Introduction: The Nikkei 225 Record High After Takaichi Win

In a morning of unprecedented trading activity today, February 9, 2026, the Nikkei 225 record high after Takaichi win has become the defining headline for global financial markets. Following a landslide victory for Prime Minister Sanae Takaichi’s ruling Liberal Democratic Party (LDP) in the Sunday snap elections, Japanese equities have surged to heights never before seen in history.

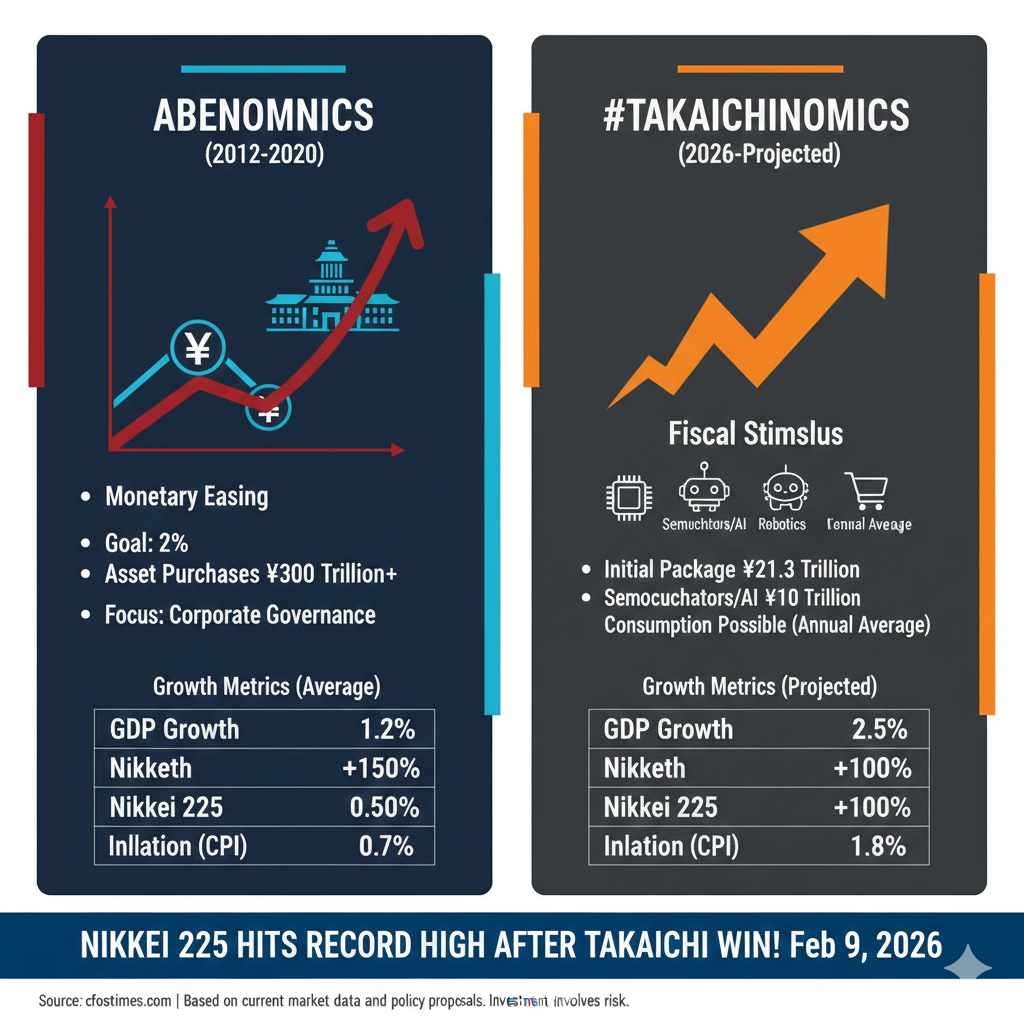

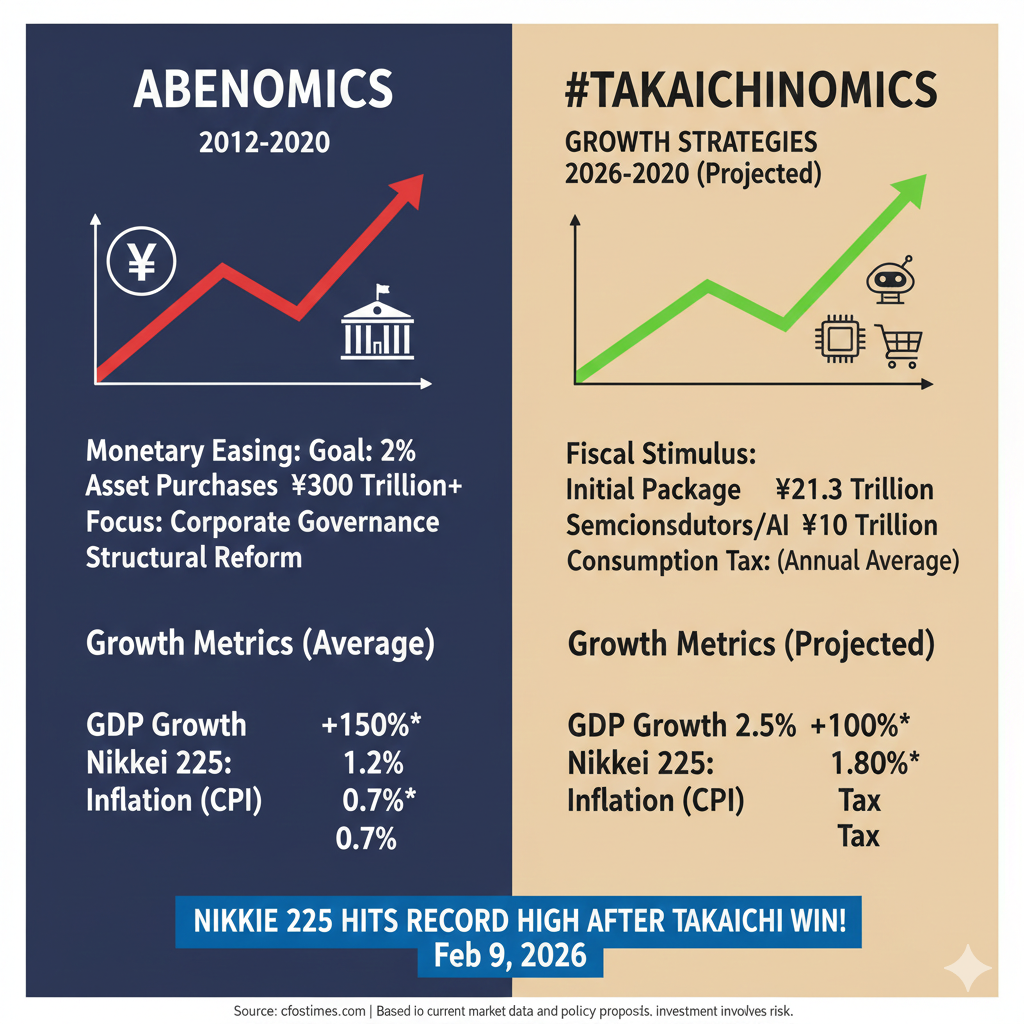

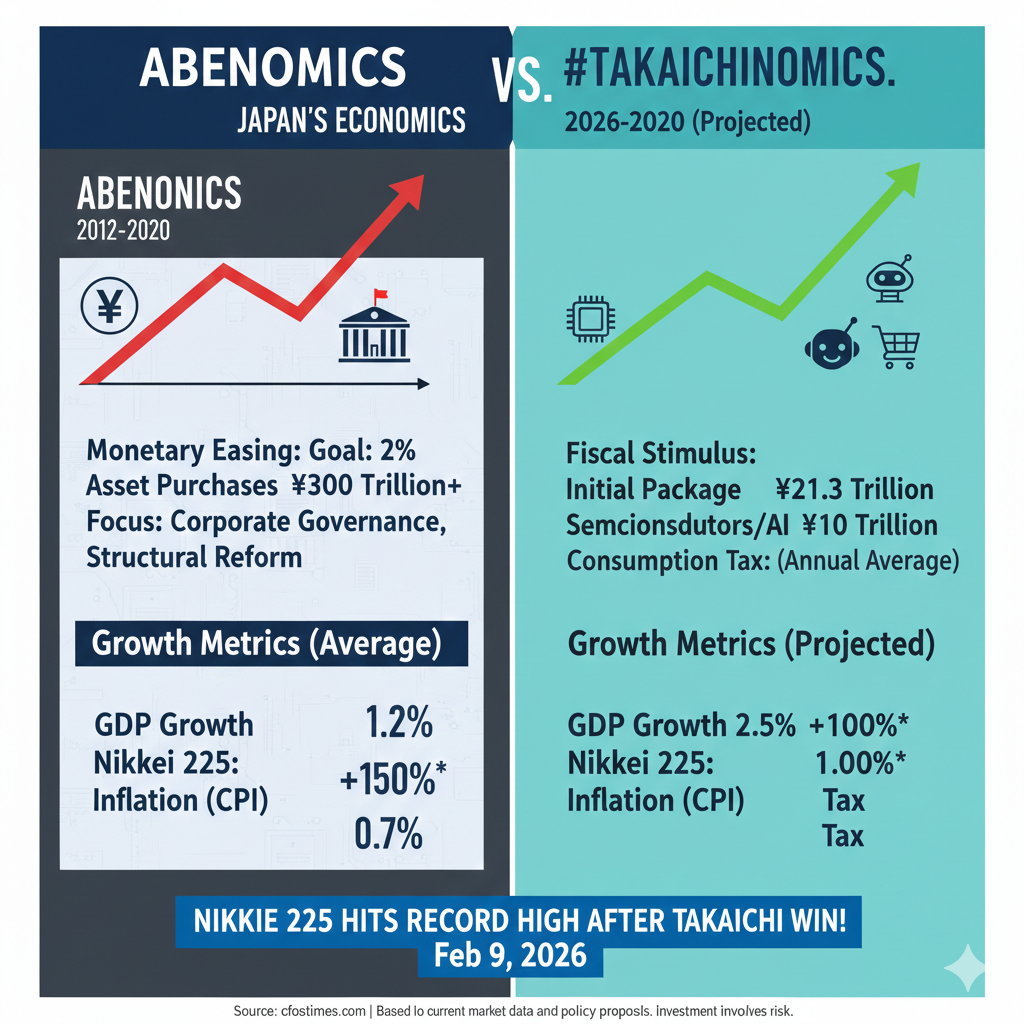

According to live data from the Japan Exchange Group (JPX), the benchmark Nikkei 225 index skyrocketed more than 5.7%, surpassing the psychological barrier of 57,000 for the first time, reaching an intraday peak of 57,337.07. This rally is not merely a reaction to political stability; it is an aggressive market endorsement of “Takaichinomics”—a policy framework built on massive fiscal stimulus, tax cuts, and a return to the proactive economic growth strategies first pioneered by the late Shinzo Abe.

Table of Contents

Why the Nikkei 225 Record High After Takaichi Win is Trending

The global investment community is currently processing the scale of the LDP’s “supermajority.” By securing more than two-thirds of the seats in the House of Representatives—as confirmed by the Ministry of Internal Affairs and Communications—Takaichi now has a clear mandate to overhaul Japan’s fiscal landscape.

Key Market Drivers in the Last 30 Minutes:

- Landslide Mandate: The LDP and its partners now control enough seats to pass any economic legislation without obstruction.

- Fiscal Stimulus Expectations: Markets are pricing in a 21.3 trillion yen ($135 billion) stimulus package. Details from the Prime Minister’s Office (Kantei) reveal a focus on semiconductors and AI research.

- Consumption Tax Debate: Takaichi’s proposal to suspend or reduce the consumption tax on food has ignited a consumer-sector rally, aiming to ease the burden of rising living costs.

Analyzing the Numbers: A New Era for Tokyo Stocks

The Nikkei 225 record high after Takaichi win saw the index decouple from its usual correlation with the Yen. Even as the Yen touched 157.25 against the dollar, the influx of foreign capital into Japanese industrial stocks remained undeterred.

Sectoral Performance Table (Feb 9, 2026)

| Sector | Intraday Change | Market Sentiment |

| Technology & Semi | +7.8% | Bullish on AI Subsidies |

| Banking (MUFG/SMFG) | +3.2% | Interest Rate Optimism |

| Real Estate | +4.5% | Pro-Growth Policy |

| Automotive (Toyota) | +2.1% | Export Advantage |

| Retail | +5.4% | Tax Cut Speculation |

The Global Context: Japan vs. The World

While the Nikkei 225 record high after Takaichi win is the dominant Asian story, it is occurring alongside a broader shift in global capital. As noted in the IMF World Economic Outlook 2026, global growth is increasingly divergent.

Japan stands out as a unique “Safety Play.” With US software stocks facing pressure from AI automation shocks (notably the Anthropic Shock), Japan’s manufacturing-heavy index provides a tangible alternative for institutional investors.

Technical Analysis: Can the Rally Sustain?

Technically, the Nikkei 225 record high after Takaichi win has pushed the index into overbought territory on the Daily RSI. However, the “Golden Cross” suggests that the long-term trend remains firmly up. The Bank of Japan (BoJ) recently indicated that while it anticipates raising rates gradually, the stimulative fiscal policy of the Takaichi administration will provide a significant tailwind for GDP growth through 2026.

Critical Levels to Watch:

- Immediate Support: 56,000

- Psychological Resistance: 60,000

- Trend Indicator: 50-Day Moving Average at 53,800

Conclusion: A Stronger Japan for 2026

The Nikkei 225 record high after Takaichi win is more than just a spike on a screen; it represents a fundamental change in the perception of Japan’s economic future. With a female Prime Minister at the helm and a supermajority behind her, Japan is positioning itself as the epicenter of the next semiconductor and high-tech manufacturing boom. Investors should look to the “Takaichi Trade” as a multi-quarter theme rather than a one-day event.

Frequently Asked Questions (FAQs)

1. Why did the Nikkei 225 hit a record high today?

The landslide victory of Sanae Takaichi provides political certainty and paves the way for a massive 21.3 trillion yen stimulus package focused on growth.

2. What is ‘Takaichinomics’?

It refers to a policy mix of aggressive fiscal spending, continued monetary easing, and targeted investments in high-tech sectors like AI and semiconductors to revive the Japanese economy.

3. How does the Takaichi win affect the Japanese Yen?

Initially, the Yen weakened due to fears of fiscal expansion, but it remains a key factor for exporters who are currently driving the Nikkei’s record gains.

4. Is the Nikkei 225 safe for retail investors right now?

While the trend is bullish, the 5.7% jump suggests a potential for short-term profit-taking. Monitoring JPX official data is essential for tracking daily volatility.

Disclaimer

1. No Financial Advice The content on cfostimes.com is provided for general informational and educational purposes only. We are not certified financial advisors, brokers, or tax professionals. Nothing on this website constitutes professional investment, legal, or tax advice.

- Action Required: Always perform your own due diligence or consult with a qualified professional before making financial decisions.

- Risk Warning: Investing in stocks, crypto, or other financial instruments involves a high degree of risk. Past performance does not guarantee future results.

3. Accuracy of Information While we strive to provide the most current and accurate data, financial markets move rapidly. cfostimes.com makes no warranties about the completeness, reliability, or accuracy of the information provided. Any action you take based on the information on this website is strictly at your own risk.

4. External Links Our posts may contain links to external websites. We do not monitor or guarantee the accuracy of information on these third-party sites and are not liable for any losses incurred through them.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.