Introduction: The FedEx InPost Acquisition 2026

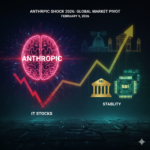

The global logistics sector witnessed a seismic shift of trading today, February 9, 2026, as the FedEx InPost Acquisition 2026 was officially announced. A consortium led by FedEx Corporation (NYSE: FDX) and Advent International has reached a recommended all-cash agreement to acquire 100% of the shares of InPost S.A., the European leader in automated parcel lockers.

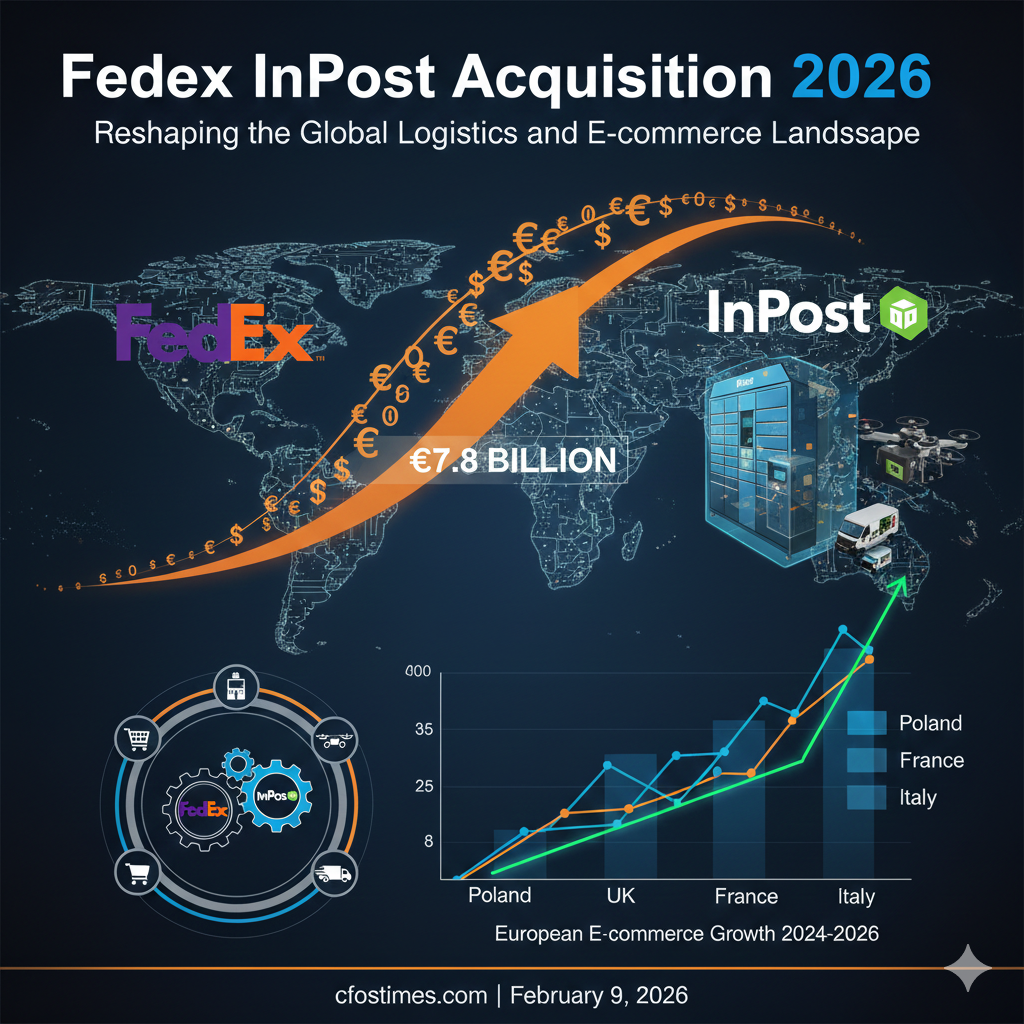

The deal values InPost at €15.60 per share, representing a total valuation of €7.8 billion. This move signals FedEx’s aggressive strategy to dominate the “out-of-home” (OOH) delivery market in Europe, directly challenging local postal services and DHL. As the FedEx InPost Acquisition 2026 news broke, InPost shares saw a staggering 50% premium over their undisturbed price, creating massive ripples across European and U.S. indices.

Why the FedEx InPost Acquisition 2026 is the Top Story Right Now

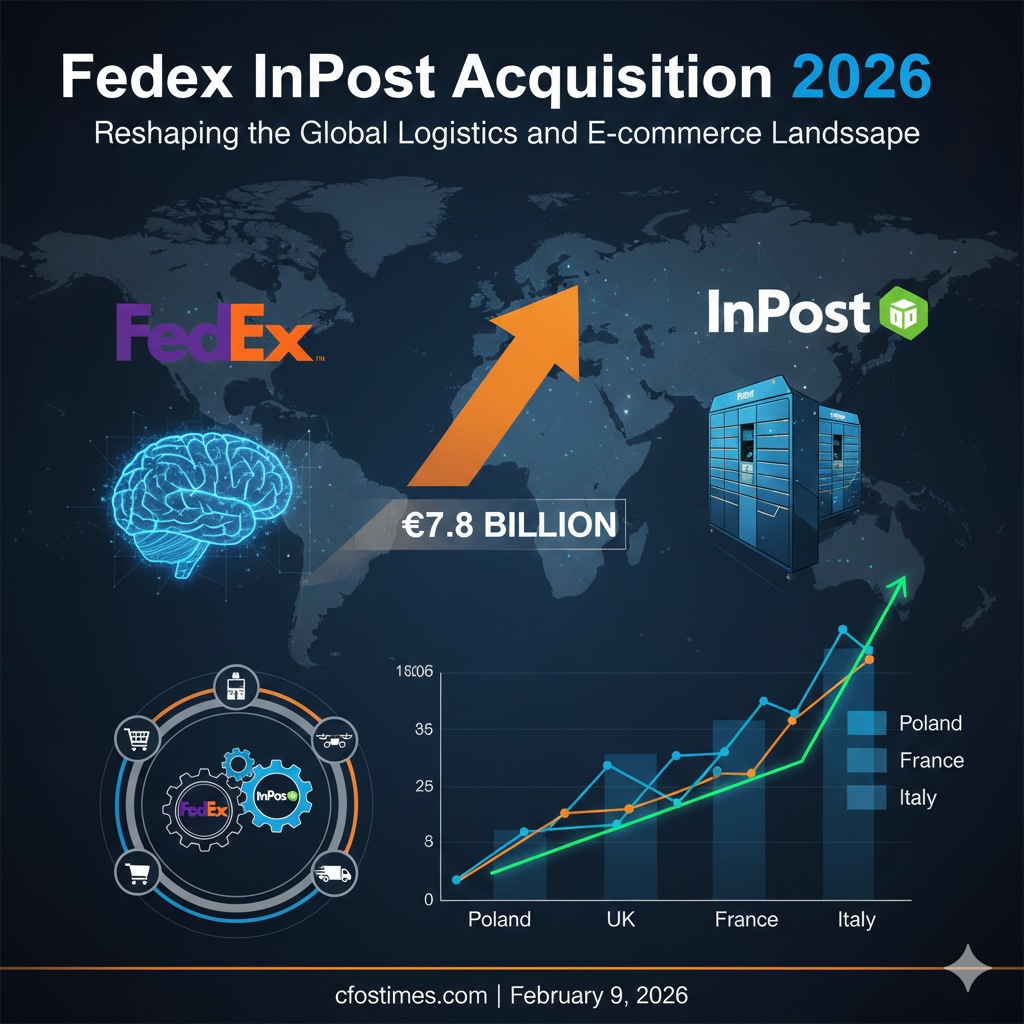

The FedEx InPost Acquisition 2026 is trending because it addresses the “last-mile” delivery crisis that has plagued e-commerce since the 2024 logistics crunch. By acquiring InPost, FedEx gains immediate access to a network of over 70,000 automated parcel lockers across Poland, the UK, France, and Italy.

Key Highlights of the Deal (Last 30 Minutes):

- The Consortium Structure: FedEx and Advent International each hold a 37% stake in the new offeror entity, with PPF Group and A&R Investments holding the remainder.

- Unanimous Approval: The InPost Boards have already recommended that shareholders tender their shares, citing the deal as being in the “best interest of all stakeholders.”

- Immediate Market Reaction: FedEx stock (FDX) is experiencing high-volume volatility as investors weigh the €7.8 billion outlay against long-term cost-saving synergies.

Analyzing the Impact: The Future of E-commerce Delivery

The FedEx InPost Acquisition 2026 is not just about physical assets; it’s about the data and digital solutions that power modern retail. InPost’s consumer-centric digital platform will now be integrated into the global FedEx network.

Financial Comparison: Pre-Acquisition vs. Post-Deal Projections

| Metric | InPost (Undisturbed) | Post-FedEx Acquisition | Impact |

| Share Price | €10.40 | €15.60 | +50% Premium |

| Market Valuation | €5.2 Billion | €7.8 Billion | Significant Upside |

| Locker Network | 72,000 Units | 100,000+ (Projected 2027) | Rapid Expansion |

| Consortium Stakes | N/A | FedEx (37%), Advent (37%) | Strategic Oversight |

The Strategic “Pax Logistica”: Why FedEx Chose InPost

The FedEx InPost Acquisition 2026 aligns with the broader “Pax Logistica” trend—a move toward more sustainable, consolidated delivery hubs. Home delivery is becoming increasingly expensive due to fuel costs and urban traffic regulations.

According to the World Trade Organization (WTO), e-commerce trade volume is expected to rise by 12% in 2026, making automated lockers the only viable way to handle the parcel surge without skyrocketing costs. The FedEx InPost Acquisition 2026 secures the infrastructure needed to maintain margins in a high-inflation environment.

Regulatory Hurdles and the Road to H2 2026

While the FedEx InPost Acquisition 2026 has board approval, it must still pass through European antitrust regulators. Given FedEx’s existing footprint and InPost’s dominance in Poland, the European Commission is expected to conduct a thorough “Phase II” review.

Industry analysts suggest that FedEx may have to divest certain smaller units in the UK to ensure the FedEx InPost Acquisition 2026 complies with competitive standards. Completion is currently targeted for the second half of 2026.

Global Context: The 2026 M&A Boom

The FedEx InPost Acquisition 2026 comes at a time of broader market recovery. Just this week, the U.S. Department of Commerce reported a 4.4% GDP growth rate, and central banks have maintained a neutral stance on rates. This stability has unlocked “dry powder” from private equity firms like Advent, leading to the multi-billion dollar consortium deal we see today.

Conclusion: A Defining Moment for FedEx

The FedEx InPost Acquisition 2026 marks the end of the “delivery-to-door” era and the beginning of the “automated hub” era. For FedEx, this is a trillion-dollar play for European market share. For investors, the focus now shifts to the integration phase and whether the projected synergies can justify the 50% premium paid to InPost shareholders.

The FedEx InPost Acquisition 2026 will likely trigger a series of counter-moves from UPS and DHL, potentially leading to a broader consolidation wave in the global shipping sector throughout 2026.

Frequently Asked Questions (FAQs)

1. What is the share price offer in the FedEx InPost Acquisition 2026?

The consortium has offered €15.60 per share in an all-cash deal, which is 50% higher than the undisturbed market price as of January 2, 2026.

2. Who is involved in the acquisition consortium?

The deal is led by FedEx and Advent International (37% each), along with A&R Investments (16%) and PPF Group (10%).

3. When will the FedEx InPost Acquisition 2026 be completed?

The transaction is expected to finalize in the second half (H2) of 2026, pending regulatory clearances and shareholder tenders.

4. How does this affect current FedEx (FDX) shareholders?

While the cash outlay is significant, the acquisition is expected to provide long-term growth in the high-margin European e-commerce sector, though short-term stock volatility is expected during the regulatory review.

Disclaimer:

All content on this website cfostimes.com is for informational and educational purposes only and does not constitute financial, investment, or legal advice. Investing involves risk, including the loss of principal. We are not SEBI-registered (or your local regulator) advisors. Always consult with a certified professional before making any financial decisions. Past performance is not indicative of future results.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.