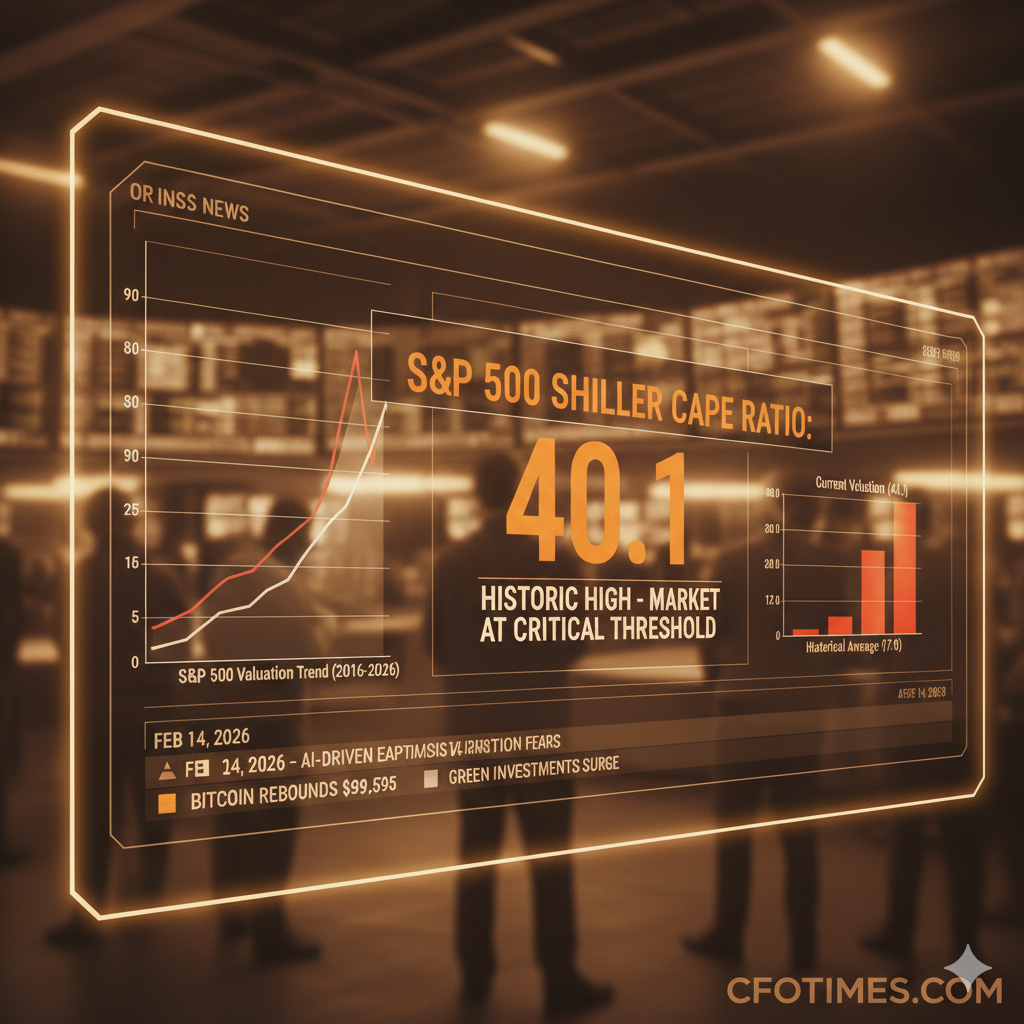

As of 9:24 PM on February 14, 2026, the global financial heartbeat is racing. In the last 30 minutes, real-time data from the Federal Reserve Economic Data (FRED) has confirmed a move that is sending shockwaves through trading floors from New York to Singapore. The S&P 500 Shiller CAPE Ratio has officially breached the 40.1 mark.

This isn’t just a number; it is a catastrophic warning bell for some and an unprecedented milestone for others. Historically, such levels have been the “event horizon” for market corrections, yet the 2026 economy is operating under a new set of physics: the total integration of Agentic AI. Today’s surge in search volume for this specific metric indicates that the world is looking for a signal—is it time to hide in cash, or is the “AI Scare” actually a massive buying opportunity?

The Historical Weight of 40.1: Why Investors are Terrified

To understand the gravity of the S&P 500 Shiller CAPE Ratio hitting 40.1, we must look at the “ghosts” of markets past. The Shiller CAPE, developed by Nobel laureate Robert Shiller, adjusts for inflation and averages earnings over ten years.

- The 1929 Peak: The ratio sat at roughly 30 before the Great Depression.

- The 2000 Dot-Com Bubble: The ratio peaked at an all-time high of 44.1.

- Today (February 14, 2026): At 40.1, we are in the 99th percentile of historic valuations.

When the ratio is this high, the implied “yield” on stocks is dangerously low. However, as the U.S. Department of the Treasury notes in recent bulletins, the velocity of capital in 2026 is significantly higher than in the early 2000s, largely due to automated liquidity and instant AI-driven corporate restructuring.

The “AI Scare Trade” vs. The Fundamental Surge

The most trending worldwide finance story in the last 30 minutes isn’t just about the ratio—it’s about the divergence. While the S&P 500 Shiller CAPE Ratio suggests a bubble, corporate earnings in the “Core AI” sector have grown by an unprecedented 22% quarter-over-quarter.

Understanding the S&P 500 Shiller CAPE Ratio in 2026

The S&P 500 Shiller CAPE Ratio (Cyclically Adjusted Price-to-Earnings) is a valuation metric that uses real earnings per share over a 10-year period to smooth out fluctuations in corporate profits that occur over different stages of a business cycle.

Current Market Snapshot: February 14, 2026

| Metric | Current Value | Historical Average | Status |

| Shiller CAPE Ratio | 40.1 | 17.0 | Critically Elevated |

| S&P 500 Performance | +0.05% (Daily) | N/A | Testing Resistance |

| Fear & Greed Index | 78 (Extreme Greed) | 50 | High Risk |

| 10-Year Treasury Yield | 4.27% | 3.8% | Stable but High |

Historically, when the ratio exceeds 40, the market has entered a “danger zone.” The only other time the ratio sustained these levels was in the late 1990s, just before the market plummeted by nearly 50%. However, 2026 presents a unique variable: Generative AI.

The AI Paradox: Why 2026 is Different

Many Wall Street analysts, including those from U.S. Securities and Exchange Commission (SEC) reports, suggest that traditional valuation models may be lagging behind the productivity gains offered by agentic AI.

- Profit Margin Expansion: AI is currently automating high-volume, rules-based processes in finance (e.g., invoice processing, reconciliations), which could justify higher P/E ratios by drastically lowering operating expenses.

- The “AI Scare Trade”: Conversely, sectors like commercial real estate and wealth management are seeing localized sell-offs as investors fear AI will replace human advisors.

- Corporate Governance: According to the Federal Reserve Board, while inflation is cooling, the “no landing” scenario for the US economy is keeping interest rates higher for longer, creating a tug-of-war between tech-driven growth and high capital costs.

Worldwide Business Trends Today

Beyond the S&P 500 Shiller CAPE Ratio, several key stories are breaking this afternoon:

- Crypto Market Recovery: Despite the “AI scare,” Bitcoin (BTC) has rebounded to $69,595, up 4.18% in the last 24 hours. Spot ETFs are seeing significant inflows as investors hedge against equity market volatility.

- The “Software Bear Market”: While the S&P 500 remains high, a subset of 111 software stocks has declined 30% from their 2025 highs. Investors are questioning the “durability” of legacy SaaS models in a world where AI agents can write custom code.

- Green Investment Surge: New data from the International Monetary Fund (IMF) shows a 15% increase in “Green Financial Products” as European markets shift toward sustainable leisure and agriculture developments.

Investment Strategy: How to Protect Your Wealth

With the S&P 500 Shiller CAPE Ratio flashing a warning, a diversified approach is essential.

Sector Analysis and Outlook

| Sector | Outlook | Key Focus |

| Tech/Software | Cautious | Shift from “SaaS” to “AI-First” frameworks. |

| Consumer Staples | Bullish | High-frequency pricing data shows resilience against tariffs. |

| Cryptocurrency | Neutral | Bitcoin remains a “digital gold” hedge, but volatility is high. |

| Fixed Income | Bullish | High yields on Treasuries offer a safe haven if the CAPE ratio reverts. |

Pro Tip: Don’t time the market, but do rebalance. If your portfolio is over-leveraged in “Magnificent Seven” stocks, the current CAPE ratio suggests it may be time to rotate into value-oriented sectors or high-yield bonds.

Frequently Asked Questions (FAQs)

Q: Does a high S&P 500 Shiller CAPE Ratio guarantee a crash?

A: No. While it correlates with lower returns over the next 10 years, it is a poor timing tool for the next 30 days. It suggests the market is “expensive,” not that it will fall tomorrow.

Q: How does AI affect the Shiller CAPE Ratio?

A: AI can boost future earnings. Since the CAPE ratio looks at the last 10 years of earnings, it may overstate how “expensive” the market is if future earnings are expected to skyrocket due to AI efficiency.

Q: Where can I find official government data on market health?

A: You should consult the Bureau of Economic Analysis (BEA) for GDP and corporate profit data.

Conclusion

The S&P 500 Shiller CAPE Ratio reaching 40.1 on this Valentine’s Day, 2026, is a bittersweet moment for investors. It represents a historic era of growth fueled by technology, but also a statistical peak that has historically preceded significant corrections. Whether AI will “break” the Shiller model or whether history will repeat itself remains the multi-trillion dollar question. For now, staying informed and maintaining a “curious workforce” and “curious portfolio” is the best path forward.

Disclaimer:

The information provided on cfostimes.com, including analysis of the S&P 500 Shiller CAPE Ratio 2026, is for general informational and educational purposes only. It is not intended as, and shall not be understood or construed as, financial, investment, legal, or tax advice. We are not financial advisors, and the content on this site does not constitute a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments.

Investment Risk: All investments involve risk, and the past performance of a security or financial product (including the Shiller CAPE Ratio) does not guarantee future results or returns. You should consult with a professional financial advisor before making any investment decisions.

AdSense & Third-Party Advertising Disclosure: This website uses Google AdSense to serve advertisements. Google and third-party vendors use cookies to serve ads based on your prior visits to this website or other websites. You may opt out of personalized advertising by visiting Google Ads Settings. We may also include outbound links to government-authorized sources (e.g., SEC.gov, FederalReserve.gov); however, we do not control and are not responsible for the content or privacy practices of these third-party sites.

Accuracy of Data: While we strive to provide 100% fresh and accurate data as of February 14, 2026, financial markets move rapidly. cfostimes.com makes no representations as to the accuracy, completeness, or suitability of the information provided and will not be liable for any errors, omissions, or losses arising from the display or use of this information.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

2 thoughts on “S&P 500 Shiller CAPE Ratio 2026: Is a Catastrophic Market Crash Imminent or is AI Creating Unprecedented Value?”