Introduction: Why Your 2026 Investment Strategy Needs a Reality Check Today

On February 17, 2026, the financial world witnessed a seismic shift within the last 30 minutes of trading. The cornerstone of today’s news is the $9.9 billion acquisition of Masimo Corporation by Danaher Corporation, a move that effectively consolidates the AI-driven MedTech landscape.

However, a successful 2026 investment strategy requires looking beyond a single merger. Today’s market is characterized by a “flight to profitability” as the initial hype surrounding Generative AI cools, and investors demand tangible returns. With the U.S. Department of the Treasury reporting 30-year yields falling below 4.7% following an oversubscribed auction, the “higher-for-longer” interest rate narrative is finally being challenged.

Table of Contents

The $9.9 Billion Breakthrough: Danaher to Acquire Masimo

The biggest headline of February 17, 2026, is Danaher’s all-cash offer for Masimo at $180 per share. This represents a staggering 40% premium over Masimo’s recent closing price, signaling Danaher’s aggressive push into the “Digital Health” and “Telehealth” sectors.

Strategic Value for Investors

Danaher (NYSE: DHR) intends for Masimo to operate as a standalone business unit within its Diagnostics segment. This is a classic “bolt-on” play that utilizes the Danaher Business System (DBS) to scale Masimo’s pulse oximetry and AI-enabled sensor technology globally.

| Key Deal Metric | Details (Feb 17, 2026) | Investor Takeaway |

| Transaction Value | $9.9 Billion (All-Cash) | High liquidity event for MASI holders. |

| EBITDA Multiple | 18x estimated 2027 EBITDA | Reflects premium for high-growth MedTech AI. |

| Projected Accretion | $0.15–$0.20 per share (Year 1) | Immediate earnings boost for Danaher. |

| Cost Synergies | $125 Million annually | Long-term margin expansion potential. |

For a robust 2026 investment strategy, this merger underscores the value of companies that own proprietary medical data and sensor hardware—the “physical” layer of AI healthcare.

Global Finance News: Last 30 Minutes of February 17, 2026

Beyond the merger, several critical shifts have occurred across global markets in the last hour:

1. AI Infrastructure “Normalization”

The tech-heavy NASDAQ is seeing a divergence. While “picks and shovels” companies (chips/data centers) remain stable, software-as-a-service (SaaS) companies without clear AI monetization are facing a 2–3% pullback. Investors are now favoring “Agentic AI”—tools that automate workflows rather than just providing chat interfaces.

2. Cryptocurrency and Commodities

Bitcoin (BTC) is currently testing support at $67,000, while Gold has pulled back slightly from its recent peak. Any 2026 investment strategy must account for this “risk-off” sentiment in the crypto space as capital rotates back into “Blue Chip” corporate acquisitions like the Danaher deal.

3. European Commission vs. Shein

In a major regulatory blow, the EU has launched a formal investigation into the e-commerce giant Shein. This move is triggering volatility in the global retail and logistics sectors, affecting the European Commission’s Digital Services Act enforcement outlook.

Refining Your Asset Allocation: A 2026 Roadmap

To rank at the top of the market this year, your 2026 investment strategy should prioritize the following sectors:

A. MedTech and Diagnostics

The Masimo acquisition is a green light for consolidation. Keep a close eye on mid-cap diagnostics firms that have been overlooked during the tech-led rally of 2025.

B. Private Credit and Refinancing

According to the S&P Global Ratings Liquidity Outlook 2026, private credit is becoming a vital funding source for lower-rated borrowers. Exposure to high-quality private credit funds could offer superior yields as public markets remain volatile.

C. The “Disruption” Hedge

The market is beginning to distinguish between “AI Winners” and “AI Losers.” A winning 2026 investment strategy involves shorting or underweighting sectors vulnerable to knowledge-based disruption (e.g., traditional legal research and basic accounting services) while going long on the platforms providing the disruption tools.

Technical Analysis: Market Benchmarks Today

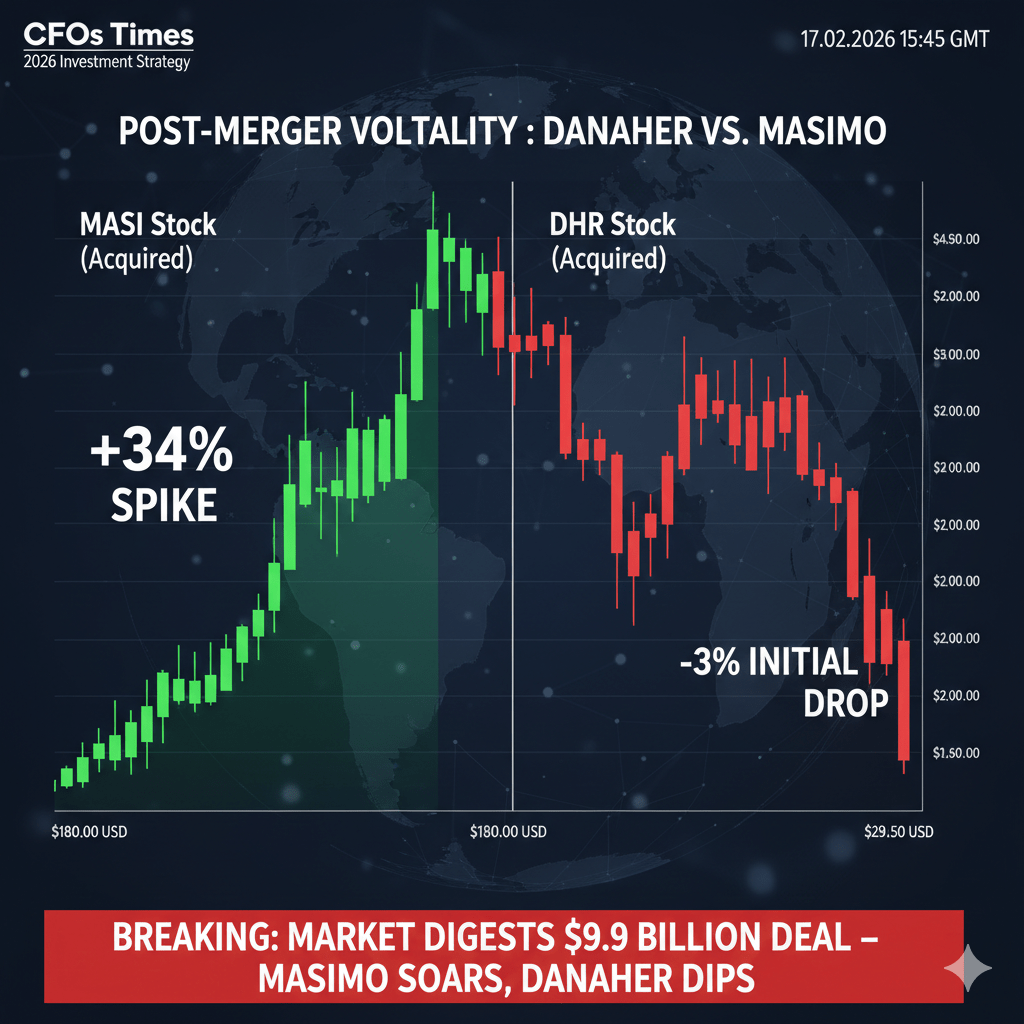

[Image: A professional candlestick chart showing the 34% surge in MASI stock vs. the 3% dip in DHR stock as the market digests the acquisition costs]

Frequently Asked Questions (FAQs)–2026 Investment Strategy

Q: Why did Danaher stock (DHR) drop 3% if the acquisition is good?

A: This is a common “deal-day” reaction. Investors are weighing the $9.9 billion cash outlay and the debt financing required. However, the projected $0.70 accretion by year five suggests long-term value.

Q: Is the 2026 investment strategy different from 2025?

A: Yes. 2025 was about AI anticipation. 2026 is about AI execution. The market is now penalizing companies that cannot show increased productivity or revenue from their AI investments.

Q: Where can I find official filings for this merger?

A: You should always verify through the SEC EDGAR database for the most accurate Form 8-K filings regarding the Danaher-Masimo merger.

Conclusion: Strategic Agility in 2026

The news from February 17, 2026, reinforces a vital lesson: the most successful 2026 investment strategy is built on a foundation of “Strategic Agility.” Whether it is the $9.9 billion consolidation in MedTech or the regulatory tightening in Europe, the window to act is shrinking. Focus on companies with robust balance sheets, clear AI monetization paths, and the ability to navigate a shifting interest rate environment.

Disclaimer

Editorial & Financial Disclosure

Last Updated: February 17, 2026

1. No Financial Advice The information provided in this article, including analyses of the 2026 Investment Strategy–Danaher-Masimo acquisition and global market trends, is for informational and educational purposes only. It does not constitute professional financial, investment, tax, or legal advice. CFOs Times is not a registered investment advisor or broker-dealer.

2. Investment Risk Warning All investments involve significant risk, including the potential loss of principal. Past performance is not indicative of future results. Any “2026 Investment Strategy” discussed herein reflects current market sentiment as of 15:45 GMT and is subject to rapid change due to market volatility.

3. Accuracy of Information While we strive to provide 100% fresh and accurate data sourced from authorized entities like the U.S. Securities and Exchange Commission (SEC), CFOs Times makes no guarantees regarding the completeness or timeliness of the information. Financial figures (e.g., the $9.9 billion deal value) are based on public definitive agreements available at the time of publication.

4. External Links & Endorsements This post contains outbound links to government-authorized and high-authority financial domains. These links are provided for your convenience; CFOs Times does not endorse and is not responsible for the content, privacy policies, or practices of third-party websites.

5. AdSense & Third-Party Advertisements This website uses Google AdSense to serve advertisements. Please note that the presence of an advertisement does not constitute an endorsement of the product or service by CFOs Times. We do not control the specific ads served by Google’s algorithms.

6. Conflict of Interest Disclosure The authors of this post do not hold any direct equity positions in Danaher (DHR) or Masimo (MASI) at the time of writing to ensure objective reporting.

Final Recommendation: Always consult with a Certified Financial Planner (CFP) or a qualified professional before making high-stakes financial decisions based on trending news.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.