The The Unit BRICS Gold-Digital Settlement has officially transitioned from a research whitepaper to a high-stakes geopolitical pilot as of February 5, 2026. While global markets have been transfixed by Bitcoin’s volatility, a more structural shift is occurring within the BRICS+ bloc. The Reserve Bank of India (RBI) has formally requested that a proposal for a “CBDC Bridge” be placed on the 2026 BRICS Summit agenda, utilizing “The Unit”—a decentralized settlement instrument backed by 40% physical gold—as the primary accounting ledger.

For institutional investors and corporate treasurers, the The Unit BRICS Gold-Digital Settlement represents the first credible, scalable alternative to the US dollar-dominated SWIFT system. This article explores the technical architecture of the Unit, its integration with the mBridge graduation, and the strategic reasons behind India’s 2026 leadership in this space.

Table of Contents

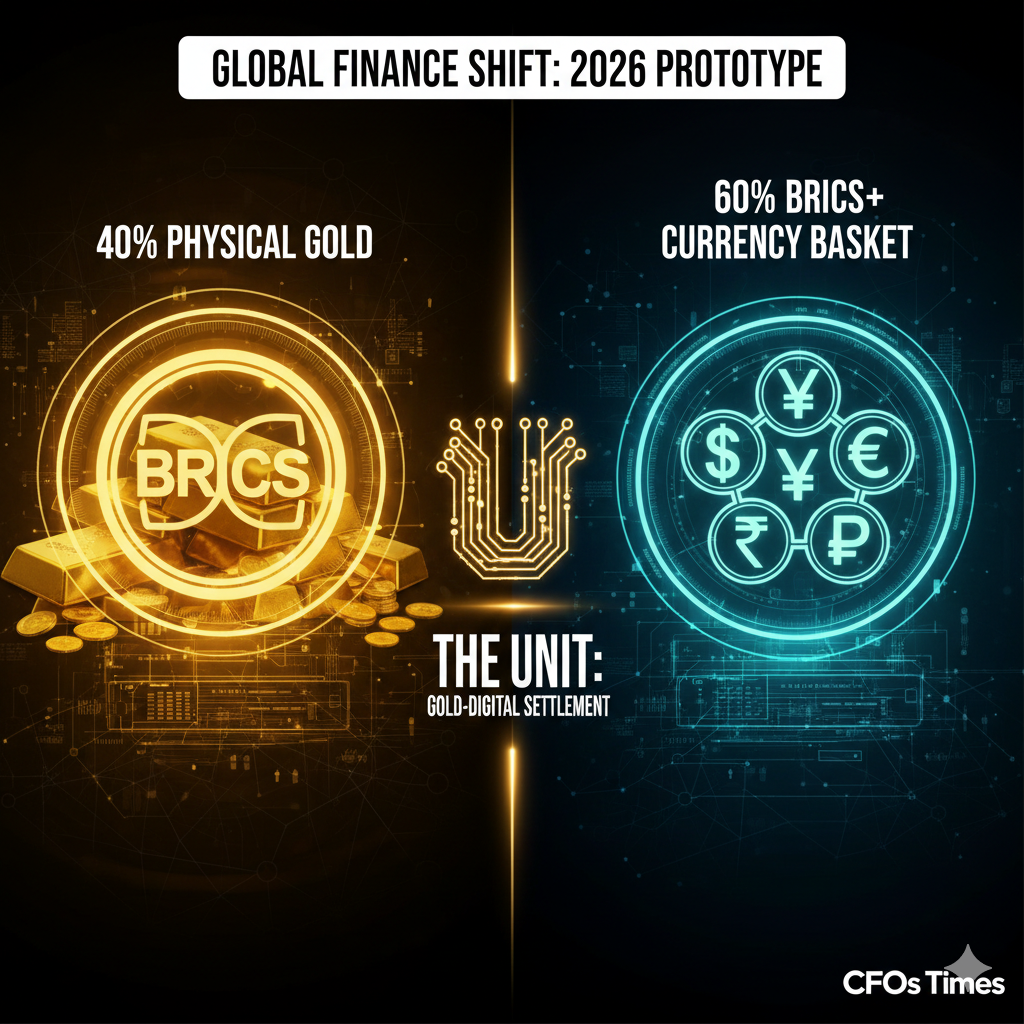

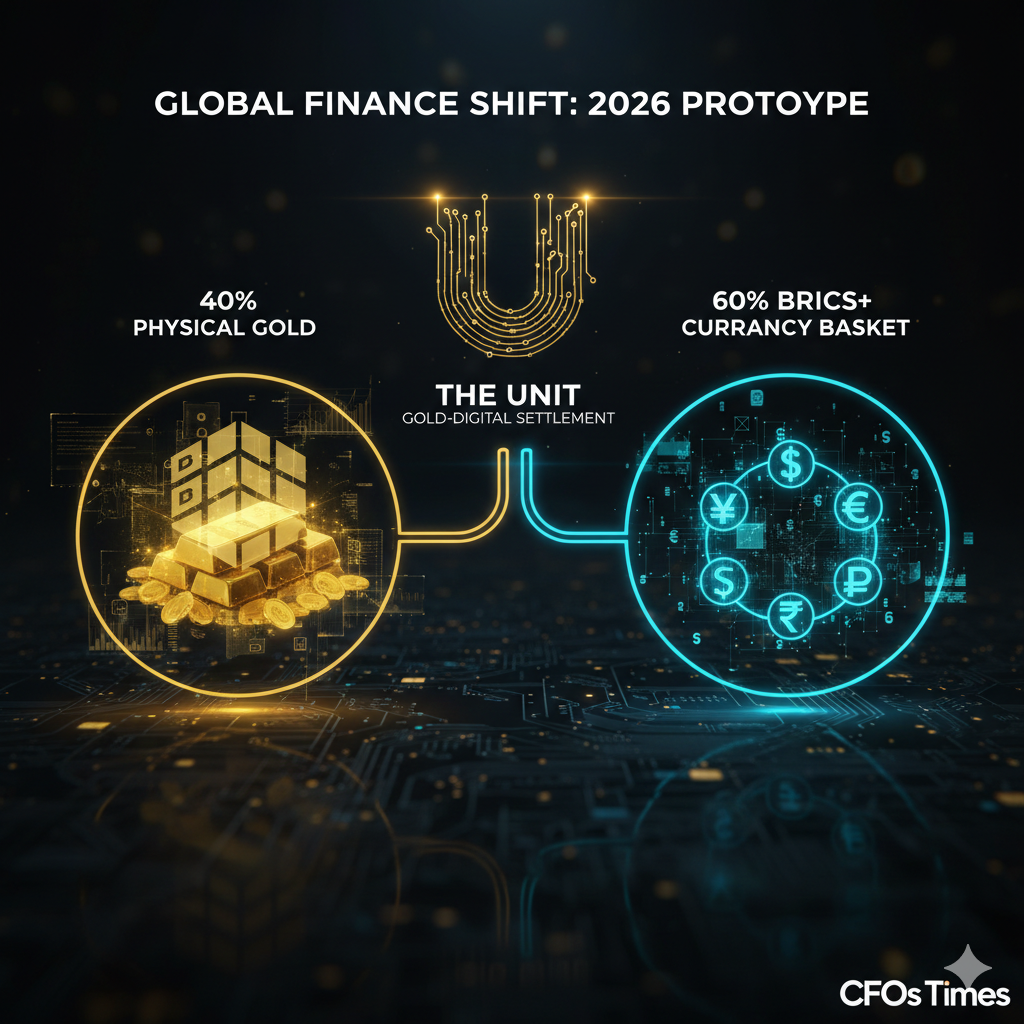

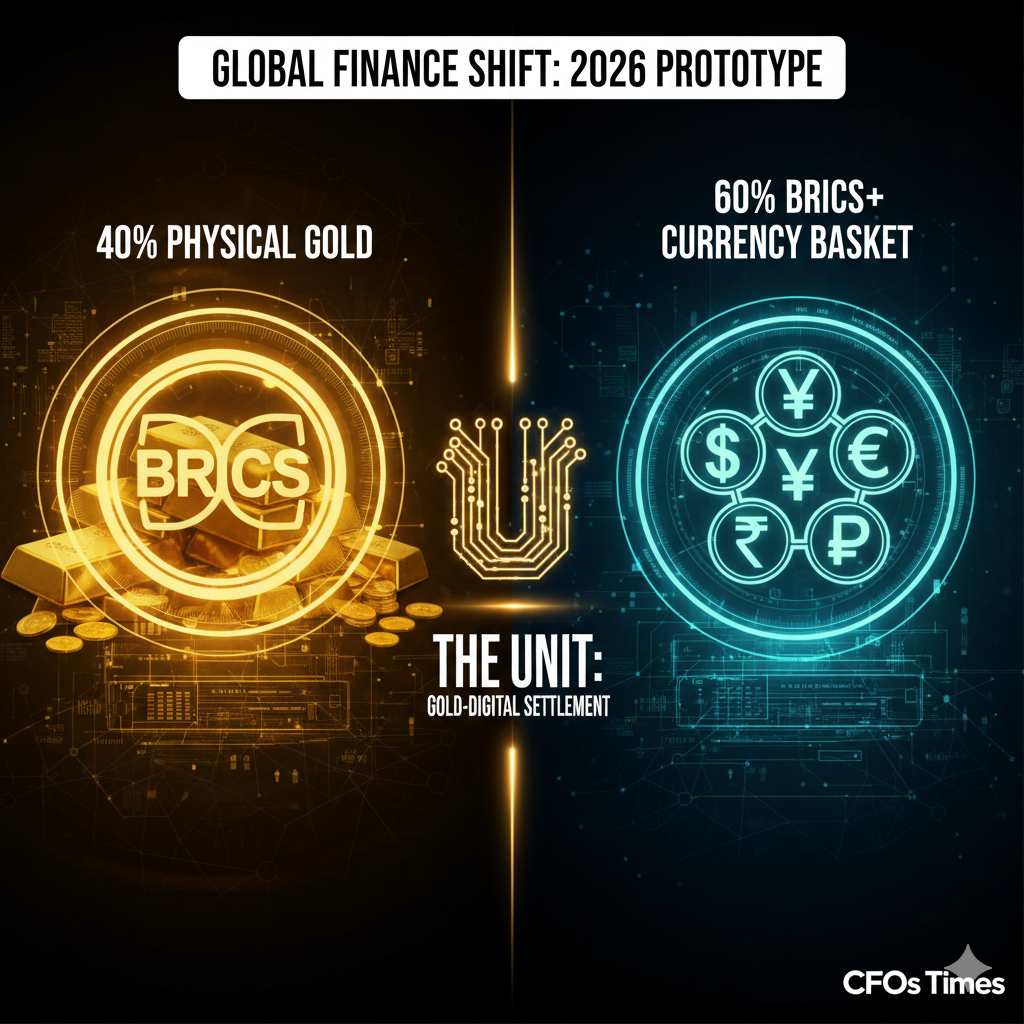

1. Technical Architecture: The “40/60” Gold-Digital Framework

The The Unit BRICS Gold-Digital Settlement is built on a “collateral-first” philosophy. Unlike fiat currencies, which rely on the sovereign credit of a single nation, The Unit is a decentralized “numéraire” or unit of account.

The Dual-Anchor Mechanism

The valuation of a single “Unit” is derived from two distinct components to ensure stability against inflation and currency manipulation:

- 40% Physical Gold Anchor: Each unit is tied to a specific weight of gold (approx. 1 gram of .999 fine gold). This gold remains in national vaults but is “tokenized” and audited on a shared distributed ledger.

- 60% BRICS+ Currency Basket: The remaining value is a weighted average of the “R5” currencies (Yuan, Rupee, Ruble, Real, and Rand).

Expert Analysis: According to theInternational Research Institute for Advanced Systems (IRIAS), this structure prevents a “Yuanization” of the system, ensuring that India and Brazil maintain monetary sovereignty while benefiting from a shared settlement rail.

2. RBI’s 2026 Proposal: The CBDC “Bridge”

A critical development in the The Unit BRICS Gold-Digital Settlement narrative is the Reserve Bank of India’s (RBI) push for interoperability. Under India’s 2026 BRICS Presidency, the RBI is advocating for a “Multi-CBDC Arrangement” (mBridge).

Key Features of the RBI Bridge:

- Direct Atomic Swap: Allows the Indian E-Rupee to swap directly into The Unit for wholesale energy settlements (e.g., UAE oil or Russian gas).

- Bypassing Correspondent Banks: Eliminates the 3-5% fee typically charged by Western intermediary banks.

- Sanction Immunity: Transactions settle on a permissioned blockchain (Cardano-based), making them invisible to the SWIFT messaging system.

3. Market Impact: The End of the Petrodollar?

The adoption of The Unit BRICS Gold-Digital Settlement for energy trade is the most significant threat to the dollar’s “Petrodollar” status. As of February 2026, nearly 20% of global oil trades are now conducted in non-USD currencies, with “The Unit” acting as the stabilizing bridge for these bilateral deals.

Comparative Settlement Efficiency (2026 Data)

| Metric | Legacy SWIFT (USD) | The Unit (DLT) |

| Settlement Time | 2 – 5 Business Days | < 60 Seconds |

| Transaction Cost | $25 – $50 + FX Spread | < $0.10 Equivalent |

| Transparency | High (for US Regulators) | High (for Bloc Members) |

| Reserve Asset | US Treasuries | Physical Gold & Local CBDC |

4. Geopolitical Strategy: Why Now?

The timing of the The Unit BRICS Gold-Digital Settlement pilot coincides with escalating trade tensions. The International Monetary Fund (IMF) notes in its 2026 outlook that the “fragmentation of global payment rails” is accelerating due to the weaponization of finance.

- For Russia and Iran: The Unit is a survival mechanism to bypass sanctions.

- For India and China: It is a strategic tool to reduce “imported inflation” caused by US Fed interest rate hikes.

- For the UAE: It solidifies Dubai’s position as the world’s premier digital gold hub.

5. Distinguishing The Unit from Crypto

To remain compliant, CFOs Times readers need to understand that the The Unit BRICS Gold-Digital Settlement is not a retail cryptocurrency.

- It is a wholesale interbank instrument.

- It cannot be bought on Binance or Coinbase.

- It is governed by central bank protocols and Financial Stability Board (FSB) guidelines for cross-border payments.

6. Conclusion: A New Financial Multi-Polarity

The activation of the The Unit BRICS Gold-Digital Settlement through the RBI’s 2026 proposal marks the dawn of a “Hard-Money Digital Era.” By combining the ancient trust of gold with the speed of 21st-century blockchain technology, the BRICS+ nations have created a prototype that is both technologically superior and fundamentally more stable than the current debt-based fiat system.

Frequently Asked Questions (FAQs)

What is ‘The Unit’ BRICS Gold-Digital Settlement?

It is a digital settlement instrument backed by 40% physical gold and 60% member currencies, used for international trade among BRICS+ nations.

Is The Unit a cryptocurrency?

No. It is a wholesale unit of account used by central banks and large institutions, not a speculative retail digital asset.

How does India’s 2026 RBI proposal change things?

The RBI is proposing the technical “Bridge” that allows national CBDCs (like the E-Rupee) to interoperate using The Unit as the common language, making de-dollarization technically seamless.

Where is the gold for The Unit stored?

The gold remains in the sovereign vaults of member nations but is digitally audited and linked to the settlement ledger for transparency.

Financial Disclosure & Professional Advice Disclaimer:

The information provided on CFOs Times regarding the The Unit BRICS Gold-Digital Settlement and other market volatility reports is for general informational and educational purposes only. It is not intended as, and should not be taken as, professional financial, investment, or legal advice.

While we utilize data from official sovereign sources like the Reserve Bank of India (RBI) and the International Monetary Fund (IMF), global financial systems and commodity markets are highly volatile. CFOs Times is not a registered investment advisor or broker-dealer. We strongly recommend that you consult with a certified financial professional before making any decisions based on our analysis or related 2026 trade prototypes.

Investments involve significant risk, including the possible loss of principal. Past performance of any digital or physical asset is not a guarantee of future results.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.