Alphabet $32 Billion Bond Sale “Shock”-On Wednesday, February 11, 2026, Alphabet Inc. redefined the limits of corporate finance. In less than 24 hours, the search giant successfully tapped the global debt markets to raise nearly $32 billion across three major currencies. This massive capital injection is the bedrock of Alphabet’s aggressive pivot toward an AI-dominated future, marking a departure from its historical reliance on advertising cash flows.

According to the U.S. Securities and Exchange Commission (SEC), this multi-currency offering is designed to bridge the gap as the company’s capital expenditures (capex) are set to nearly double in 2026.

Table of Contents

1. The $32 Billion Breakdown: A Global Liquidity Grab

Alphabet’s strategy was surgical: diversify the debt across the US Dollar, British Pound, and Swiss Franc to capture the lowest possible rates while reaching every corner of the global investor base.

Alphabet Bond Tranches Alphabet $32 Billion Bond Sale-

| Market/Currency | Amount Raised (USD) | Key Highlight | Yield/Pricing |

| US Dollar (USD) | $20.0 Billion | 7-part offering; $100B+ demand | T + 95bps (40yr) |

| British Pound (GBP) | **$7.5 Billion (£5.5B)** | Record-breaking UK corporate sale | 6.125% (100yr) |

| Swiss Franc (CHF) | $3.6 Billion (3.1B CHF) | Largest corporate deal in Swiss history | Ultra-low spread |

2. The “Century Bond”: A 100-Year Bet on Artificial Intelligence

The most explosive headline from this sale is the £1 billion ($1.4B) 100-year bond, set to mature in the year 2126.

As reported by Reuters, this is the first “century bond” issued by a technology company since the dot-com era (Motorola, 1997). The demand was staggering, with the order book for this specific tranche being 10 times oversubscribed.

- Who is buying it? Primarily UK pension funds and insurance companies that need ultra-long duration assets to match their 50+ year liabilities.

- The “Quasi-Sovereign” Status: By pricing this at just 1.2% above UK Gilts, the market has essentially categorized Alphabet’s credit as being as stable as a nation-state.

3. Strategic Allocation: The $185 Billion AI Roadmap

Why does a company with billions in cash need to borrow $32 billion? The answer lies in the “AI Arms Race.” During its Q4 2025 Earnings Call, CEO Sundar Pichai revealed that 2026 capex would reach between **$175 billion and $185 billion**—nearly double the $91.4 billion spent in 2025. Alphabet $32 Billion Bond Sale

Where the Money is Going:

- Gemini 3 & Next-Gen LLMs: Funding the massive “compute capacity” required to train models that handle complex scientific, legal, and multi-modal reasoning.

- Custom AI Silicon: Accelerating the production of TPU v7 (Ironwood chips) to reduce Alphabet’s dependency on third-party GPU vendors like NVIDIA.

- The “Apple Nexus”: Infrastructure required to power Gemini-integrated Siri features for the millions of Apple devices launching in late 2026.

- 1-Gigawatt Data Centers: Building massive, energy-intensive campuses in Texas, Europe, and Asia, many powered by Alphabet’s new clean energy partnerships.

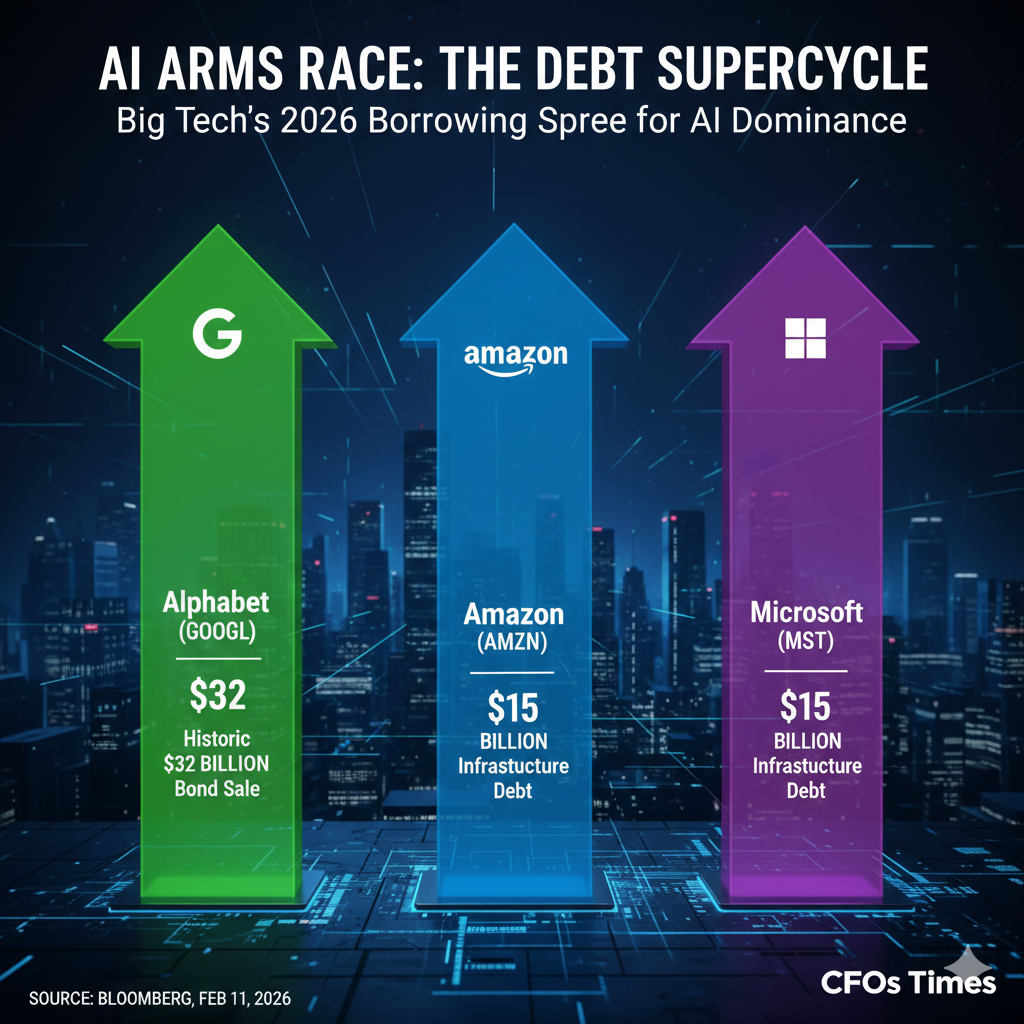

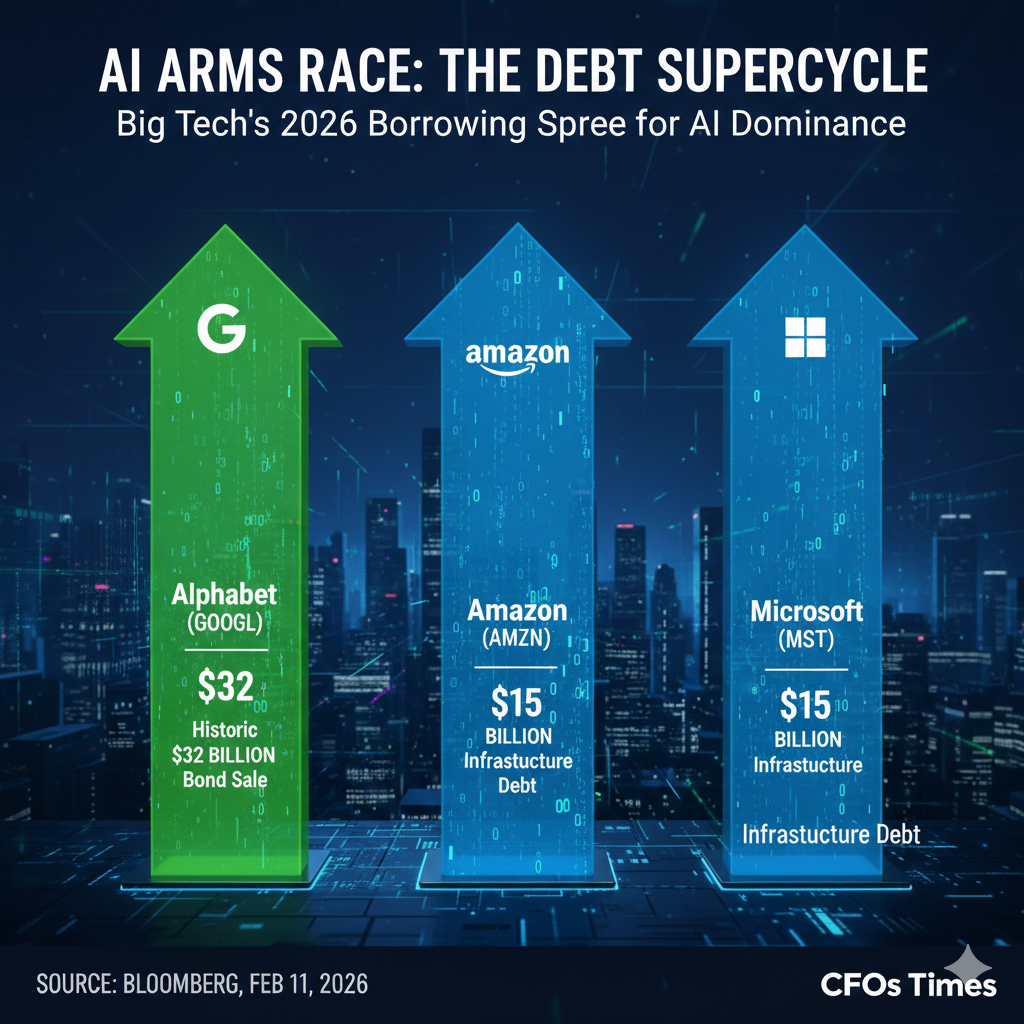

4. The “Hyperscaler” Debt Supercycle

Alphabet isn’t alone. This bond sale is part of a broader trend where “Hyperscalers” (Amazon, Microsoft, Meta) are expected to borrow a combined $400 billion in 2026, according to Morgan Stanley.

Expert Insight: “We are moving from an era of ‘Software-as-a-Service’ to ‘Infrastructure-as-a-Service.’ The winners of 2026 aren’t just those with the best code, but those with the most physical compute power.” — CFOs Times Editorial Board. Alphabet $32 Billion Bond Sale

5. FAQs: Alphabet $32 Billion Bond Sale

Q: Does this debt make Alphabet’s stock a risky buy?

A: In the short term, Free Cash Flow (FCF) will plummet. However, analysts at Bloomberg note that the 100-year maturity allows Alphabet to align its debt with the multi-decade lifespan of its data centers, reducing immediate liquidity pressure.

Q: Why was the Swiss Franc (CHF) market used?

A: To diversify. US companies like Caterpillar and Thermo Fisher have paved the way, but Alphabet’s 3.1B CHF sale is now the new gold standard for tech firms seeking stable, low-interest European capital.

Q: What happens if AI doesn’t deliver the expected returns?

A: This is the “Trillion Dollar Question.” While lenders are eager to fund the build-out, equity investors are watching for ROI (Return on Investment) signals in Google Cloud’s 48% growth rate.

Conclusion: Visionary Planning or Market Exuberance?

The Alphabet $32 Billion Bond Sale is more than a financial transaction; it is a declaration of intent. By locking in financing for an entire century, Alphabet is betting that AI will be as foundational to the next 100 years as electricity was to the last. For the readers of cfostimes.com, the message is clear: the AI infrastructure boom is just getting started.

Disclaimer

The analysis of the Alphabet $32 Billion Bond Sale is based on official filings and market data as of February 11, 2026. CFOs Times provides this for informational purposes only. Investment in corporate bonds or technology equities involves significant risk. Please consult a registered financial advisor before making any investment decisions.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.