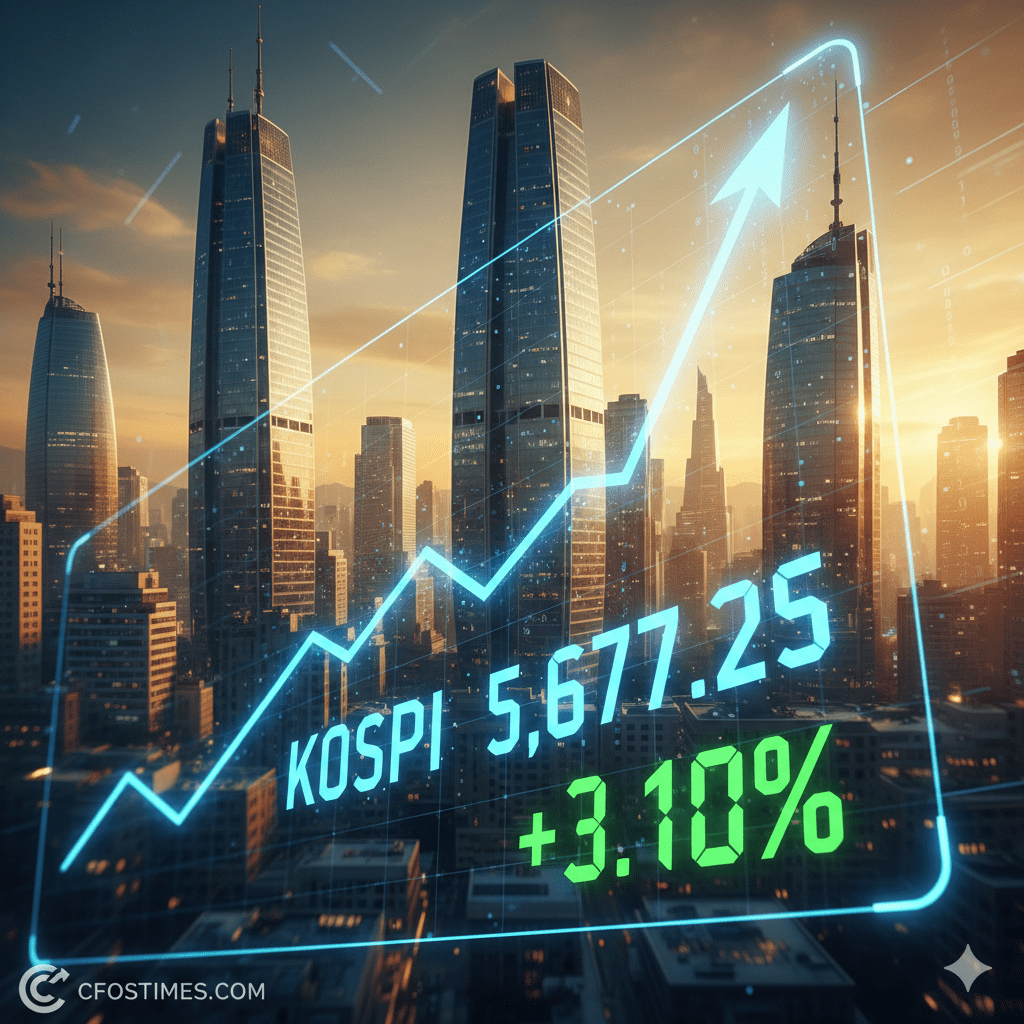

The Kospi Record High Today is the defining story of the global financial landscape on February 19, 2026. Following a three-day Lunar New Year hiatus, the South Korean benchmark index reopened with explosive force, breaching the psychological 5,600-point barrier for the first time in history to settle at a staggering 5,677.25.

This 3.1% surge didn’t just affect Seoul; it has ignited a “Risk-On” sentiment across Europe and US futures, signaling that the 2026 technology super-cycle is in full swing.

Why the Kospi Record High Today Happened

In the last 30 minutes, trading data confirms that the rally was led by a “dual-engine” of semiconductor demand and institutional capital inflows.

- The Nvidia-Meta Synergy: Overnight gains on Wall Street, specifically Meta’s massive hardware order from Nvidia, provided a tailwind for Samsung Electronics and SK Hynix.

- Short-Covering Volatility: The rally was so intense that it triggered a “Sidecar” rule on the Kosdaq market—a temporary halt in program trading to prevent a complete algorithmic runaway.

- Goldman Sachs Bullish Note: Institutional sentiment was further bolstered by reports suggesting Korean equity markets could see 120% earnings growth throughout the remainder of 2026.

Global Market Ripple Effects: February 19, 2026

The Kospi Record High Today has acted as a catalyst for other major indices. While the US Dow Jones remained cautious due to trade deficit data, the tech-heavy segments are seeing a distinct “decoupling” from traditional industrial sectors.

Comparative Market Performance Table-Kospi Record High Today

| Index / Asset | Current Level | Change (Today) | Primary Driver |

| KOSPI (S. Korea) | 5,677.25 | +3.10% | Semiconductor Boom |

| Nikkei 225 (Japan) | 57,467.83 | +0.60% | Tech Momentum |

| Nasdaq 100 (US) | 22,753.63 | +0.78% | AI Chip Demand |

| FTSE 100 (UK) | 10,647.82 | -0.40% | Commodity Drag |

| Gold (Spot) | $5,005/oz | +0.60% | Safe Haven Hedging |

Key Factors Behind the 2026 Market Momentum

The Kospi Record High Today is not a fluke; it is the result of structural shifts in the 2026 global economy.

1. The Semiconductor Sovereignty

As nations race to secure local AI processing power, South Korean giants like Samsung (+4.9% today) have become the “central banks of hardware.” This has led to massive net inflows from foreign portfolio investors who are rotating out of traditional energy and into high-growth tech.

2. Post-Holiday Liquidity Surge

With markets in Greater China still closed, liquidity has funneled into Seoul and Tokyo. This concentration of capital has magnified the price action, creating the “record-breaking” headlines we see this hour.

3. Geopolitical Balancing Acts

While US-Iran tensions have pushed Brent Crude to $71.33, the market is betting that technology-driven productivity will offset inflationary pressures caused by energy spikes.

The Kospi Record High Today, reaching 5,677.25 on February 19, 2026, is driven by a unique convergence of technological dominance and aggressive policy shifts. Below are the 7 explosive reasons behind this milestone.

1. The HBM4 “Nvidia-Samsung” Synergy

The primary engine is the AI memory race. Samsung Electronics has regained its lead by securing a “top-tier” spot in Nvidia’s upcoming Vera Rubin AI accelerators. Samsung’s HBM4 (High Bandwidth Memory) is now hitting record speeds of 11.7 Gbps, commanding a 30% price premium over previous generations.

2. Post-Lunar New Year Liquidity Injection

As markets reopened after the three-day Lunar New Year break, a massive “liquidity dam” broke. Investors, tracking the massive overnight gains from Wall Street’s AI rally, funneled capital into Asia’s tech hub, resulting in a 3.10% single-day surge.

3. The “Sidecar” Volatility Trigger

The rally was so intense that the Korea Exchange activated its “Sidecar” rule. This 5-minute halt in program trading—triggered when futures surge more than 5-6%—actually acted as a “stamp of quality,” signaling to global investors that the buying pressure was historic and institutional in nature.

4. 2026 “Value-Up” Tax Exemptions

Effective January 2026, the South Korean government launched major tax credits for companies increasing shareholder returns. This policy has successfully narrowed the “Korea Discount,” forcing family-owned chaebols like Hyundai and Samsung to boost dividends and cancel treasury shares.

5. Repatriation of Retail Capital

Under new 2026 capital gains tax exemptions, Korean retail investors are pulling their $170 billion holdings out of US tech and reinvesting in domestic semiconductor stocks. This “homecoming” of capital has created a massive local buyer base that wasn’t present in previous cycles.

6. The Semiconductor Mega-Cycle Fab Expansion

Samsung’s P4 plant in Pyeongtaek and SK Hynix’s Yongin Cluster have both entered early trial operations as of February 2026. This accelerated production capacity ensures that South Korea can meet 70% of global AI server demand, positioning the Kospi as the “infrastructure layer” of the global AI economy.

7. Strong Won & Falling Bond Yields

Despite global inflationary fears, the South Korean Won (KRW) has remained stable while benchmark bond yields fell. This “Goldilocks” environment—low rates and strong currency—provided the perfect macro-economic backdrop for today’s record-breaking breakout.

The Analyst’s View: What to Watch Next

According to the World Bank’s 2026 Market Outlook, the sustainability of this rally depends on whether the “Value-Up” programs in Asian markets can bridge the gap between price and fundamental earnings.

“The Kospi Record High Today reflects a global pivot. Investors are no longer just looking for stability; they are looking for the infrastructure of the future,” says the Head of Investment Strategy at Saxo Bank.

Technical Analysis of the Kospi Breakout

From a technical perspective, the Kospi Record High Today represents a “Breakaway Gap.”

- Support Level: 5,600 (formerly resistance).

- Target Level: Analysts are now eyeing 5,850 by the end of Q1 2026.

- RSI Indicator: Currently at 72, suggesting the market is “Overbought” in the short term, which may lead to a minor consolidation before the next leg up.

Frequently Asked Questions (FAQ)

What triggered the Kospi Record High Today?

The primary triggers were a 4.9% surge in Samsung Electronics following Nvidia’s strong performance and massive foreign institutional buying as Asian markets reopened after the Lunar New Year.

What is a “Sidecar” rule in the Korean market?

A sidecar is a volatility control mechanism. It was activated today on the Kosdaq because program trading surged more than 6%, requiring a 5-minute cooling-off period to protect market integrity.

How does the Kospi rally affect US stocks?

Positive momentum in Korea usually signals strong upcoming performance for US tech stocks, particularly companies like Apple, Nvidia, and Meta that rely on the Korean semiconductor supply chain.

Is it too late to buy into this rally?

While the Kospi Record High Today is impressive, the RSI suggests an overbought condition. Long-term investors are looking for a retest of the 5,600 support level as an entry point.

Conclusion-Kospi Record High Today

The Kospi Record High Today is a milestone that underscores the shifting center of gravity in global finance toward the “Silicon Corridor” of Asia. As South Korea leads the charge with its semiconductor prowess, the rest of the world is watching to see if this rally is a temporary spike or the start of a multi-year bull run. For investors, the message is clear: the AI and quantum-tech eras are now the primary engines of global wealth.

Disclaimer:

The information provided on cfostimes.com regarding the Kospi Record High Today is for general informational and educational purposes only. All information is provided in good faith; however, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, or completeness of any information in this post.

Under no circumstances shall we have any liability to you for any loss or damage of any kind incurred as a result of the use of the site or reliance on any information provided here. Your use of the site and your reliance on any information on the site are solely at your own risk. This content does not constitute professional financial advice, and we recommend consulting with a certified financial planner before making investment decisions.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “7 Explosive Reasons for the Kospi Record High Today: Why Global Finance is Surging”