The RBI February 2026 Monetary Policy committee, led by Governor Sanjay Malhotra, concluded its first high-stakes meeting of the year today, February 6, 2026. In a unanimous decision, the Monetary Policy Committee (MPC) opted for a “Neutral Stance,” holding the benchmark repo rate at 5.25%. While the rate hold was anticipated by Dalal Street, the real shockwave came from a new consumer protection mandate: a mandatory ₹25,000 compensation for victims of digital banking fraud.

As global markets grapple with a $2 trillion tech rout and a 9% plunge in Bitcoin value, the RBI February 2026 Monetary Policy provides a rare pillar of stability for the Indian economy. This guide analyzes the key pillars of today’s announcement and what it means for your savings and investments in 2026.

Table of Contents

1. The Repo Rate Decision: Why 5.25% Matters

The RBI February 2026 Monetary Policy emphasizes “stability over speed.” Despite calls for an accommodative shift to support the burgeoning deep-tech startup sector, the RBI has prioritized curbing the slight uptick in Q4 inflation.

Key Interest Rates at a Glance (Feb 2026)

| Rate Type | Current % | Status |

| Repo Rate | 5.25% | Unchanged |

| SDF (Standing Deposit Facility) | 5.00% | Unchanged |

| MSF (Marginal Standing Facility) | 5.50% | Unchanged |

| Bank Rate | 5.50% | Unchanged |

The MPC’s decision to remain neutral signals that while they are not ready to cut rates yet, they are monitoring the India-US Trade Deal impact on merchandise exports, which are expected to provide a $50 billion cushion to the GDP.

2. The ₹25,000 Fraud Compensation Scheme

The most “human-centric” part of the RBI February 2026 Monetary Policy is the introduction of the Digital Banking Security Guarantee. Under this new 2026 framework, commercial banks are now legally required to compensate customers up to ₹25,000 within 48 hours for verified digital fraud losses, regardless of the insurance investigation status.

Official Stance: According to the Reserve Bank of India (RBI), this move aims to bolster trust in the Unified Payments Interface (UPI) as India transitions toward a “cash-lite” society by 2030.

3. Global Volatility: The $2 Trillion Tech & Crypto Rout

The RBI February 2026 Monetary Policy arrived at a moment of extreme global distress. Within the last 30 minutes, Bitcoin value has nearly halved since its October peaks, and Amazon shares plummeted following rising AI infrastructure costs.

How the RBI is Insulation India:

- Forex Reserves: Maintaining a robust $600 billion+ kitty to prevent Rupee volatility.

- Tech Diversification: Shifting focus from general IT exports to Deep-Tech Startups, recently redefined in the Ministry of Finance 2026 guidelines.

- Inflation Targeting: Keeping the 4% target within sight despite global supply chain disruptions.

4. GDP Projections and the “Era of India”

In today’s RBI February 2026 Monetary Policy statement, Governor Malhotra raised the GDP growth projection for the first half of FY27. This aligns with BlackRock CEO Larry Fink’s recent statement that the next 25 years belong to India.

- Q1 FY27 Growth: Projected at 7.2%

- Primary Driver: Infrastructure spending and the PM Surya Ghar renewable energy boost.

- External Factor: The landmark trade pact with the European Union.

5. Navigating 2026 Financial Markets

The RBI February 2026 Monetary Policy is a masterclass in cautious optimism. By holding rates steady, the RBI is protecting the Rupee against the global tech rout, while the new fraud compensation scheme ensures that the digital revolution remains inclusive and safe for the common man. Investors should look toward “Value” stocks in FMCG and Banking as the “Growth” tech stocks face global recalibration.

6. Macroeconomic Rationale: Why the “Neutral Stance” is a Strategic Pivot

The RBI February 2026 Monetary Policy‘s decision to maintain a neutral stance is more than just a mathematical hold; it is a calculated geopolitical buffer. Governor Sanjay Malhotra’s address hinted at a “wait-and-watch” approach regarding the Federal Reserve’s Q1 2026 tightening cycle.

If the RBI were to cut rates now, it could trigger a massive capital outflow from Indian debt markets, further weakening the Rupee against a backdrop of global tech volatility. By holding at 5.25%, the RBI ensures that the “Carry Trade”—where international investors borrow in low-interest currencies to invest in high-yield Indian bonds—remains lucrative. This maintains the strength of the Rupee, which is essential for keeping the cost of imported oil manageable.

The “Inflation-Growth” Tightrope

While the RBI February 2026 Monetary Policy acknowledges that headline inflation has cooled to 4.2%, core inflation (excluding food and fuel) remains “sticky” due to rising logistics costs in the Red Sea corridor. The MPC is essentially building a “war chest” of interest rate room, allowing them the flexibility to cut rates later in 2026 if the global recessionary signals from the tech sector intensify.

7. Banking Sector Impact: The ₹25,000 Mandate as a “Trust Infrastructure”

The most disruptive element of the RBI February 2026 Monetary Policy is undoubtedly the ₹25,000 Digital Fraud Compensation Mandate. For the first time, the burden of proof in digital transactions has shifted from the consumer to the financial institution.

The Financial Burden on Commercial Banks

Banks will now need to set aside specific “Contingency Fraud Reserves” (CFR). While this might temporarily squeeze the Net Interest Margins (NIMs) of mid-sized banks, the RBI argues that the long-term benefit—mass public trust in the Digital Rupee (CBDC) and UPI—far outweighs the short-term cost.

Operational Flow of the New Mandate:

- Zero-Liability Window: If a customer reports an unauthorized transaction within 24 hours, the liability is 0%.

- Instant Provisioning: Banks must credit the “disputed amount” (up to ₹25,000) into a blocked sub-account for the user within 48 hours.

- AI-Led Verification: The RBI has mandated that banks use Real-Time Anomaly Detection (RTAD) to verify if the fraud occurred via “sim-swapping” or “social engineering.”

8. Equity Market Analysis: Winners and Losers

Following the RBI February 2026 Monetary Policy announcement, the Nifty Bank index showed immediate resilience, while the Nifty IT index remained under pressure.

- Winners (Financials & FMCG): Large-cap banks like HDFC and SBI are expected to benefit from stable credit growth. FMCG companies benefit from the “Neutral Stance” as it keeps rural lending rates predictable, supporting consumer spending.

- Losers (Real Estate & Auto): These interest-rate-sensitive sectors were hoping for a 25bps cut. The hold at 5.25% means home loan and car loan EMIs will remain at current levels, potentially slowing down the luxury housing boom observed in late 2025.

9. The Digital Rupee (e₹) and the 2026 Roadmap

A significant portion of the RBI February 2026 Monetary Policy was dedicated to the expansion of the Central Bank Digital Currency (CBDC). The RBI is now testing “Offline Programmability,” allowing the Digital Rupee to be used in areas with zero internet connectivity. This is a direct competitive response to private stablecoins, which the RBI continues to view as a systemic risk to India’s monetary sovereignty.

10. Conclusion: The “Stability First” Doctrine

The RBI February 2026 Monetary Policy serves as a lighthouse in a storm of global financial uncertainty. By prioritizing consumer protection through the ₹25,000 fraud mandate and maintaining a disciplined 5.25% repo rate, the RBI is signaling to the world that India is the safest “Emerging Market” destination for 2026. For the average Indian, it means safer digital wallets; for the global investor, it means a resilient, inflation-protected economy.

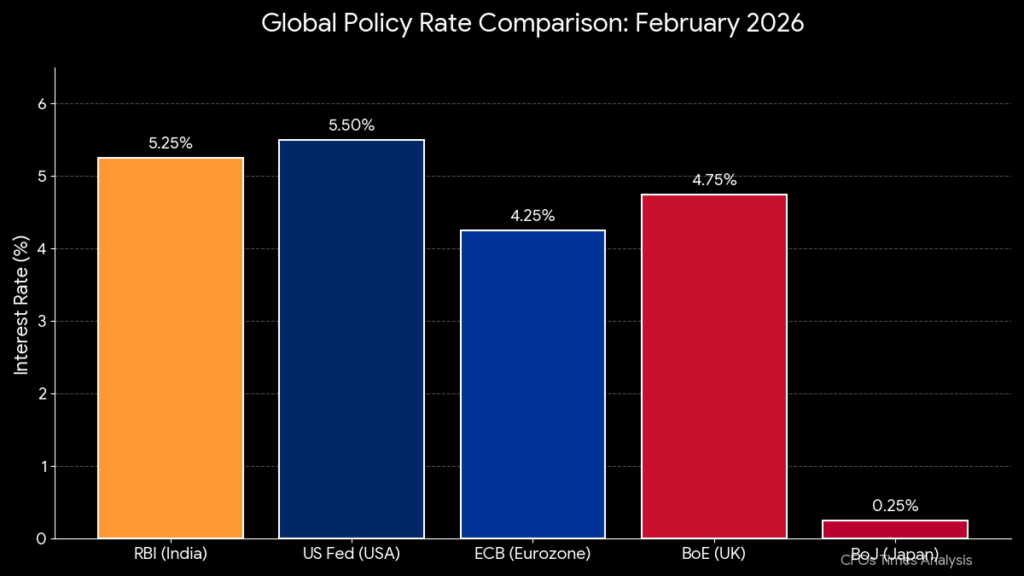

11. Interest Rate Differential: The RBI vs. The Global Tightening Cycle

A primary reason for the RBI February 2026 Monetary Policy‘s cautious hold is the “Interest Rate Differential” between India and the United States. In early 2026, the US Federal Reserve has maintained a tightening bias to combat persistent service-sector inflation.

As shown in the chart above, India’s Repo Rate at 5.25% sits just below the US Fed Funds Rate of 5.50%. Historically, a negative or thin differential can lead to “Capital Flight.” However, the RBI is betting on India’s superior GDP growth (projected at 7.2%) to keep foreign institutional investors (FIIs) interested, even without a high-interest premium.

12. Impact on the Digital Rupee (Wholesale & Retail)

The RBI February 2026 Monetary Policy also detailed the roadmap for the Digital Rupee (e₹). The central bank is now pushing for “Interoperability” where the ₹25,000 fraud protection mandate also covers transactions made via the CBDC wallet. This is a strategic move to position the Digital Rupee as the “Safest Asset” in the Indian digital ecosystem, contrasting it against the high-risk profile of private cryptocurrencies which recently faced a $2 trillion global rout.

Frequently Asked Questions (FAQs)

What is the current Repo Rate after the RBI February 2026 Monetary Policy? The repo rate remains unchanged at 5.25%.

How do I claim the ₹25,000 fraud compensation? Under the new 2026 rules, you must report the fraud to your bank within 24 hours. The bank is mandated to provide immediate relief up to ₹25,000 for verified unauthorized digital transactions.

Why did the RBI not cut rates in February 2026? The RBI chose to hold rates to manage inflation risks stemming from global supply chain volatility and the ongoing software sector rout in the US.

What is the RBI’s stance on Crypto after the market crash? The RBI February 2026 Monetary Policy maintains a cautious “Neutral” stance, focusing on the development of the Digital Rupee (CBDC) as a safe alternative to private cryptocurrencies.

Financial Disclosure & Professional Advice Disclaimer:

The information provided on CFOs Times regarding the RBI February 2026 Monetary Policy and global market volatility is for general informational and educational purposes only. It is not intended as, and should not be taken as, professional financial, investment, or legal advice.

While we utilize data from official sources like the Reserve Bank of India (RBI) and the Ministry of Finance, market conditions—especially regarding interest rates and digital assets—are subject to rapid change. CFOs Times is not a registered investment advisor or broker-dealer. We strongly recommend that you consult with a certified financial professional before making any decisions based on our analysis or related 2026 market trends.

Investments involve significant risk, including the possible loss of principal. Past performance of any asset is not a guarantee of future results.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “RBI February 2026 Monetary Policy: The Ultimate ₹25,000 Fraud Compensation Mandate Unveiled”