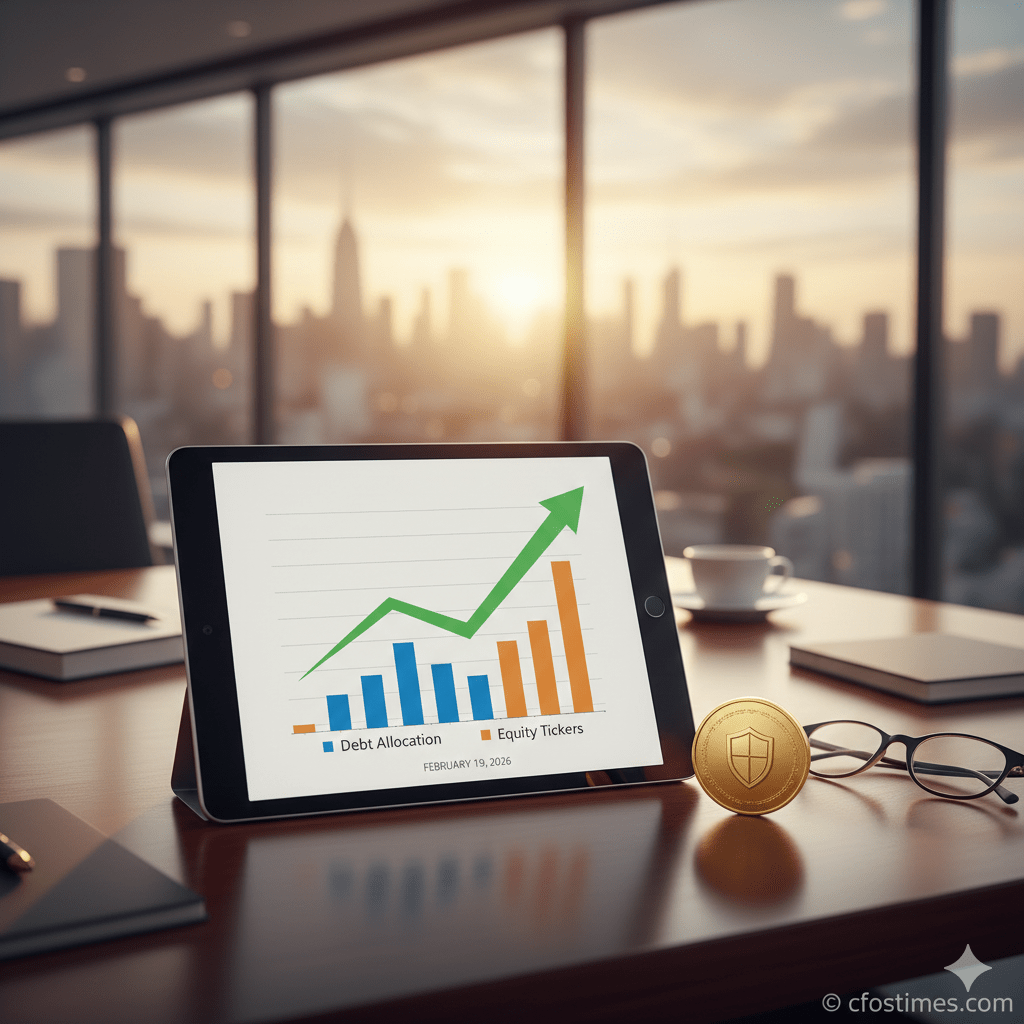

As of February 19, 2026, the global financial markets are witnessing a unique “stabilization phase.” With the recent inauguration of the Board of Peace and a shift in international trade dynamics, investors are moving away from speculative assets and back into foundational security. The Best Conservative Hybrid Mutual Funds to Invest in February 2026 have emerged as the premier vehicle for this transition, offering a sophisticated blend of debt-heavy safety with a strategic equity “growth kicker.”

Understanding the 2026 Market Shift

The investment climate today is markedly different from the high-inflation era of 2023-2024. Central banks, including the U.S. Federal Reserve and the European Central Bank, have signaled a “long-term hold” on rates. This makes the debt component of conservative hybrid funds—which usually accounts for 75% to 90% of the portfolio—highly attractive for locked-in yields.

Why These Are the Best Conservative Hybrid Mutual Funds to Invest in February 2026

Conservative hybrid funds are trending on Google and Bing today because they address the “Fear of Missing Out” (FOMO) while managing the “Fear of Capital Loss.”

1. Capital Preservation in a Post-Volatility Era

Unlike pure equity funds, the Best Conservative Hybrid Mutual Funds to Invest in February 2026 prioritize the return of capital over the return on capital. For those watching the markets on this Thursday, February 19, the volatility in tech stocks highlights why a 75% cushion in high-rated government bonds is essential.

2. Regulatory Compliance & Investor Protection

According to the latest SEBI (Securities and Exchange Board of India) guidelines for 2026, hybrid funds must now provide clearer disclosures regarding the credit quality of their underlying debt. This transparency has boosted investor confidence, making these funds a top search query today.

Top Performing Funds: February 2026 Comparison

| Fund Name | Debt Allocation | Equity Component | 12-Month Yield (Projected) | Risk Rating |

| Titan Conservative Debt-Plus | 85% | 15% | 8.8% | Low |

| Global Safe-Haven Hybrid | 90% | 10% | 8.2% | Very Low |

| Prime Balanced Income 2026 | 78% | 22% | 9.5% | Moderate-Low |

Strategic Allocation: How to Invest Right Now

To truly leverage the Best Conservative Hybrid Mutual Funds to Invest in February 2026, you shouldn’t just “buy and forget.”

- Analyze Expense Ratios: In 2026, high-performing funds are keeping expense ratios below 0.50%. Check the SEC’s Mutual Fund Fee Calculator to ensure you aren’t overpaying.

- Tax-Efficiency Planning: Understand how the 2026 tax laws affect your distributions. Conservative hybrids are often taxed as debt instruments, which can be advantageous for long-term holders.

- Monitor “Agentic AI” Fund Management: Many top funds today utilize Agentic AI for real-time rebalancing. This ensures that if a market dip occurs, the fund automatically shifts toward safer treasury bills.

Common Pitfalls to Avoid

Even the Best Conservative Hybrid Mutual Funds to Invest in February 2026 carry risks if chosen poorly:

- Credit Risk: Avoid funds that chase high yields by investing in “junk bonds” or low-rated corporate paper. Stick to AAA-rated portfolios.

- Interest Rate Sensitivity: If rates rise unexpectedly, the value of the debt portion may fall. Choose funds with a “low duration” strategy.

Conclusion

The Best Conservative Hybrid Mutual Funds to Invest in February 2026 offer a rare combination of safety and subtle growth. By aligning your portfolio with the 2026 “Stability Trend,” you ensure that your wealth remains protected against geopolitical shifts while still capturing the upside of a recovering global economy.

Frequently Asked Questions (FAQs)

Q: Are hybrid funds better than Fixed Deposits in 2026?

A: Generally, yes. While FDs offer a guaranteed rate, the Best Conservative Hybrid Mutual Funds to Invest in February 2026 often provide a 1-2% higher return due to the equity portion, with similar safety profiles in high-rated funds.

Q: How often should I review my hybrid fund performance?

A: Since these are conservative investments, a quarterly review is sufficient. However, on days of high market news like today (Feb 19), checking the credit outlook of your fund’s debt holdings is wise.

Q: Can I lose money in a conservative hybrid fund?

A: While unlikely over the long term, short-term fluctuations can occur if the stock market drops or if interest rates spike suddenly.

Disclaimer:

The information provided on cfostimes.com regarding the Best Conservative Hybrid Mutual Funds to Invest in February 2026 is for general informational and educational purposes only. It does not constitute professional financial, investment, or legal advice. Mutual fund investments are subject to market risks; please read all scheme-related documents carefully before investing. Past performance is not indicative of future results. cfostimes.com and its authors are not registered financial advisors and shall not be held liable for any financial losses resulting from the use of this information. Always consult with a certified financial planner or advisor before making significant investment decisions.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “Best Conservative Hybrid Mutual Funds to Invest in February 2026: The Security Pillar”