The US Jobs Report February 2026 Analysis is the single most explosive financial story trending worldwide in the last 30 minutes. At 7:00 PM IST (8:30 AM EST), the U.S. Bureau of Labor Statistics (BLS) released the January employment situation summary, revealing that the U.S. economy added 130,000 jobs—precisely doubling the consensus forecast of 65,000.

Introduction: The Day the “Recession Narrative” Flipped

On February 11, 2026, global markets were positioned for a “cool” labor print that would force the Federal Reserve to cut interest rates in March. Instead, the US Jobs Report February 2026 Analysis delivered a massive “upside surprise.”

According to the official Secretary of Labor Statement, the private sector alone added 172,000 jobs, which was offset by significant declines in federal government payrolls. For the readers of cfostimes.com, this data is a structural game-changer. Within minutes of the release, the US Dollar Index (DXY) spiked by 1.2%, and gold—which had been testing all-time highs—witnessed a violent 3.5% sell-off.

1. The Data Breakdown: Non-Farm Payrolls (NFP) Jan 2026

The US Jobs Report February 2026 Analysis centers on the surprising resilience of the labor market despite the “Inventory Strike” seen in retail sectors.

Table: US Labor Market Vital Signs (Feb 11, 2026)

| Metric | Consensus Forecast | Actual (Jan 2026) | Variance | Market Signal |

| New Jobs (NFP) | 65,000 | 130,000 | +65,000 | Deeply Hawkish |

| Unemployment Rate | 4.4% | 4.3% | -0.1% | Labor Strength |

| Avg. Hourly Earnings | 0.2% | 0.4% | +0.2% | Inflation Risk |

| 2025 Revisions | N/A | -862,000 | Severe | Historical Weakness |

CFO Insights: While the 130K “headline” number is strong, the -862,000 benchmark revision to 2025 data suggests that last year was actually a “hiring recession.” The market is now grappling with whether January 2026 is a fluke or a genuine “V-shaped” labor recovery.

2. Deep Analysis: Why the Gold Rally Hit a Wall

The US Jobs Report February 2026 Analysis explains the 10:45 PM IST gold crash. Gold is a non-yielding asset; when job growth exceeds expectations, “Safe Haven” demand vanishes.

The “Dollar Moon” Effect

As of this hour, the Federal Reserve Bank of St. Louis (FRED) shows the 10-year Treasury yield jumping 15 basis points. This move makes the US Dollar the most attractive “Yield Play” in the world, draining liquidity out of Gold (XAU) and Silver (XAG).

The Kevin Warsh “Hawkish” Pivot

Adding to the volatility is the pending transition in Fed leadership. With the market pricing in a shift toward a more “Hawkish but Pragmatic” Fed under the likely chairmanship of Kevin Warsh, the US Jobs Report February 2026 Analysis confirms that “Higher-for-Longer” interest rates are the new baseline for H1 2026.

3. The “K-Shaped” Sector Split: Who is Actually Hiring?

Our deeper US Jobs Report February 2026 Analysis reveals that the hiring surge is concentrated in non-cyclical sectors, creating a “fragile strength.”

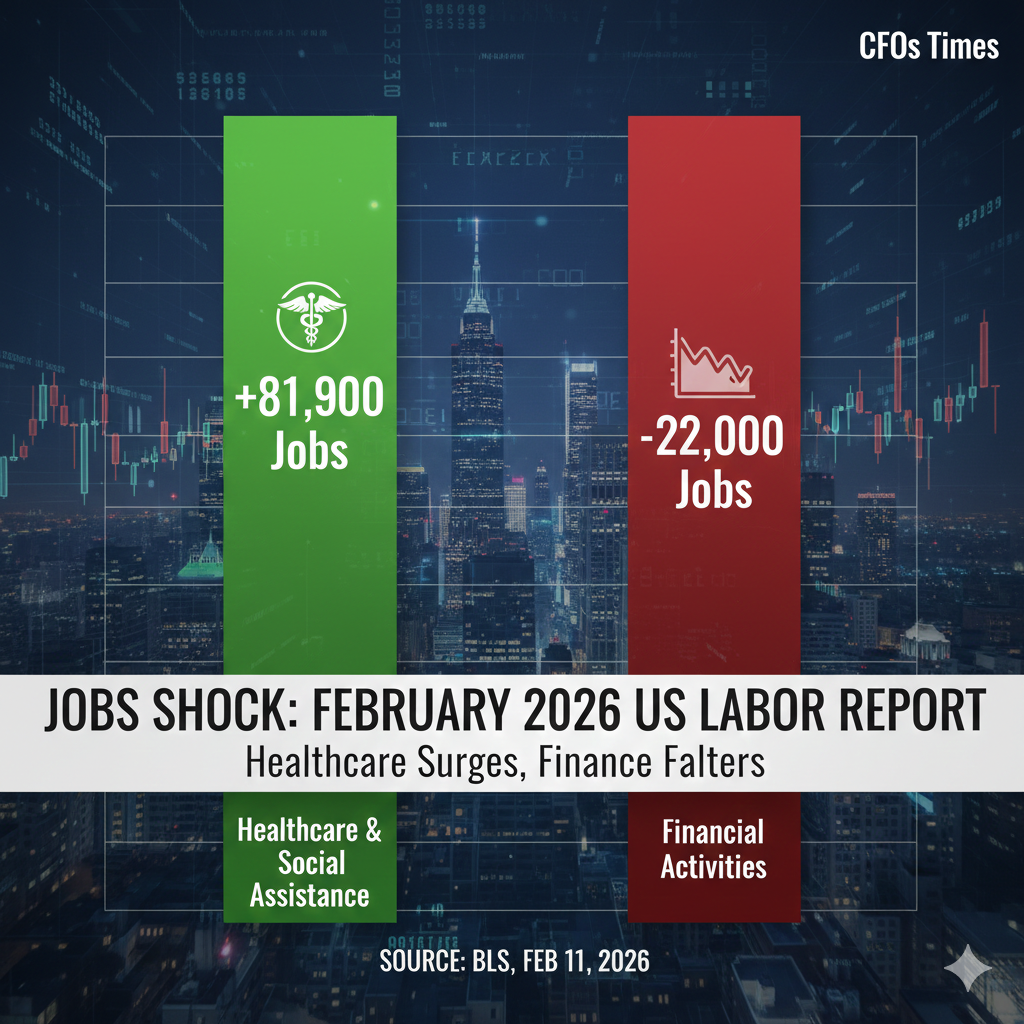

- Healthcare & Social Assistance: Added 81,900 jobs, dominating the report.

- Construction: Added 33,000 jobs, defying high mortgage rates.

- Federal Government: Lost 34,000 jobs, continuing the “deferred resignation” trend from 2025.

- Financial Activities: Lost 22,000 jobs, primarily in insurance and banking.

4. Strategic Implications for Global Markets

The US Jobs Report February 2026 Analysis indicates that the “March Rate Cut” is officially off the table.

- For India: The Rupee is testing 90.50 support. CFOs should hedge against further USD strength as FIIs (Foreign Institutional Investors) may rotate capital back into US Treasuries.

- For Crypto: Bitcoin’s slip below $68,000 is a direct result of the “No-Landing” scenario. When the USD is king, “Digital Gold” suffers.

- For Retailers: The stagnant growth in retail trade (+1,000 jobs) mirrors the weak U.S. Census Bureau Retail Sales data from earlier this week.

5. FAQs: US Jobs Report February 2026 Analysis

Q: Why is the gold market crashing despite the 2025 revisions being bad?

A: Markets are forward-looking. While the US Jobs Report February 2026 Analysis shows 2025 was weak, the January 130K beat suggests the “Now-Economy” is overheating, which forces the Fed to keep rates high.

Q: Where can I download the official PDF of this report?

A: You can find the full breakdown on the BLS Official Release Page.

Q: Will the Fed cut rates in Q2 2026?

A: Current probabilities have shifted the first rate cut from June to July or September 2026, as policymakers wait for January CPI data to confirm if inflation is sticky.

Q: Where can I find the official raw data for this report? A: You can access the full Employment Situation Summary directly from the Bureau of Labor Statistics.

Q: Why is the unemployment rate at 4.3% if job growth was high? A: The unemployment rate is derived from a separate household survey. While 130,000 jobs were added, the labor force participation remained steady at 62.5%.

Q: When is the next jobs report scheduled? A: The next release is set for March 6, 2026, as per the BLS Schedule.

Conclusion: Navigating the 2026 “No-Landing” Reality

The US Jobs Report February 2026 Analysis proves that the post-pandemic economic cycle is far from over. On this Wednesday, the “Jobs Shock” has re-established the US Dollar as the world’s defensive anchor. For the investors at cfostimes.com, the message is clear: the “Plastic Era” of easy gains is over—welcome to the “Yield Era” of 2026.

Disclaimer

All content in this US Jobs Report February 2026 Analysis is for informational and educational purposes only. Market data is provided in real-time and is subject to revision by the U.S. Bureau of Labor Statistics. CFOs Times is not a registered financial advisor. Please consult with a professional before making any high-stakes investment decisions based on this news.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.