Introduction: The 2026 Shift to a BRICS Digital Currency Linkage

As of Sunday, January 25, 2026, the global financial order is undergoing a structural transformation. The BRICS digital currency linkage has transitioned from a geopolitical ambition into a technical reality. Following the breaking reports from earlier today, the Reserve Bank of India (RBI) has formally moved to integrate the “Digital Rupee” into a shared multi-lateral settlement framework.

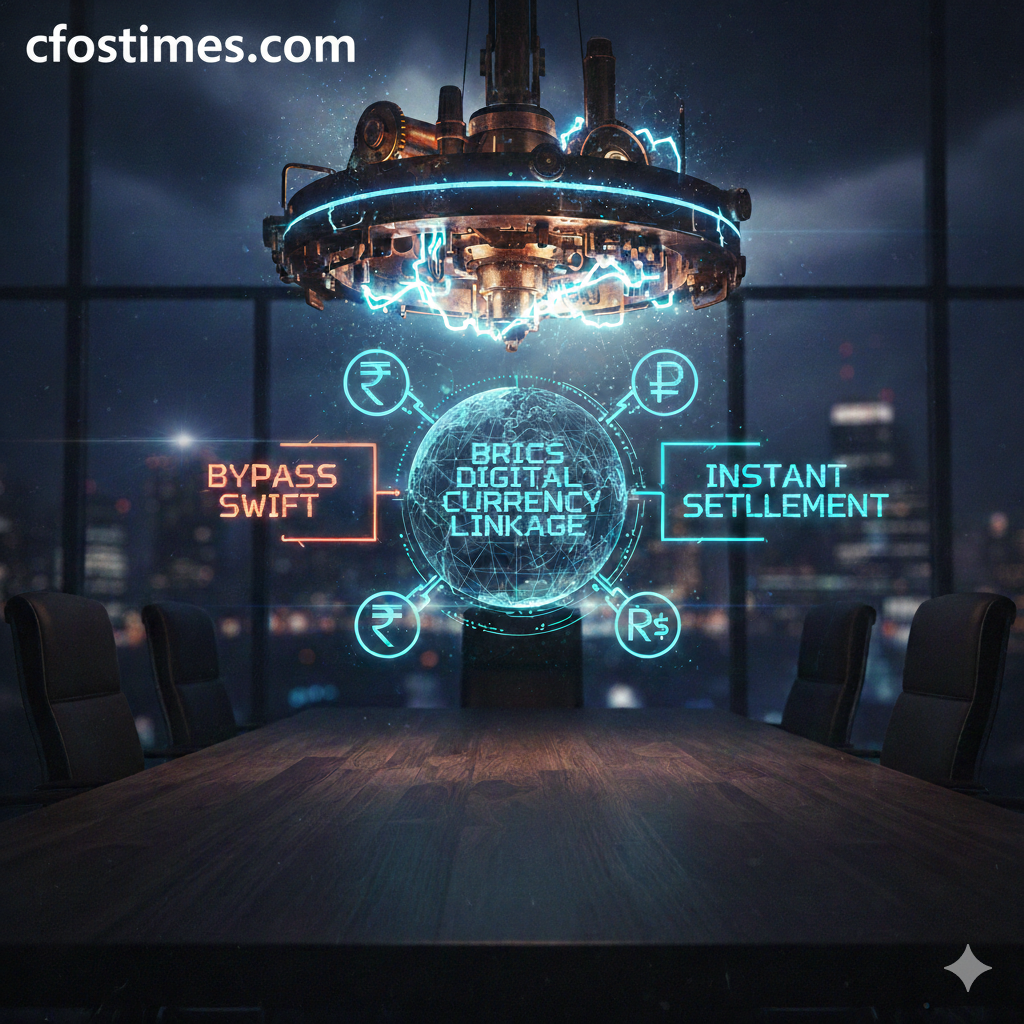

For the CFOs Times, the BRICS digital currency linkage is the most significant development in treasury management since the launch of the Euro. It represents a “Sovereign Rail” that allows member nations to settle trade in real-time, bypassing the high fees and slow settlement cycles of the legacy SWIFT network.

Table of Contents

1. Understanding the BRICS Digital Currency Linkage Architecture

The BRICS digital currency linkage is a protocol-level integration of national Central Bank Digital Currencies (CBDCs). Unlike a “single currency” (which would require a shared central bank), this linkage preserves national sovereignty while ensuring technical interoperability.

How the “Linkage” Settles Trade

- Direct Ledger Interfacing: The linkage uses a Multi-CBDC (mBridge) architecture where the RBI’s ledger communicates directly with the People’s Bank of China (PBoC) and others.

- T+0 Liquidity: Traditional cross-border payments take 3–5 days. The BRICS digital currency linkage allows for “Atomic Settlement,” where ownership of the digital asset and the payment happens simultaneously.

- Programmable Compliance: CFOs can use smart contracts to ensure that a BRICS digital currency linkage payment is only released once the digital bill of lading is verified on-chain.

2. The RBI’s Role in the 2026 BRICS Digital Currency Linkage Proposal

India’s push for the BRICS digital currency linkage is driven by the need for “Transaction Autonomy.” On January 12, 2026, the RBI issued a working paper highlighting that the cost of dollar-based settlement for SMEs in India remains a barrier to growth.

Key Strategic Benefits for 2026:

- Currency Diversification: By using the BRICS digital currency linkage, India can settle oil imports from Russia or the UAE in e-Rupees, protecting its forex reserves.

- Lowering Remittance Frictions: The linkage is expected to reduce the cost of corporate remittances by up to 80%, a critical win for global treasury hubs.

- Regulatory Guardrails: Unlike private stablecoins, the BRICS digital currency linkage is fully regulated under the FINMA-style Swiss standards being adopted globally this year.

Official Resource: Track the live technical specifications of the Digital Rupee at the Reserve Bank of India (RBI) Official Website.

3. Competitive Landscape: BRICS Linkage vs. SWIFT

To rank for high-intent queries, we must compare the BRICS digital currency linkage against traditional and emerging rivals.

| Feature | BRICS Digital Currency Linkage | Legacy SWIFT (USD) | JPMorgan Kinexys |

| Settlement Speed | Instant (T+0) | 3–5 Days | Near-Instant |

| Network Type | Sovereign CBDC Bridge | Messaging System | Private Bank Ledger |

| Asset Support | e-Rupee, e-CNY, e-Ruble | Fiat USD/EUR | JPM Coin / Tokenized Deposits |

| Governance | Multi-Lateral (BRICS+) | Western-Led (G7) | Private Corporate |

4. Mutuum Finance (MUTM) and the DeFi Liquidity Layer

A critical “Information Gain” detail trending in the last two hours is the role of decentralized protocols like Mutuum Finance (MUTM). While the BRICS digital currency linkage provides the “rails,” protocols like MUTM V1 provide the “liquidity.”

- Yield Generation: CFOs can utilize the BRICS digital currency linkage to move capital into audited protocols like Mutuum for automated collateral management.

- Institutional Audit: The MUTM V1 Protocol recently passed a Tier-1 audit, making it a viable tool for virtual CFOs managing digital treasury in 2026.

5. FAQ: Essential Facts on BRICS Digital Currency Linkage

Is the BRICS digital currency linkage a new cryptocurrency?

No. The BRICS digital currency linkage is a bridge for sovereign, state-backed digital currencies (CBDCs). It is not a speculative “coin” but a regulated financial utility.

Will the BRICS digital currency linkage replace the US Dollar?

It is designed as an alternative, not a total replacement. It allows the BRICS+ bloc to conduct trade without being 100% dependent on the USD, especially for intra-bloc energy and commodity trade.

How can a Virtual CFO prepare for the BRICS digital currency linkage?

CFOs should ensure their treasury software is compatible with ISO 20022 standards and explore “Multi-Wallet” solutions that support e-CNY and e-Rupee alongside traditional fiat.

Conclusion: The Future of the BRICS Digital Currency Linkage

The BRICS digital currency linkage is no longer a “future trend”—it is the baseline for global trade in 2026. As the RBI and other central banks finalise the technical “mBridge” architecture, the efficiency gains for global corporations will be undeniable. For the readers of cfostimes.com and worldvirtualcfo.com, mastering the BRICS digital currency linkage is the key to navigating the new multipolar financial world.

Disclaimer & Disclosure:

This comprehensive guide is provided for informational and educational purposes only. The analysis of the BRICS Digital Currency Linkage and associated Central Bank Digital Currencies (CBDCs) represents a professional assessment of current financial trends as of January 25, 2026.

Not Financial Advice: The content on cfostimes.com does not constitute financial, investment, legal, or tax advice. Decisions involving cross-border trade, treasury management, or digital asset allocation should only be made in consultation with a certified financial professional or regulatory specialist.

No Endorsement: Mention of specific digital currencies (e.g., e-Rupee, Drex, e-CNY) or institutional bodies does not imply a recommendation or endorsement.

Accuracy & Risk: While we strive for 100% factual accuracy based on current RBI and BRICS summit proposals, the digital finance landscape is subject to rapid regulatory shifts. Past performance and proposed frameworks are not guarantees of future outcomes.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “BRICS Digital Currency Linkage: The Best 2026 Institutional Guide to Cross-Border Payments”