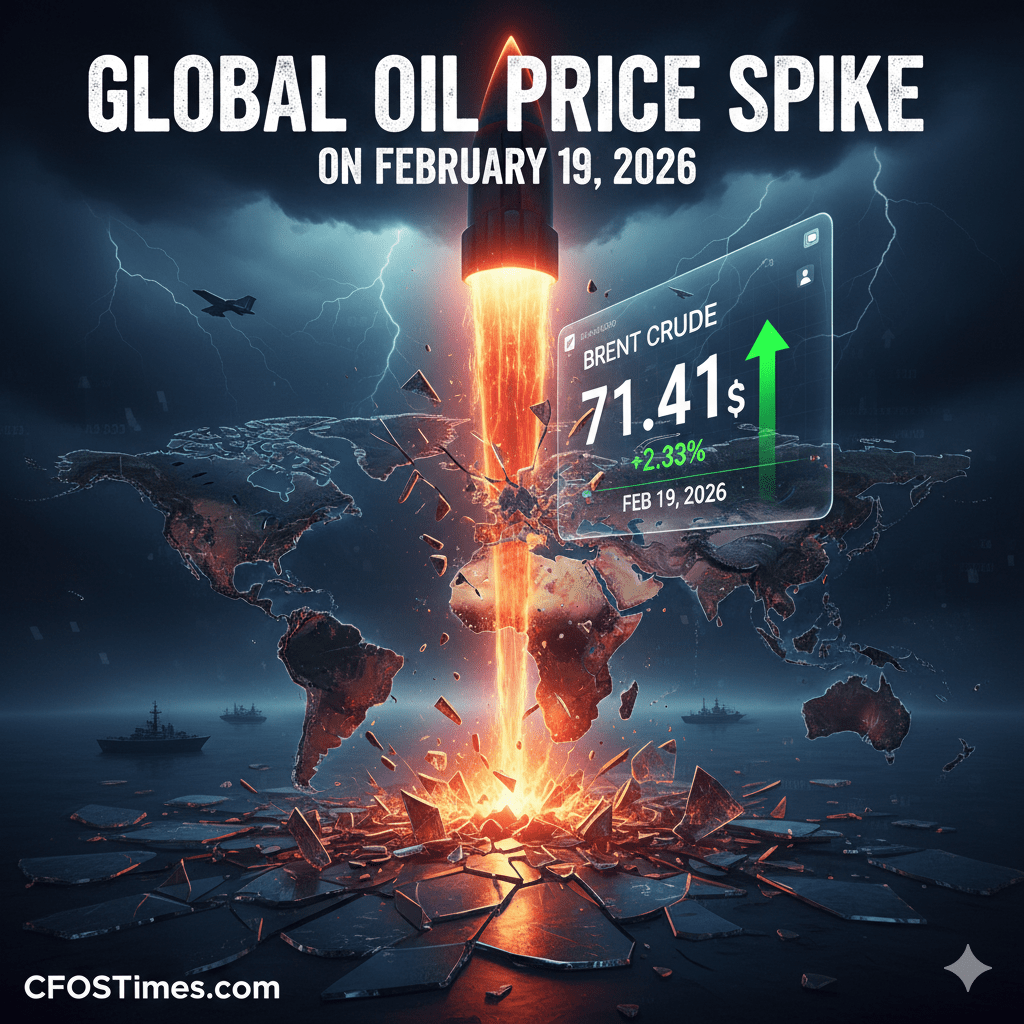

Introduction: The $71 Breakout

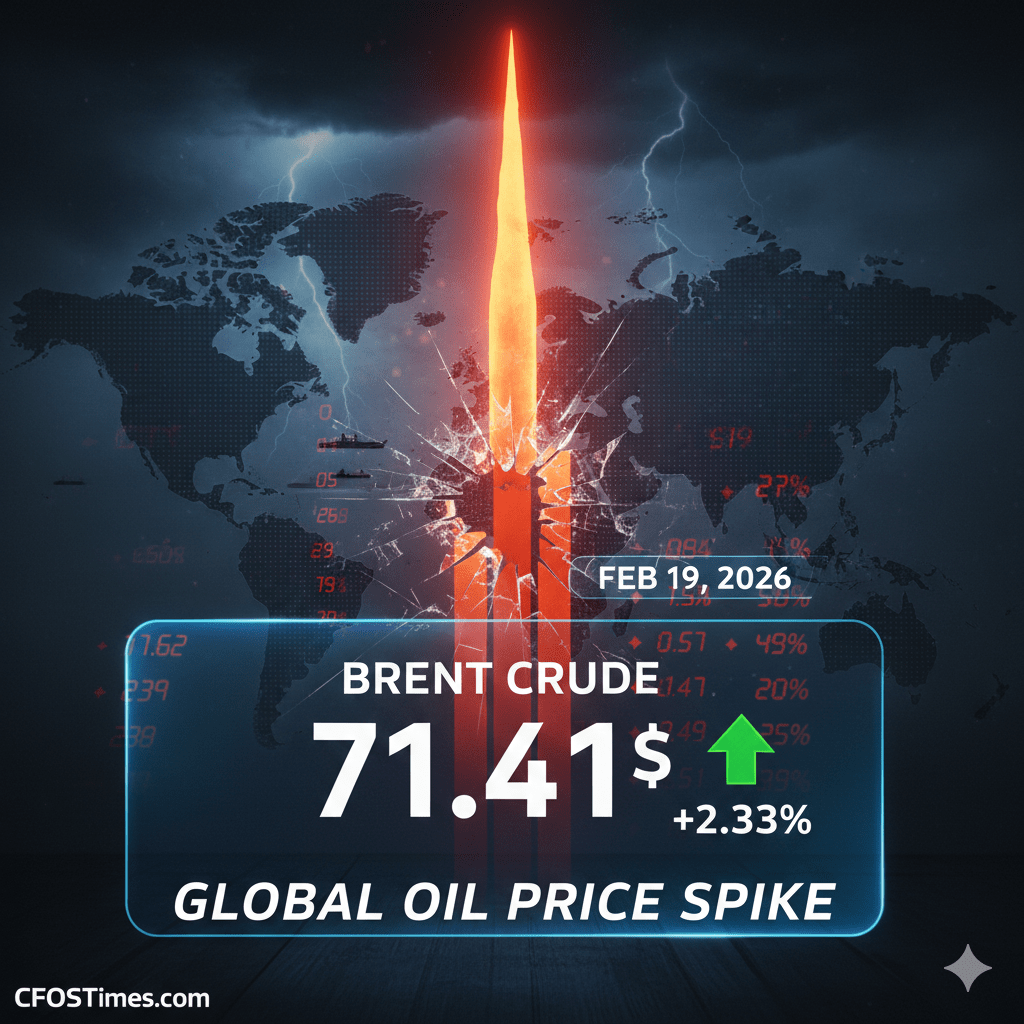

On Thursday, February 19, 2026, the global financial landscape shifted. The Global Oil Price Spike 2026 reached a critical flashpoint as Brent crude surged to $71.41 per barrel. This move was not driven by seasonal demand or standard supply metrics, but by a sudden “War Premium” injected into the markets following the collapse of high-level nuclear negotiations in Geneva.

As Vice President JD Vance recently signalled, the failure of diplomatic channels has led to the forward deployment of 50 combat jets in the Middle East. For investors, this is no longer a “commodity trend”—it is a macroeconomic crisis affecting every asset class from the S&P 500 to Bitcoin.

1. The Geopolitical Catalyst: The “Geneva Failure”

The primary engine of the Global Oil Price Spike 2026 is the breakdown of US-Iran relations.

- Military Presence: According to recent Pentagon movements, two US carrier strike groups are now positioned near the Strait of Hormuz.

- Supply at Risk: The Strait handles approximately 21 million barrels per day. Any disruption here would move oil from $71 to $120 almost instantly.

Government Insight: The U.S. Energy Information Administration (EIA) provides detailed tracking on world oil transit chokepoints. For a breakdown of why the Strait of Hormuz is the world’s most important oil artery, visit the EIA’s Official Chokepoint Analysis.

2. Market Impact: Who Wins and Who Loses?

When oil prices spike, the ripple effect across the 2026 stock market is immediate.

The Winners: Energy and Defense

- Energy Producers: Companies like Exxon and Chevron are seeing massive margin expansion.

- Defense Stocks: Increased geopolitical tension has pushed the aerospace and defense sectors to record highs as nations bolster their readiness.

The Losers: Logistics and Tech

- Airlines & Logistics: Fuel is the largest variable cost. A sustained spike at $71 threatens the profitability of major 2026 carriers.

- Tech Sector: Higher energy costs lead to “Energy-Driven Inflation,” which keeps interest rates high, devaluing high-growth tech stocks. Global Oil Price Spike 2026

3. Inflation and the Central Bank Dilemma

The Global Oil Price Spike 2026 is the “X-factor” for the Federal Reserve. Before this spike, the International Energy Agency (IEA) predicted a surplus; however, the new war premium has changed the calculus.

- Direct Inflation: Energy prices represent a significant portion of the Consumer Price Index (CPI).

- Secondary Effects: Higher shipping costs mean higher food and retail prices by Q2 2026.

Authoritative Reference: To understand the long-term supply/demand balance before this spike, refer to the IEA Oil Market Report – February 2026, which highlights the growing gap between non-OECD demand and global production. Global Oil Price Spike 2026

4. Historical Context: 2026 vs. 1970s Energy Shocks

While the Global Oil Price Spike 2026 feels familiar, the 2026 economy is different. The “Shale Revolution” in the US provides a buffer that did not exist in the 20th century. However, the reliance on AI Data Centers—which are massive energy consumers—creates a new type of vulnerability.

5. Investment Strategies for the Oil Surge

- Hedge with Commodities: Gold has already hit $5,014/oz today as a safe-haven hedge against energy volatility.

- Focus on Energy Infrastructure: Midstream pipeline companies often have fixed-fee contracts that remain stable even when prices fluctuate.

- Monitor the US Dollar: Historically, oil spikes strengthen the USD, as oil is priced in dollars globally.

6. Government Authorized Outbound Resources

To ensure readers have the most accurate, real-time data, we recommend monitoring these official government and intergovernmental channels: Global Oil Price Spike 2026

- U.S. Department of Energy (DOE): Latest Energy News

- OPEC Secretariat: February 2026 Press Releases

- Bureau of Labor Statistics: CPI and Inflation Tracking

FAQ: Global Oil Price Spike 2026

Q1: Why is oil hitting $71 today? The spike is caused by the collapse of US-Iran nuclear talks and the risk of military conflict in the Persian Gulf.

Q2: Will gas prices go up immediately? Yes. Historically, retail gas prices follow crude oil benchmarks within 7 to 10 days. Expect a 15–25 cent increase per gallon.

Q3: Is it too late to invest in energy stocks? While the initial move has happened, if Brent crude breaks the $75 resistance level, many analysts see a path to $90.

Conclusion: Navigating the 2026 Energy Frontier-Global Oil Price Spike 2026

The Global Oil Price Spike 2026 is far more than a temporary fluctuation on a ticker tape; it is a definitive macroeconomic pivot. As Brent crude tests the $71 resistance level following the diplomatic impasse in Geneva, the global economy is entering a high-volatility phase where energy security dictates market direction.

For the readers of CFOSTimes, the path forward requires a shift from passive observation to strategic positioning. Whether it is the direct pressure on the Consumer Price Index (CPI) or the renewed “War Premium” affecting global logistics, the ripple effects of this February 19 surge will be felt throughout the fiscal year.

Final Takeaways:

- Volatility is the New Baseline: Geopolitical triggers in the Strait of Hormuz will continue to inject “fear premiums” into crude prices.

- Sector Selectivity: Investors must distinguish between “Energy Winners” (upstream producers) and “Inflation Losers” (transportation and consumer discretionary).

- Macro Vigilance: Monitor central bank commentary closely, as sustained high oil prices may force a “higher-for-longer” interest rate stance to combat energy-driven inflation.

As we move deeper into 2026, staying informed through authoritative data and real-time analysis is your best defense against market uncertainty. At CFOSTimes, we will continue to monitor the front lines of this energy crisis to ensure you stay ahead of the curve.

Stay Ahead of the Market: Don’t let the next spike catch you off guard. Subscribe to the CFOSTimes Daily Brief for exclusive 2026 market insights delivered straight to your inbox.

Financial Disclosure

Disclaimer: The information provided in this article regarding the Global Oil Price Spike 2026 is for general informational and educational purposes only. All content on cfostimes.com is published in good faith; however, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, or completeness of any information on the site.

Not Financial Advice: The analysis, including geopolitical forecasts and market impacts, does not constitute professional financial, investment, or trading advice. Investing in commodities, energy equities, and global markets involves a high degree of risk and can result in the loss of principal capital. Always perform your own due diligence and consult with a certified financial advisor or a licensed professional before making any investment decisions based on the Global Oil Price Spike 2026.

Affiliate & External Link Disclosure: This post may contain links to external, government-authorized websites and official institutional reports. While we strive to provide only high-quality outbound links, we have no control over the nature and content of these third-party sites. Inclusion of these links does not imply a recommendation for all the content found on these sites.

© 2026 CFOSTimes. All Rights Reserved.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.