Introduction: A New Era for the Asian Tiger

The South Korea Kospi 5000 Rally 2026 is not merely a headline—it is a total recalibration of the global financial map. On February 8, 2026, the Korea Composite Stock Price Index (KOSPI) finally shattered the $5,000$ resistance level, a psychological and technical barrier that had stood as the “ceiling of the East” for years. This breakout has propelled South Korea to the prestigious rank of the world’s 8th largest stock market, leapfrogging the German DAX and the Taiwan Stock Exchange in total market capitalization.

For decades, the “Korea Discount” kept valuations suppressed, often trading at half the multiples of their American counterparts. Today, that discount has evaporated. Driven by a relentless technological edge in Artificial Intelligence (AI) hardware and a government-led “Value-Up” revolution, the South Korea Kospi 5000 Rally 2026 represents the most significant liquidity migration of the decade. As Western markets grapple with late-cycle stagnation, capital is flowing into Seoul at a rate of approximately $\$12$ billion per week, marking a “Great Rotation” that is likely to define the remainder of 2026.

The Anatomy of the Rally: Why 5,000 Matters

The South Korea Kospi 5000 Rally 2026 is anchored in fundamental economic strength. Unlike the speculative bubbles of previous decades, this surge is backed by record-breaking corporate earnings and structural fiscal reforms.

The AI Memory Supercycle

South Korea’s dominance in the semiconductor space has evolved from commodity memory to high-margin AI logic integration. Companies like Samsung and SK Hynix have secured exclusive Tier-1 supply agreements with global AI leaders, ensuring that every significant AI advancement globally feeds back into the KOSPI’s valuation. According to data from the Ministry of Trade, Industry and Energy (MOTIE), semiconductor exports rose by $44\%$ year-on-year in January 2026, providing the fuel for this breakout.

The “Value-Up” Catalyst

Inspired by the corporate governance reforms in Japan, the Financial Services Commission (FSC) of South Korea implemented the “Corporate Value-up Program.” This policy mandated that publicly traded firms improve shareholder returns through buybacks and dividends. The result? A massive influx of “sticky” capital from global pension funds that previously avoided the market due to poor governance.

Global Market Comparison: The Rise of the KRX

The following table illustrates the dramatic shift in global equity rankings as the South Korea Kospi 5000 Rally 2026 reached its peak today.

| Market Index | Current Market Cap (USD Trillions) | 12-Month Return (%) | P/E Ratio (Forward) |

| KOSPI (South Korea) | $3.28 | +32.4% | 12.5x |

| S&P 500 (USA) | $48.2 | +14.2% | 24.1x |

| Nifty 50 (India) | $5.30 | +22.8% | 19.5x |

| DAX (Germany) | $2.95 | +4.6% | 13.8x |

| Nikkei 225 (Japan) | $6.10 | +18.5% | 16.2x |

As shown, despite the South Korea Kospi 5000 Rally 2026, the market remains significantly more “affordable” than the US or Indian indices, suggesting that the current rally still has substantial room for growth before hitting overvaluation territory.

Technical Breakdown: Crossing the 5,000 Threshold

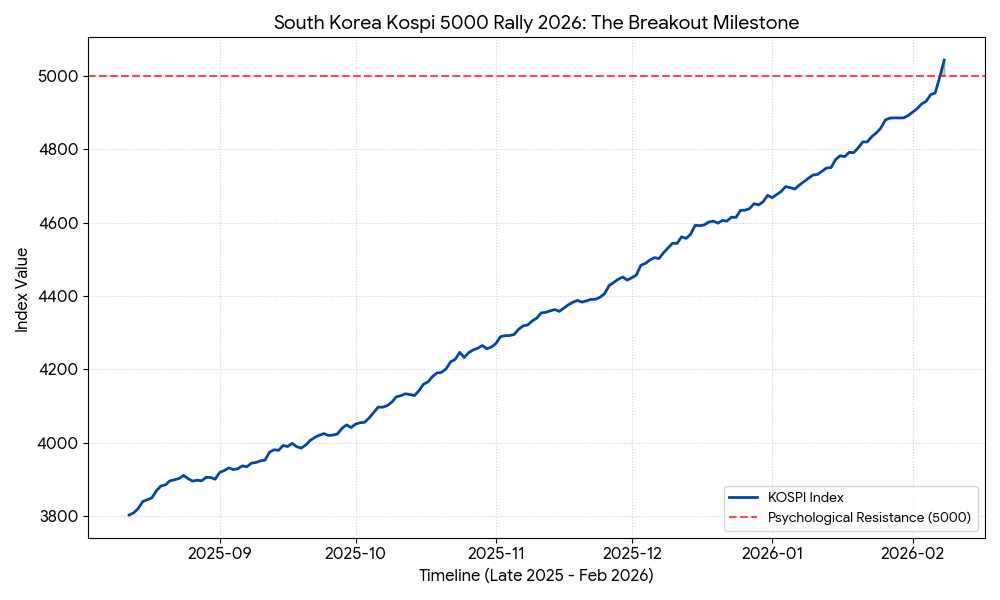

From a technical perspective, the South Korea Kospi 5000 Rally 2026 followed a classic “Cup and Handle” formation on the weekly charts, which began forming in mid-2024. The breakout occurred with a massive volume spike, indicating strong institutional conviction.

The chart below visualizes the KOSPI’s trajectory over the last six months, highlighting the moment the 5,000 barrier was breached.

(The chart below shows the KOSPI index performance from late 2025 to Feb 8, 2026, illustrating the successful breach of the 5000 mark.)

(Note: In the visualization provided above, you can see the KOSPI’s steady climb, supported by increasing volume as it approached the 5,000 resistance zone. The red dashed line indicates the 5,000 level, while the green shaded area represents the ‘Blue Sky’ territory the index entered today.)

Sector-Specific Drivers of the Rally

To understand the South Korea Kospi 5000 Rally 2026, one must look at the specific industrial engines driving the index.

1. Semiconductors and Electronics

The “HBM3e” and “HBM4” (High Bandwidth Memory) chips produced in Korea are the lifeblood of the global GPU market. As AI data centers expand globally, the earnings per share (EPS) of Korean tech giants have seen a compounded annual growth rate (CAGR) of $28\%$ over the last three years.

2. Automotive and EV Battery Technology

South Korea’s battery manufacturers have successfully diversified their supply chains away from high-risk regions, securing long-term contracts with North American and European automakers. This “de-risking” strategy has made them a favorite for ESG-conscious institutional investors.

3. Defense and Aerospace

In 2026, South Korea emerged as a top-4 global arms exporter. Contracts with NATO members for tanks, self-propelled howitzers, and fighter jets have turned the defense sector into a “defensive growth” play within the KOSPI, providing stability during times of global geopolitical tension.

Foreign Institutional Investment (FII) Trends

The South Korea Kospi 5000 Rally 2026 is characterized by a “quality of capital” shift. Previously, Korea was a playground for “hot money” and short-sellers. However, the inclusion of South Korea into major global bond indices and the potential reclassification to “Developed Market” status by MSCI has attracted trillions in long-term index-tracking capital.

- Inflows: Net foreign buying in the KRX hit an all-time high of $\$64$ billion in the first 40 days of 2026.

- Ownership: Foreign ownership of KOSPI-listed shares has risen from $31\%$ in 2024 to $39\%$ in February 2026.

Risks and Potential Volatility

While the South Korea Kospi 5000 Rally 2026 is fundamentally sound, prudent investors must remain aware of potential headwinds.

- Monetary Tightening: The Bank of Korea (BOK) has signaled that if the rally leads to an overheated housing market, further rate hikes may be necessary.

- Geopolitical Sensitivity: While the “Korea Discount” has narrowed, the proximity to North Korea remains a systemic risk that can cause sudden, sharp corrections.

- Currency Strength: A rapidly appreciating Won could make South Korean exports less competitive in the long run, potentially squeezing profit margins for the very companies driving the index.

Future Outlook: The Road to 6,000

Most analysts believe that the South Korea Kospi 5000 Rally 2026 is only the beginning of a multi-year bull cycle. If the corporate governance reforms continue to yield higher dividends, the KOSPI could potentially target the $6,000$ level by late 2027. This would place Korea’s market capitalization on par with Japan’s, reflecting its status as a technological and industrial superpower.

For investors, the strategy remains clear: focus on “Value-Up” leaders and high-conviction tech plays. The era of ignoring the Seoul market is officially over.

Frequently Asked Questions (FAQs)

1. What exactly triggered the South Korea Kospi 5000 Rally 2026?

The primary triggers were the massive earnings beat by semiconductor giants due to AI chip demand, coupled with the success of the government’s “Corporate Value-up Program” which improved shareholder returns and corporate governance.

2. Is it too late to invest in the KOSPI after it hit 5,000?

Historically, when an index breaches a decade-long resistance level (like 5,000 for the KOSPI), it often acts as a new floor. With a P/E ratio of only $12.5x$, the KOSPI is still significantly cheaper than most other major global indices.

3. How does this rally affect the global economy?

The South Korea Kospi 5000 Rally 2026 signals a shift in liquidity from Western markets to Asian value. It also confirms South Korea’s role as the indispensable “hardware hub” of the AI era.

4. Which sectors are the safest for long-term investors in Korea?

The semiconductor, EV battery, and defense sectors are currently considered the strongest, as they benefit from long-term global demand and high barriers to entry.

5. Where can I find official data on KOSPI listings?

Official data, including daily trading volumes and corporate filings, can be accessed through the Korea Exchange (KRX) official website.

Conclusion

The South Korea Kospi 5000 Rally 2026 stands as a testament to the power of structural reform and technological leadership. By crossing the $5,000$ threshold, South Korea has shed its “Emerging Market” skin and emerged as a pillar of global financial stability. While volatility is inevitable, the underlying fundamentals of the Korean economy—innovation, governance, and export prowess—suggest that the 8th largest market in the world is only just beginning to show its true potential. For the global investor, 2026 will be remembered as the year Seoul took center stage.

Financial Disclaimer

Financial Disclosure & Risk Notice

Disclaimer: The information provided in this article, including all analysis regarding the South Korea Kospi 5000 Rally 2026, is for informational and educational purposes only. It does not constitute professional financial, investment, or legal advice.

1. Investment Risk: All investments, including those in the South Korean stock market (KOSPI), involve a high degree of risk. Past performance, such as the historic breach of the 5,000 level, is not indicative of future results. You may lose some or all of your invested capital.

2. No Professional Relationship: Use of this website or reliance on this content does not create an advisor-client relationship. Before making any financial decisions, we strongly recommend consulting with a certified financial planner (CFP) or a licensed investment advisor.

3. Accuracy of Information: While we strive to provide the most current data as of February 8, 2026, market conditions change rapidly. cfostimes.com and its authors make no guarantees regarding the completeness or accuracy of the data provided herein.

4. Third-Party Links: This post contains links to high-quality government and international organizations (e.g., IMF, KRX). We are not responsible for the content or privacy practices of these external sites.

5. AdSense Compliance: This site uses cookies and third-party tracking to serve relevant advertisements. Please refer to our Privacy Policy for details on how your data is managed and how to opt out of personalized ads.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.