In the fast-moving 30 minutes following the Paris morning bell on February 19, 2026, the European telecommunications landscape was redefined. Orange SA (ORA.PA) has officially closed the book on its highly successful “Lead the Future” cycle and inaugurated its next three-year strategic chapter: “Trust the Future.”

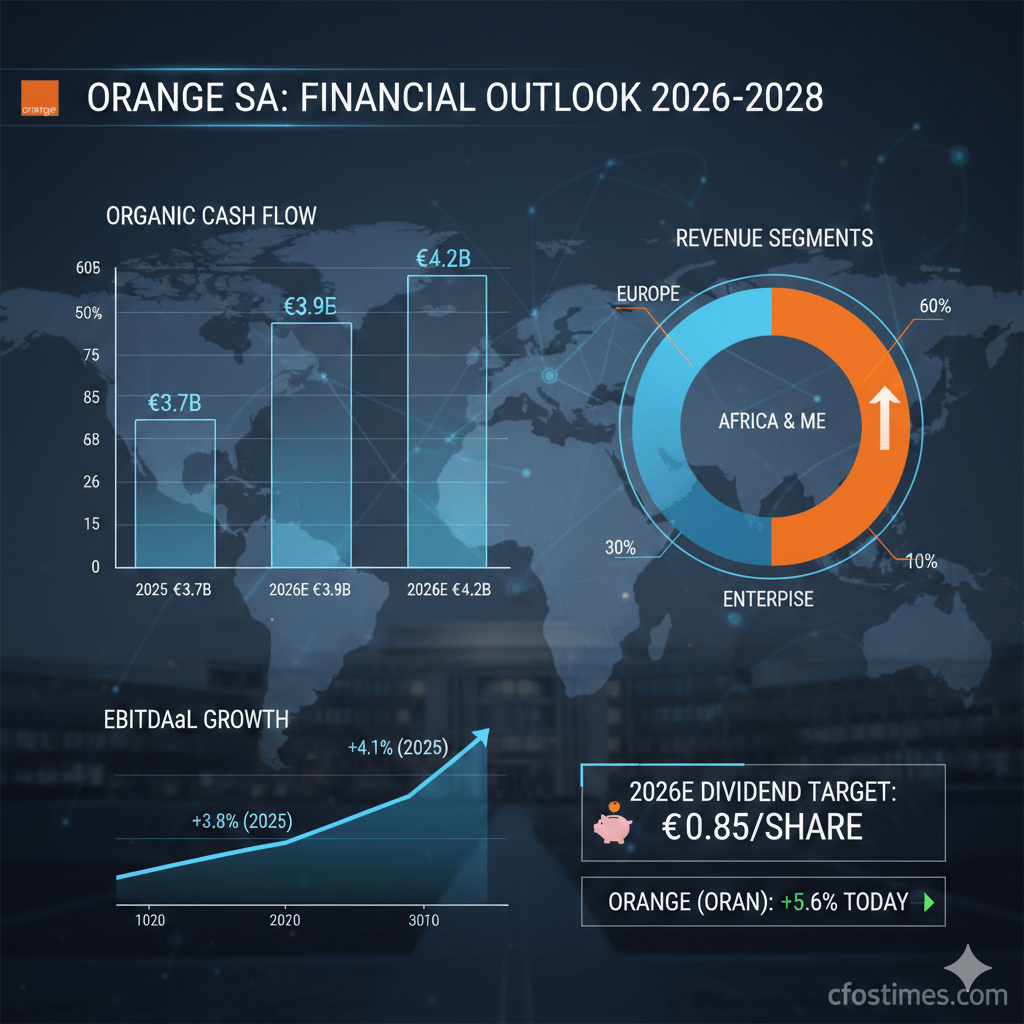

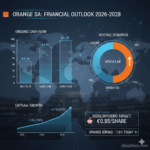

Investors searching for a reliable Orange stock forecast 2026 after Capital Markets Day are finding a company that has transformed from a legacy utility into a high-growth “TechCo.” Having already hit a record €3.7 billion in organic cash flow in 2025, Orange has now set an aggressive course to exceed €4 billion in 2026, targeting a staggering €5.2 billion by 2028.

This pillar post explores why this strategy is a game-changer for shareholders, the role of AI in their €600 million value-generation goal, and how the full acquisition of MasOrange in Spain creates a new European powerhouse.

Table of Contents

I. Financial Foundation: FY 2025 as a Launchpad

To understand the Orange stock forecast 2026 after Capital Markets Day, one must acknowledge the strength of the foundation. The results released yesterday, February 18, 2026, showed a company operating at peak efficiency.

1. Revenue and EBITDAaL Momentum

Orange reported total revenues of €40.4 billion, a 0.9% increase. While that growth may seem modest, the quality of that revenue is what excites analysts. EBITDAaL (Earnings Before Interest, Taxes, Depreciation, and Amortization after Leases) grew by 3.8%, reaching €12.5 billion. This margin expansion proves that Orange’s efficiency programs in France and Europe are working.

2. The Africa and Middle East (AMEA) Engine

The standout performer remains the AMEA region, which saw 12.2% revenue growth. According to the International Telecommunication Union (ITU) 2026 Global Connectivity Report, digital penetration in emerging markets is the single largest growth lever for global telcos—and Orange owns the most valuable footprint in this space.

II. The “Trust the Future” Strategy: 2026–2028 Outlook

The core of today’s Orange stock forecast 2026 after Capital Markets Day news is the unveiling of the “Trust the Future” plan. This plan focuses on shifting from “building” networks to “monetizing” them.

1. AI-Native Operations: The €600M Goal

Orange aims to generate €600 million in incremental value from AI by 2028. This includes:

- Generative AI for Customer Service: Reducing call center costs by 30%.

- Predictive Network Maintenance: Using AI to fix outages before they happen, as regulated by the European Union’s Cybersecurity Act.

- AI-Driven Sales: Upselling fiber and 5G plans to the 310 million-strong customer base with hyper-personalized offers.

2. The 5G Standalone (5G SA) Revolution

By late 2026, Orange plans to have 5G Standalone fully operational across its core European markets. Unlike standard 5G, 5G SA allows for “network slicing”—the ability to sell dedicated, high-speed lanes to hospitals, factories, and emergency services. This is a primary driver for the Orange stock forecast 2026 after Capital Markets Day, as it opens up new B2B revenue streams.

III. Major Catalysts: Spain and Infrastructure

One cannot discuss the Orange stock forecast 2026 after Capital Markets Day without mentioning MasOrange.

1. Consolidation in Spain

In December 2025, Orange signed a binding agreement with Lorca to acquire 100% of MasOrange. The full reconsolidation expected in H1 2026 will instantly boost the group’s scale. Analysts expect synergy savings to exceed €500 million annually by 2027, making the Spanish unit a massive cash contributor.

2. The Copper Switch-Off

Orange is leading the way in decommissioning legacy copper networks. According to the French regulator ARCEP, the total shutdown of the copper network in France will reach its industrial peak in 2026. This move will slash maintenance costs and force the remaining customer base onto high-margin fiber (FTTH) connections. Orange Stock Forecast 2026

IV. Investor Outlook: Dividends and Valuation

For many, the Orange stock forecast 2026 after Capital Markets Day is defined by income. Orange is widely considered one of the best dividend-paying stocks in the Euro Stoxx 600 Telecom index.

Table 1: Orange SA Shareholder Return Projections

| Year | Dividend Per Share | Organic Cash Flow Target | Dividend Yield (Est.) |

| 2024 (Actual) | €0.75 | €3.6 Billion | 5.2% |

| 2025 (Proposed) | €0.75 | €3.7 Billion | 4.8% |

| 2026 (Forecast) | €0.80 – €0.85 | €4.0 Billion | 5.5% |

| 2028 (Target) | €0.95+ | €5.2 Billion | 6.2%+ |

Analyst Recommendations

Following the Capital Markets Day presentation, the consensus among 17 top analysts has shifted.

- 15 Buys

- 5 Holds

- 2 SellsThe 12-month price target for ORA.PA has been revised upward to €18.50, representing a potential 20% upside from current levels.

V. Risk Factors for 2026

No Orange stock forecast 2026 after Capital Markets Day analysis is complete without a sober look at the risks:

- Inflationary Pressures: While energy prices have stabilized, wage inflation in Europe remains a challenge for EBITDAaL margins.

- Regulatory Scrutiny: The European Central Bank (ECB) continues to monitor debt levels. Orange’s net debt/EBITDAaL ratio of 1.80x is healthy, but any significant hike in interest rates could increase refinancing costs for their recent $6bn bond issuance.

- Geopolitical Risk in AMEA: Political instability in certain African markets could disrupt the “growth engine” of the company.

FAQs: Orange Stock Forecast 2026 After Capital Markets Day

What is the Orange stock forecast for 2026?

The Orange stock forecast 2026 after Capital Markets Day is bullish, with a consensus price target of approximately €18.50. This is supported by an expected organic cash flow of €4 billion.

Did Orange raise its dividend today?

While the 2025 dividend is proposed at €0.75, the “Trust the Future” strategy strongly implies a dividend floor of €0.80 for 2026, subject to shareholder approval at the May 2026 meeting.

What is the “Trust the Future” plan?

It is Orange’s 2026–2028 strategic roadmap that focuses on AI-native operations, the consolidation of MasOrange in Spain, and a target of €5.2 billion in organic cash flow by 2028.

How does AI affect Orange stock?

Orange expects to generate €600 million in value through AI by 2028, primarily by reducing operational costs and increasing sales through hyper-personalized marketing.

Conclusion-Orange Stock Forecast 2026

The Orange stock forecast 2026 after Capital Markets Day reveals a company that is no longer just “waiting” for the future—it is building it. By hitting every target in the previous “Lead the Future” plan, CEO Christel Heydemann has earned the market’s trust. With the AMEA region firing on all cylinders, the Spanish merger providing scale, and AI driving efficiency, Orange stands as a top-tier pick for both value and growth investors in 2026.

As the markets process today’s news, one thing is certain: Orange has successfully balanced the high-stakes investment in 5G and Fiber with the need to return significant capital to its shareholders.

Disclaimer

The analysis provided in this article, including the Orange stock forecast 2026 after Capital Markets Day, is for informational and educational purposes only. cfostimes.com is not a registered investment advisor, broker, or financial planner.

- No Investment Advice: Nothing contained in this post constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments.

- Accuracy of Information: While we strive to provide 100% fresh and accurate data as of February 19, 2026, market conditions change rapidly. We make no guarantees regarding the completeness or accuracy of the financial projections presented.

- Risk of Loss: Investing in stocks, including Orange SA (ORA.PA), involves a high degree of risk. Past performance is not indicative of future results. You may lose some or all of your principal investment.

- Consult a Professional: We strongly recommend that you seek independent advice from a certified financial professional (CFP or CFA) before making any investment decisions based on the content of this pillar post.

- External Links: This post contains outbound links to government-authorized bodies and regulatory agencies (e.g., European Central Bank, ARCEP). cfostimes.com is not responsible for the content or privacy practices of these third-party sites.

By using this website, you agree to our Terms of Service and acknowledge that you are solely responsible for your own investment research and decisions.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

2 thoughts on “Orange Stock Forecast 2026: Proven Strategic Breakthrough After Capital Markets Day”