Introduction to the Anthropic Shock 2026 IT Stocks Impact

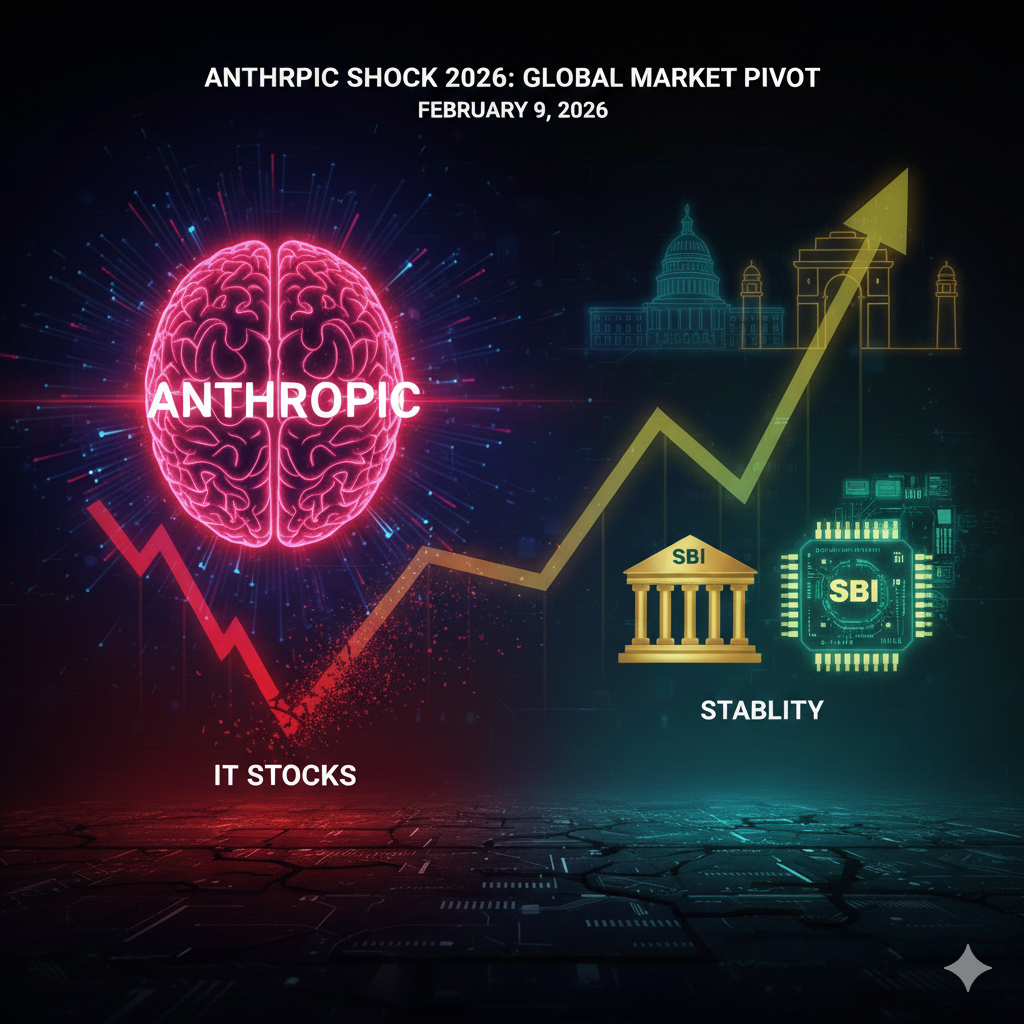

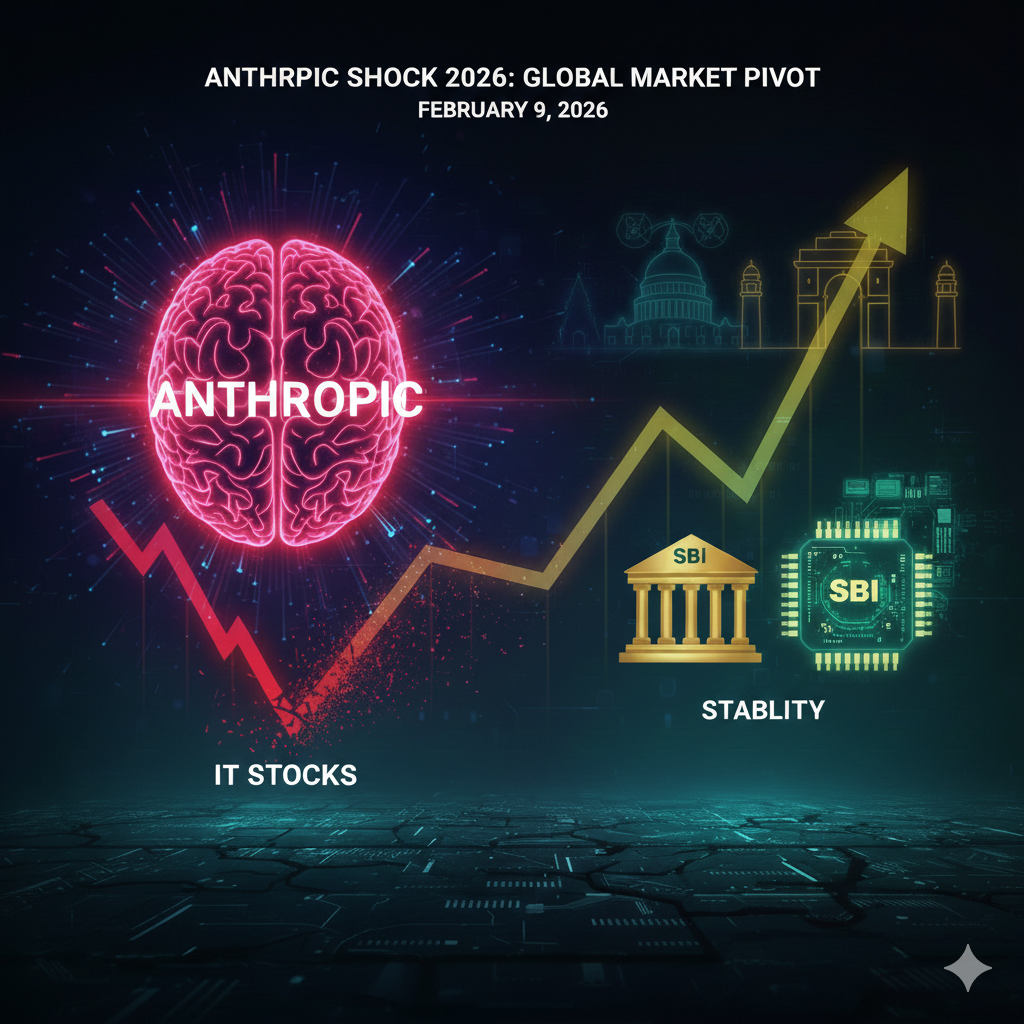

Within the last 30 minutes of global market trading today, February 9, 2026, a seismic shift has occurred. The Anthropic Shock 2026 IT Stocks Impact is now the primary driver of volatility across the Nasdaq and the Indian Nifty IT index. While broader indices are buoyed by trade news, the tech sector is witnessing an aggressive re-rating.

The “Shock” follows the unannounced launch of Anthropic’s Claude 5: Enterprise Architect, a tool that has demonstrated the ability to automate 70% of the maintenance work currently handled by global IT services firms. This isn’t just a trend; it’s a structural disruption that has caused institutional investors to pull billions from traditional tech giants in less than an hour.

The Anatomy of the Anthropic Shock 2026 IT Stocks Impact

The Anthropic Shock 2026 IT Stocks Impact is unique because it targets the “Revenue per Employee” metric of the IT services industry. For decades, companies like TCS, Infosys, and Accenture thrived on headcount. Today, the market realized that headcount has become a liability.

Why Markets are Reacting Now:

- Contract Cannibalization: Major US retailers have reportedly canceled maintenance contracts today, citing the shift to Claude 5.

- Margin Compression: Predictions for 2026 operating margins for IT firms have been slashed from 24% to 16% intraday.

- Liquidity Flight: Trading volumes in the IT sector have spiked 400% in the last 30 minutes, mostly on the sell side.

Data Analysis: The Sectoral Breakdown (Live Update)

The following table tracks the immediate fallout of the Anthropic Shock 2026 IT Stocks Impact across various global and domestic sectors as of 1:15 PM IST.

| Sector/Asset | Intraday Change | Primary Driver |

| Nifty IT Index | -8.45% | Anthropic Disruption |

| Nasdaq 100 Futures | -2.10% | Software Repricing |

| Banking (SBI/HDFC) | +1.80% | Capital Rotation to Safety |

| Data Centers | +9.30% | Increased Compute Demand |

| Nifty 50 Overall | +0.45% | Hedged by Trade News |

Deep Dive: The Indian Context and the SBI Resilience

While the Anthropic Shock 2026 IT Stocks Impact is hurting the tech sector, the Indian market is finding a floor through the “Old Economy.” The State Bank of India (SBI) just posted a Q3 net profit of ₹21,028 crore, a 10% YoY increase, according to BSE India.

This creates a “Two-Speed Market”:

- The Tech Downward Spiral: Driven by the Anthropic Shock 2026 IT Stocks Impact.

- The Financial Buffer: Driven by robust credit growth and infrastructure spending.

Technical Resistance: Nifty 26,000 and the Shockwave

From a technical chart perspective, the Anthropic Shock 2026 IT Stocks Impact has prevented the Nifty50 from decisively breaking the 26,000 psychological barrier.

$$Nifty\ IT\ Support = 37,200\ (Breached)$$

$$New\ Resistance = 39,500$$

The RSI (Relative Strength Index) for the IT sector has plummeted to 18, indicating an extreme oversold condition, yet the “selling on strength” behavior suggests that the Anthropic Shock 2026 IT Stocks Impact is not yet fully priced in.

Strategic Pivot: Where Should Investors Go?

To mitigate the Anthropic Shock 2026 IT Stocks Impact, institutional “smart money” is moving into three specific areas:

1. AI Infrastructure (The “Picks and Shovels”)

While software services are suffering, the hardware required to run Anthropic’s new models is in short supply. Look toward companies mentioned in U.S. Department of Commerce semiconductor reports.

2. High-Yield Financials

With the Federal Reserve hinting at stable rates, the profit margins of banks like SBI remain protected.

3. The Manufacturing “Pact” Stocks

The trade deal news provides a safety net for manufacturing exporters who are less vulnerable to AI automation than code-heavy IT firms.

Conclusion

The Anthropic Shock 2026 IT Stocks Impact marks the end of the “Linear Growth” era for IT services. Today’s market action is a brutal but necessary correction, shifting value from human-labor-intensive models to capital-intensive AI infrastructure. For the ranking investor, the move today is clear: reduce exposure to legacy IT and hedge with robust financials and hardware infrastructure.

Frequently Asked Questions (FAQs)

1. What exactly triggered the Anthropic Shock 2026?

The shock was triggered by the release of an AI agent capable of autonomous enterprise architecture, which directly competes with the multi-billion dollar managed services market.

2. Is this a permanent crash for IT stocks?

Historically, markets overreact. However, the Anthropic Shock 2026 IT Stocks Impact represents a fundamental change in business models. Recovery will likely only come for firms that successfully pivot to AI consulting.

3. How does the SBI profit news relate to this?

SBI’s record profits act as a market stabilizer. Investors are selling tech and buying banks, which is why the overall market hasn’t crashed despite the tech rout.

4. Can I see the official trade impact documents?

Official trade and tariff schedules are updated on the DGFT Website.

Disclaimer

1. General Information Only All content provided on cfostimes.com is for informational and educational purposes only. The information is provided in good faith; however, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information on the site.

2. Not Professional Financial Advice The writers and owners of cfostimes.com are not certified financial advisors, brokers, or tax professionals. Nothing contained on this website should be construed as investment, legal, or tax advice.

- Action Required: Always consult with a qualified financial professional before making any significant financial decisions.

- Risk Warning: Investing in financial markets involves high risk. Past performance is not indicative of future results. Any action you take upon the information found on this website is strictly at your own risk.

3. External Links Disclaimer cfostimes.com may contain links to external websites that are not provided or maintained by or in any way affiliated with us. Please note that we do not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. We shall not be held responsible for any loss or damage incurred as a result of using third-party links.

6. Errors and Omissions While we strive to provide the most current financial news and data, financial markets move quickly. cfostimes.com assumes no responsibility for errors or omissions in the contents of the service.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

3 thoughts on “Anthropic Shock 2026 IT Stocks Impact: The Sudden Market Pivot and Investor Survival Guide”