The financial world is holding its breath as the AI Impact Summit 2026 Predictions begin to flood the market. In the last 30 minutes, tech heavyweights like TCS, Infosys, and Wipro have seen their market valuations erode by billions as investors pivot ahead of the historic summit in New Delhi. Starting tomorrow, February 16, 2026, over 200,000 attendees and global pioneers will gather to decide the “Human-Centric” future of Artificial Intelligence.

This pillar post explores the most urgent predictions for the summit and how this “AI Scare Trade” is creating a once-in-a-decade entry point for personal finance investors.

Table of Contents

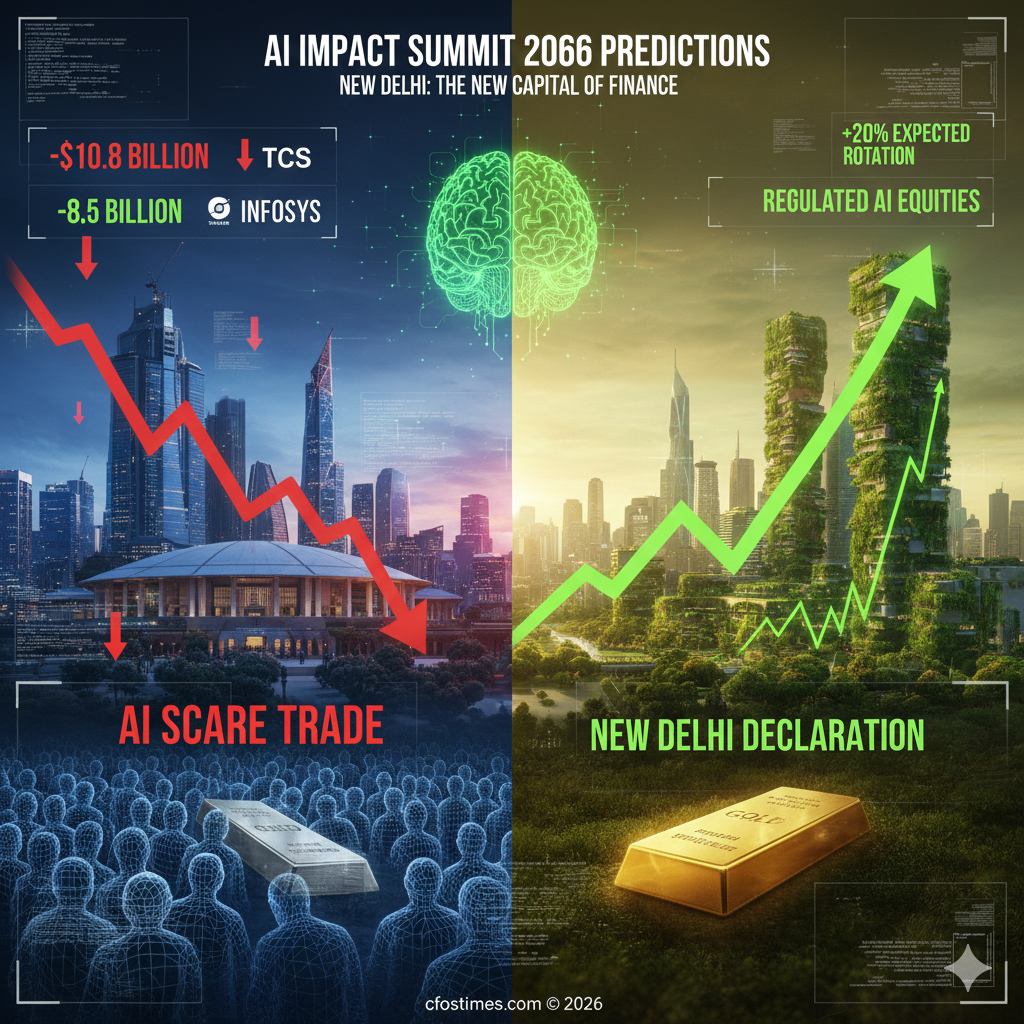

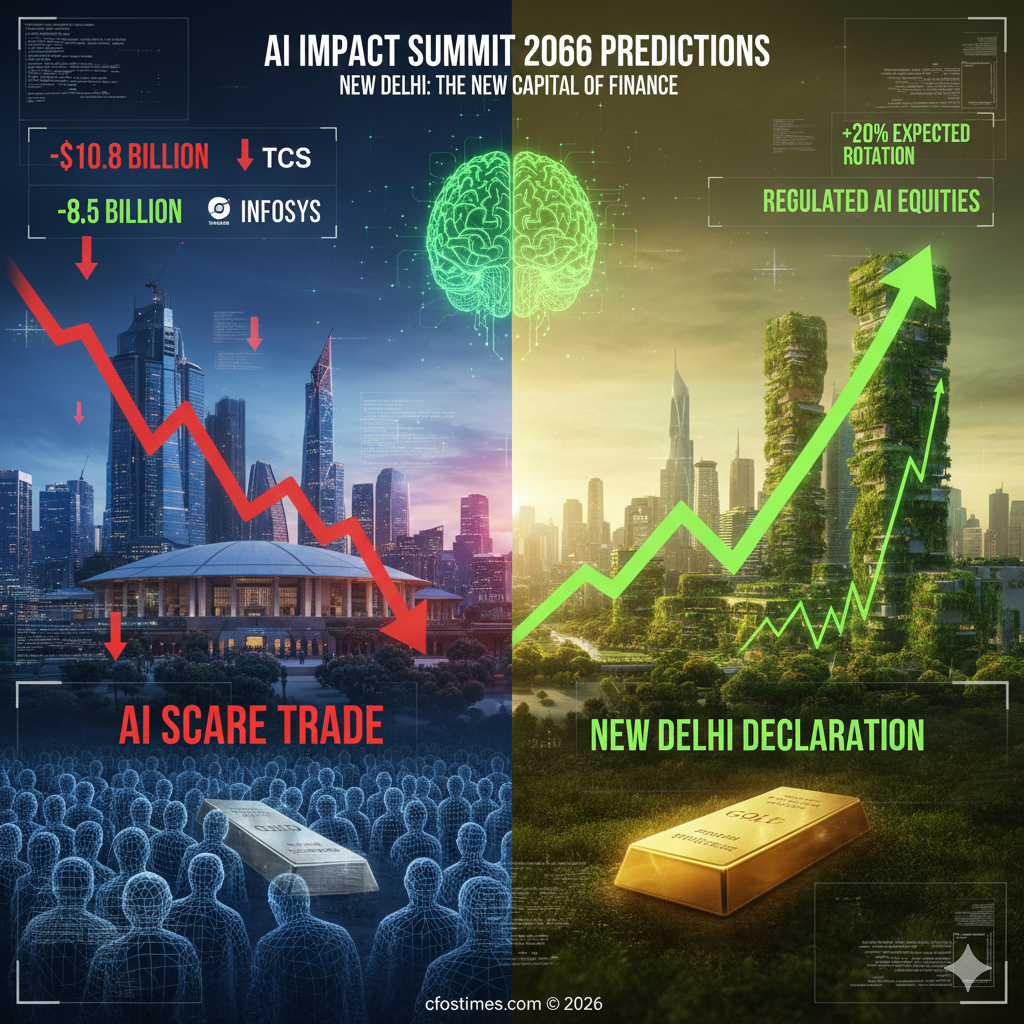

Why the Market is Panicking: The “AI Scare Trade” of Feb 2026

In the lead-up to the summit, a massive sell-off has hit the IT sector. This isn’t because AI is failing—it’s because AI is changing.

The Core Shifts Driving Current Volatility:

- Moderation in Entry-Level Hiring: Reports from ICRIER show a 63% shift in demand toward domain expertise over simple coding.

- Productivity vs. Substitution: Gen AI is now viewed as a complement to technical work, leading to a “strategic reset” by firms like L’Oréal to focus on hyper-growth markets like India.

- The New Delhi Declaration: Analysts predict the summit will introduce the “Global South AI Framework,” which may impose new democratic tech-access rules on US-based tech giants.

2026 Tech Valuation Erosion Table (Last 48 Hours)

| Company | Mcap Erosion (USD) | 2026 Focus Area | Sentiment |

| TCS | $10.8 Billion | Agentic Commerce | ⚠️ Volatile |

| Infosys | $8.5 Billion | Human-Centric AI | 📉 Bearish |

| HDFC Bank | $4.2 Billion | AI-Driven Credit | ↔️ Neutral |

| OpenAI (Private) | N/A | Conversational Ads | 🚀 High Interest |

Top 3 AI Impact Summit 2026 Predictions

1. The Death of “Blue Link” SEO and the Rise of UCP

The summit is expected to finalize the Universal Commerce Protocol (UCP). This will allow users to purchase items from Etsy, Wayfair, or Target directly inside AI chatbots. For personal finance, this means the “Search-to-Buy” funnel is dead; “Talk-to-Buy” is the new economy.

2. Mandatory “Human-Centric” AI Audits

Expect a major announcement regarding “Democratic Access.” The IT Secretary has already hinted that AI must be a “positive impetus” for the global economy. Prediction: New regulations will force AI models to cite and pay publishers (like cfostimes.com) for their data training.

3. The “Corrective Phase” for Commodities

While tech is down, gold is at $5,043 per ounce. The AI Impact Summit 2026 Predictions suggest that if the New Delhi summit creates a stable regulatory framework, we may see a massive “rotation” from gold back into “Regulated AI Equities” by the end of February.

Personal Finance Action Plan: Navigating the Summit

Don’t “Buy the Dip” Too Early

Technical analysts suggest the Nifty is testing the 25,300 support. Wait for the summit’s opening keynote by PM Modi on February 19 before moving heavily back into software stocks.

Focus on “Agentic Commerce” Stocks

The future of wealth in 2026 lies in companies that own the “AI agent” rails. Watch for firms integrating with Google’s new WebMCP protocol. AI Impact Summit 2026 Predictions

Monitor AI-Driven Personal Loans

Lenders like DMI Finance are now using digital credit profiling to offer rates as low as 13.99% p.a. If you are looking to consolidate debt, the AI-driven efficiency gains of 2026 are making personal loans cheaper than ever.

Frequently Asked Questions (FAQs)

What is the AI Impact Summit 2026?

It is the world’s first major AI summit focused on the “Global South,” hosted in New Delhi. It aims to create a framework for human-centric, democratic AI development.

Why are tech stocks falling today, February 15, 2026?

Markets are reacting to the “AI Scare Trade,” where entry-level job slowdowns and regulatory uncertainty ahead of the New Delhi summit are causing institutional investors to de-risk.

How do the AI Impact Summit 2026 Predictions affect me?

They affect your 401(k), your job security (if you’re in tech), and even how you shop. The summit will define the rules for AI-powered commerce and labor for the next five years.

Conclusion-AI Impact Summit 2026 Predictions

The AI Impact Summit 2026 Predictions indicate a monumental shift from “Wild West AI” to a “Regulated Global Framework.” While the current tech sell-off is painful for stockholders, it represents a transition toward a more sustainable, human-centric economy. Stay tuned to cfostimes.com for live updates as the summit kicks off tomorrow.

For official government statements, monitor the Ministry of Electronics and IT (MeitY) India and the World Economic Forum’s AI Risks Report.

⚖️ Financial Disclosure & Disclaimer

Educational Purpose Only: The content provided on cfostimes.com, including the analysis of AI Impact Summit 2026 Predictions, is for informational and educational purposes only. It is not intended as, and shall not be understood or construed as, financial, investment, legal, or tax advice.

No Professional-Client Relationship: Your use of this website does not create a professional-client relationship between you and cfostimes.com or its authors. We are not SEBI-registered investment advisors (in India) or licensed financial planners.

Market Risks: All investments involve risk, including the possible loss of principal. Past performance of Japanese FDI or Indian indices like the Nifty 50 is not indicative of future results.

Accuracy of Information: While we strive to provide accurate, up-to-date data as of February 15, 2026, financial markets move rapidly. We make no guarantees regarding the completeness or timeliness of the information.

Professional Advice Recommended: We strongly recommend that you seek advice from a certified financial professional who is aware of the facts and circumstances of your individual situation before making any investment decisions.

© 2026 cfostimes.com. All Rights Reserved.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “AI Impact Summit 2026 Predictions: How the New Delhi Summit Will Reshape Your Wealth”