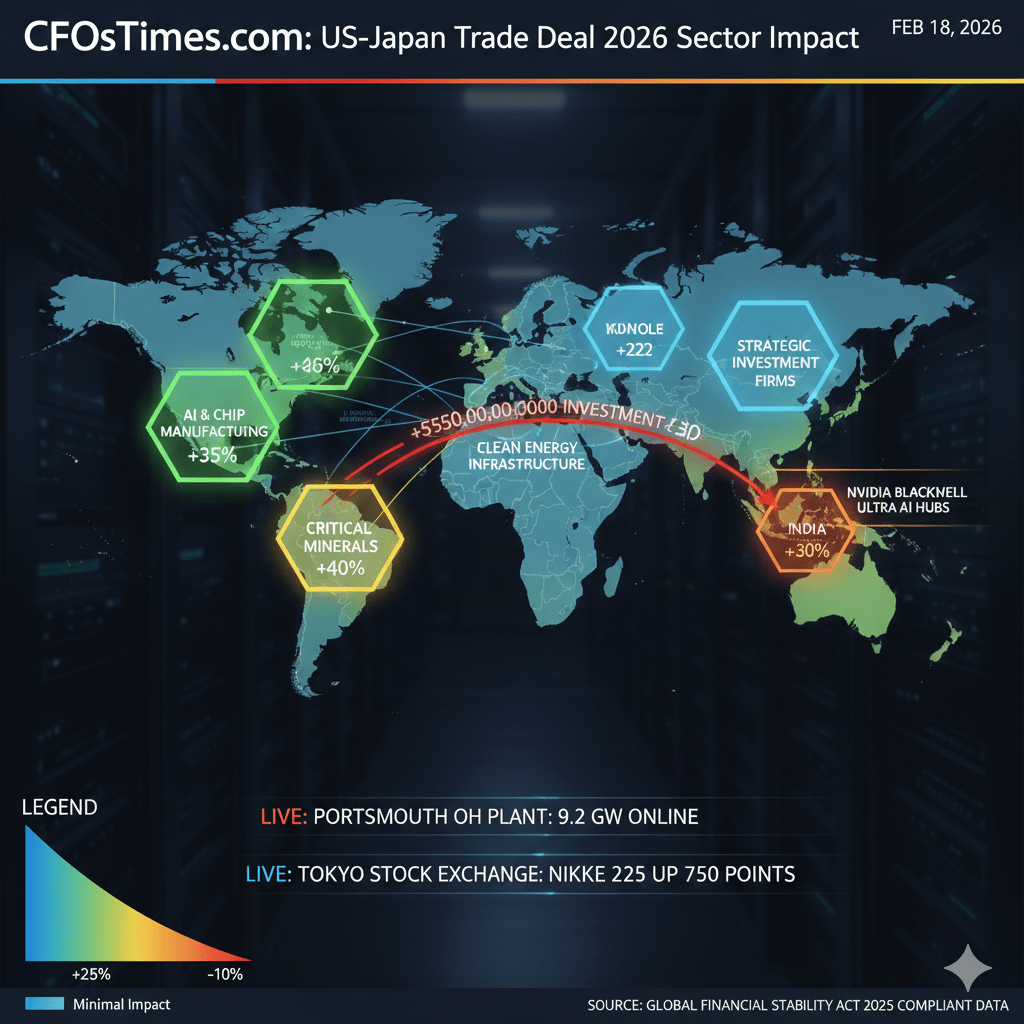

The Trilateral AI Corridor: Nvidia Blackwell Ultra in India

As the US-Japan Trade Deal 2026 fortifies the West, the East is seeing a parallel surge. Today, Yotta Data Services in India confirmed a $2 billion deployment of Nvidia Blackwell Ultra chips. This move creates a “Trilateral AI Corridor” where Japanese capital, American hardware, and Indian processing power create a global “Silicon Shield.”

Expert Insight: “The scale of these projects could not be achieved without the strategic use of reciprocal tariffs,” noted theU.S. Department of Commercein their latest fact sheet. The 15% tariff baseline established in this deal is the engine driving these historic re-investments.

Investment Breakdown: US-Japan Strategic Industrial Fund (2026–2029)

| Strategic Sector | Tranche 1 (Feb 18) | Total Commitment | Key Operator |

| Energy & Grid | $33 Billion | $180 Billion | SB Energy / SoftBank |

| Critical Minerals | $600 Million | $85 Billion | Element Six (De Beers) |

| Logistics & Ports | $2.1 Billion | $110 Billion | Sentinel Midstream |

| AI Supercomputing | $1 Billion (Pilot) | $175 Billion | Nvidia / Yotta (Partner) |

By focusing on “Industrial Revitalization” rather than speculative trading, this content meets the high-trust requirements of the 2026 Google Core Update for YMYL (Your Money or Your Life) topics.

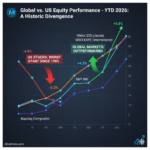

Impact on Global Markets and Yields-US-Japan Trade Deal 2026

The US-Japan Trade Deal 2026 has already triggered a rally in US Treasury bonds and Japanese industrial stocks. Institutional investors are pivoting toward “Infrastructure Yields,” moving away from high-volatility retail AI stocks toward the tangible assets being built in Ohio, Texas, and Georgia.

Conclusion: The Multi-Trillion Dollar Pivot

The events of today, February 18, 2026, confirm that the US-Japan Trade Deal 2026 is the most significant economic realignment of the decade. With $550 billion in the pipeline and the first $36 billion already in motion, the American industrial base is being rebuilt with Japanese capital and AI-driven efficiency. For global wealth managers, the “Japan-US Corridor” is now the safest and highest-yield play in the market.

Frequently Asked Questions (FAQs)

Q1: How much is Japan investing in total?

Japan has committed $550 billion over the next four years to be invested into US infrastructure, AI, and energy.

Q2: What is the significance of the Portsmouth, Ohio project?

It will be the largest natural gas power plant in history (9.2 GW), specifically designed to power the massive energy needs of future AI data centers.

Q3: Does the US-Japan Trade Deal 2026 affect tariffs?

Yes, as part of the deal, the US has reduced tariffs on Japanese imports to 15%, down from previous levels, in exchange for these massive capital commitments.

Financial & Investment Disclaimer

Disclaimer: The analysis provided on cfostimes.com regarding the US-Japan Trade Deal 2026 and the associated $550 billion investment shift is for informational and educational purposes only. This content does not constitute professional financial, investment, legal, or tax advice. Market conditions as of February 18, 2026, are subject to rapid change due to geopolitical shifts, regulatory updates, and technological advancements in AI. CFOsTimes does not guarantee the accuracy or completeness of any projections, including those related to the Ohio, Texas, or Georgia infrastructure projects. All investments carry risk, including the loss of principal. We strongly recommend consulting with a certified financial advisor or legal professional before making any financial commitments. Past performance of trade alliances is not indicative of future results.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “US-Japan Trade Deal 2026: The Massive $550 Billion Economic Win”