RBI 2026 Monetary Policy Inflation Reset– On February 11, 2026, the Reserve Bank of India (RBI) didn’t just announce a rate decision; it launched a structural overhaul of the Indian economy. Under Governor Sanjay Malhotra, the first Monetary Policy Committee (MPC) meeting of 2026 has introduced the “Inflation Reset”—a complete rebasing of the Consumer Price Index (CPI) to the year 2024.

This move marks the end of the 2012-base era and aligns India’s economic measurement with the realities of a digital-first, services-heavy superpower.

Table of Contents

1. The Headline Decision: Why 5.25% is the New “Anchor”

The MPC unanimously voted to keep the Policy Repo Rate unchanged at 5.25%. After a cumulative cut of 125 basis points throughout 2025, the RBI has shifted to a “Neutral” stance, signaling that the era of aggressive easing has concluded.

The Rate Corridor

| Facility | Rate | Status |

| Repo Rate | 5.25% | Neutral/Held |

| Standing Deposit Facility (SDF) | 5.00% | No Change |

| MSF & Bank Rate | 5.50% | No Change |

The Rationale: With the India-US Trade Deal targeting $500 billion in trade and a landmark EU-India FTA already in play, the RBI believes the current 5.25% rate provides the perfect “Goldilocks” environment—balancing high growth with stable prices. RBI 2026 Monetary Policy Inflation Reset

2. The “Inflation Reset”: Breaking Down the New 2024 CPI Series

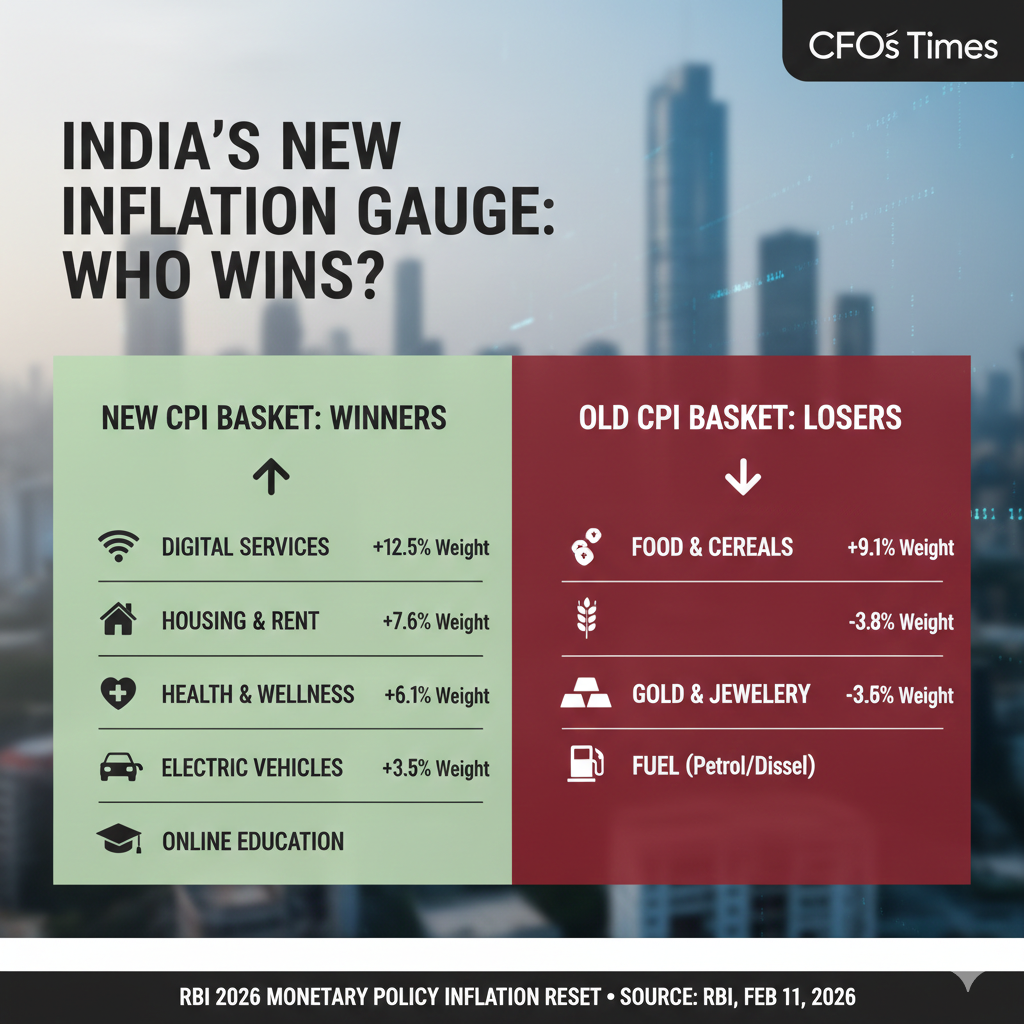

The most trending aspect of today’s policy is the Base Year Revision. The 2012 basket was increasingly irrelevant, as it spent too much weight on food and too little on the modern lifestyle.

The Massive Weightage Shift

The new series, formally launching on February 12, 2026, features 358 items (up from 299).

- The Food Drop: Food and Beverages weight has been slashed from 45.86% to 36.75%. This 9% drop means seasonal “tomato shocks” will no longer trigger panic at the RBI.

- The Housing Surge: Housing weight has nearly doubled to 17.66%, reflecting the urban reality of the 2026 property boom.

- Digital Adoption: For the first time, the basket includes OTT subscriptions, e-commerce delivery fees, and EV charging costs. RBI 2026 Monetary Policy Inflation Reset

3. Solving the “Gold-Core” Paradox–RBI 2026 Monetary Policy Inflation Reset

Governor Malhotra made a startling revelation during today’s press conference: Gold and Silver are the primary drivers of headline inflation right now.

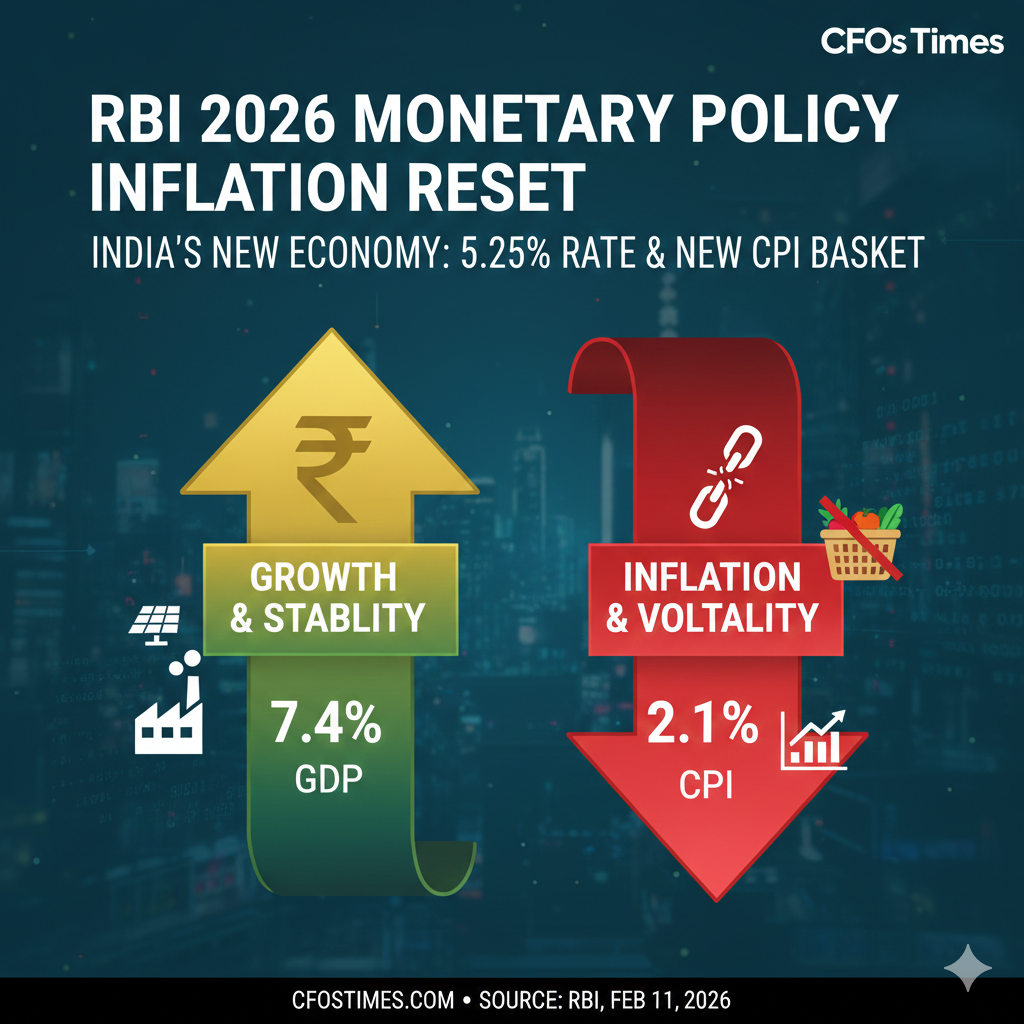

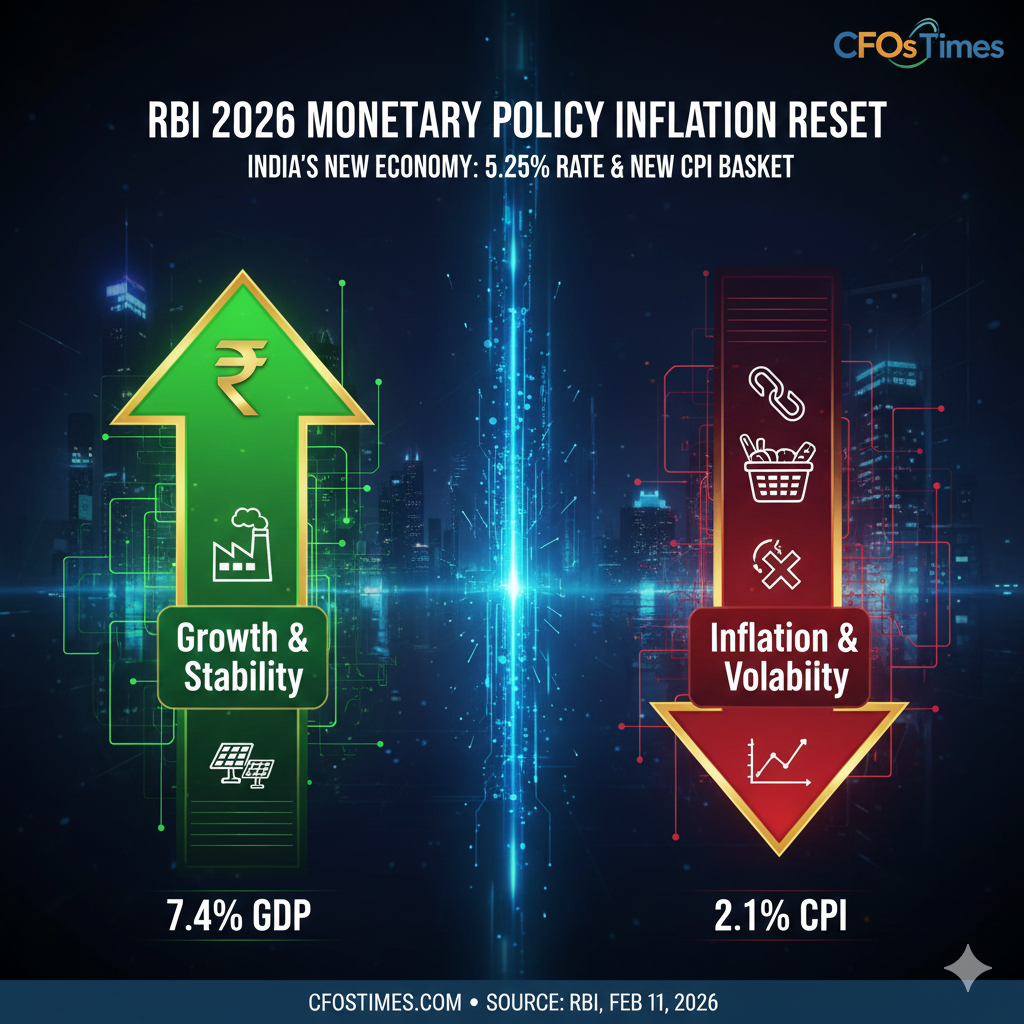

- The Data: Headline inflation is projected at 2.1% for FY26.

- The Distortion: However, a 70% rally in gold prices over the last year is adding roughly 60-70 basis points to the CPI.

- The “Real” Number: If you strip out precious metals, Underlying Core Inflation is at a benign 2.6%.

This “Precious Metal Noise” is why the RBI is holding rates steady—it refuses to overreact to commodity-driven volatility while the actual “cost of living” remains controlled.

4. Growth Projections: The 7.4% GDP Roadmap–RBI 2026 Monetary Policy Inflation Reset

Despite global headwinds and unravelling trade orders, the RBI has boosted its growth forecast for India.

- FY 2025-26 GDP: Revised upward to 7.4% (from 7.3%).

- FY 2026-27 Outlook: Q1 is projected at 6.9% and Q2 at 7.0%.

- The Drivers: 1. Private Consumption: Expanding at 7% thanks to recent income tax cuts.2. Infrastructure: Government capex of ₹12.21 trillion is “crowding in” private investment.3. Trade Corridors: Resilience in IT and travel-related services.

5. Regulatory Game-Changers for CFOs and Small Businesses

For the professional audience of cfostimes.com, the RBI announced three major “Ease of Doing Business” measures: RBI 2026 Monetary Policy Inflation Reset

A. The MSME Credit Revolution

The limit for collateral-free loans for Micro and Small Enterprises has been doubled from ₹10 lakh to ₹20 lakh. This is a massive win for the informal sector and startups seeking rapid scale-up.

B. NBFC De-regulation

Eligible Type-I NBFCs (with assets up to ₹1,000 crore) that do not handle public funds are now exempted from registration. This move reduces the compliance burden for thousands of small-tier lenders.

C. REITs Lending

Banks are now permitted to lend directly to Real Estate Investment Trusts (REITs). This will unlock billions in liquidity for the commercial real estate sector, which is currently undergoing a “green-building” transformation.

6. FAQ: RBI 2026 Monetary Policy Inflation Reset

Q: Will my Home Loan EMI go down after this policy?

A: No. Since the repo rate was held at 5.25%, EMIs will remain stable. However, banks have already passed on 105 bps of the previous 125 bps cuts, so lending rates are already at multi-year lows.

Q: Why is the RBI changing the CPI base year now?

A: To accurately reflect the “New India.” The 2012 basket didn’t account for the explosion in digital services and the shift from rural to urban consumption seen between 2023 and 2026.

Q: How can I track the new 2024 inflation series?

A: The first data points will be released by MoSPI on February 12, 2026. You can follow the official RBI Database (DBIE) for the latest charts.

Conclusion: A Policy of Confidence

The RBI 2026 Monetary Policy Inflation Reset is a testament to India’s economic resilience. By holding rates at 5.25% and fixing the measurement of inflation, the RBI has prepared a stable runway for India to remain the world’s fastest-growing economy through 2027.

Disclaimer

Information Accuracy – The information provided on CFOs Times is for general informational purposes only. While we strive for accuracy, the financial and economic landscape of 2026 changes rapidly. We make no warranties about the completeness or reliability of this information. Any action you take upon the information on this website is strictly at your own risk.

Professional Advice – CFOs Times is not a registered financial advisor. The content here—including our analysis of the RBI Inflation Reset or US Jobs Reports—should not be construed as professional financial, legal, or tax advice. Always consult with a qualified professional before making high-stakes decisions.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.