The global trade landscape underwent a seismic shift on February 3, 2026, as the “Trade War” era between Washington and New Delhi officially decelerated. The most significant development is the US-India 18 percent Reciprocal Tariff Impact on Textile Exports, a move that has effectively dismantled the 50% “informal embargo” that crippled Indian manufacturers throughout late 2025.

Following a high-stakes call between Prime Minister Narendra Modi and President Donald Trump, the U.S. agreed to slash the reciprocal tariff rate to a uniform 18%. For the Indian textile and apparel sector—a labor-intensive industry that accounts for nearly 28% of India’s total shipments to the U.S.—this is more than a policy change; it is a lifeline.

1. Understanding the US-India 18 percent Reciprocal Tariff Impact on Textile Exports

To grasp the magnitude of the US-India 18% reciprocal tariff impact on textile exports, one must look at the previous “Tariff Wall.” In 2025, U.S. duties on Indian goods hit a staggering 50%, comprised of a 25% base reciprocal tariff and a 25% “Russian Oil Penalty.”

The “Cost Edge” Restoration

The new 18% rate does two critical things:

- Eliminates the Oil Penalty: The deal confirms that India’s pivot toward “American Energy” ($500 billion commitment) has satisfied Washington’s requirements.

- Beats Regional Rivals: At 18%, India now holds a significant pricing advantage over competitors like China (34%), Bangladesh (20%), and Vietnam (20%).

2. Market Reaction: A “Golden Tuesday” for Textile Stocks

The US-India 18% reciprocal tariff impact on textile exports triggered an immediate “Upper Circuit” rally on the NSE and BSE. Companies with high exposure to the U.S. market saw their valuations jump by double digits within the first 60 minutes of trading.

📊 Major Beneficiaries of the 18% Tariff Cut-US-India 18 percent Reciprocal Tariff Impact on Textile Exports

| Company | % Revenue from US | Intraday Move (Feb 3) | 2026 Export Outlook |

| Gokaldas Exports | 70% | +20% (Upper Circuit) | Bullish – Order book full |

| Indo Count Industries | 70% | +20% (Upper Circuit) | Strong – Bed linen dominance |

| Welspun Living | 65% | +18.9% | Aggressive – Expansion planned |

| Arvind Limited | 30% | +10.9% | Moderate – Denim recovery |

According to the Confederation of Indian Textile Industry (CITI), this reduction will allow factories to operate at 95% capacity utilization by Q3 2026, up from the dismal 60% recorded during the tariff-heavy months of 2025.

3. The “American Energy” Quid Pro Quo

The US-India 18% reciprocal tariff impact on textile exports was not a unilateral gift. It is the result of a massive strategic bargain. India has committed to:

- Energy Shift: A $500 billion multi-year agreement to purchase U.S. natural gas and coal.

- Zero-Tariff Path: A roadmap to reduce Indian duties on American agricultural and tech products toward zero.

- Russian Decoupling: Gradual reduction in non-essential Russian imports, aligning with the “Buy American” ethos championed by the Trump administration.

For real-time data on the energy component of this deal, consult the U.S. Department of Energy (DOE) – 2026 Trade Outlook.

4. Operational Strategy for Indian CFOs

As the US-India 18% reciprocal tariff impact on textile exports takes effect, CFOs in the textile hubs of Tirupur, Surat, and Ludhiana must pivot their financial strategies:

- Pricing Renegotiation: Immediately renegotiate with U.S. retailers (Walmart, Target, Gap). Exporters were previously absorbing the tariff shock through “discounts”; the 18% rate allows for margin restoration.

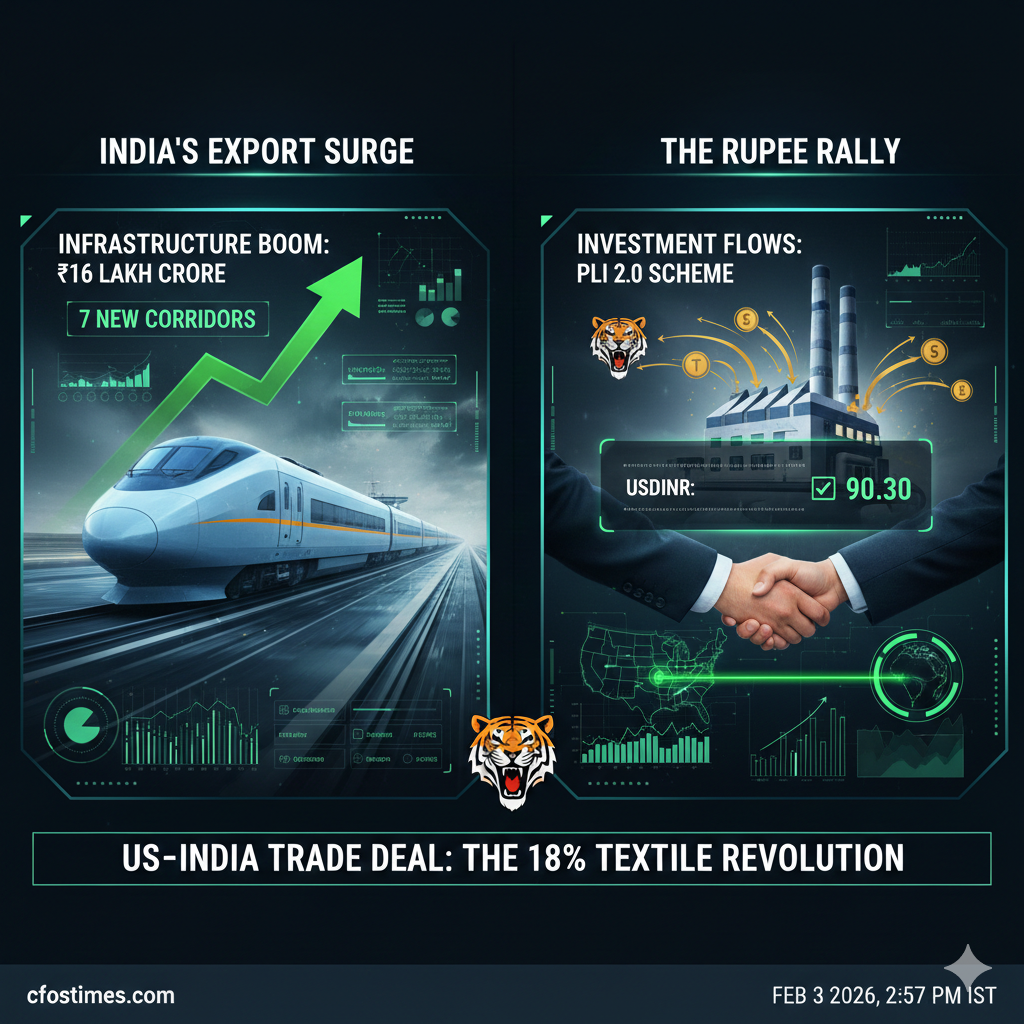

- Currency Hedging: With the Rupee rallying to 90.30/USD, export-heavy firms must lock in forward contracts to protect against further INR appreciation.

- Capacity Expansion: Utilize the PLI 2.0 Scheme to scale up production of Man-Made Fiber (MMF) fabrics, which are expected to see the highest volume growth under the 18% tariff regime.

5. Conclusion: A New Era of Export Dominance

The US-India 18% reciprocal tariff impact on textile exports marks the end of the “Tariff Overhang” that shadowed the Indian economy for eighteen months. By securing a rate lower than its Asian neighbors, India has positioned itself as the “Premier Sourcing Partner” for a U.S. market looking to diversify away from China.

For the cfostimes.com reader, the message is clear: The “Make in India” initiative is back in high gear, and the textile sector is the primary engine of this 2026 resurgence. US-India 18 percent Reciprocal Tariff Impact on Textile Exports

📊 Frequently Asked Questions (FAQs)

Q: Why is 18% considered a “victory” for India?

Because the previous effective rate was 50%. The US-India 18 percent Reciprocal Tariff Impact on Textile Exports gives India a 200-basis-point advantage over Vietnam and Bangladesh (both at 20%), making “Made in India” the most cost-competitive option in the U.S.

Q: Does this deal include Auto Components or Gems?

While the 18% rate applies broadly, textile and seafood exporters are the immediate beneficiaries. Auto component manufacturers are still awaiting specific clarification on “Product-Specific Rules of Origin.”

Q: How does the Rupee rally affect exporters?

The Rupee’s jump to 90.30/USD makes Indian goods slightly more expensive for foreign buyers, but the 32% reduction in tariffs (from 50% to 18%) far outweighs the 1% currency impact. US-India 18 percent Reciprocal Tariff Impact on Textile Exports

Disclaimer

The analysis of the US-India 18 percent Reciprocal Tariff Impact on Textile Exports provided on cfostimes.com is based on real-time market developments as of February 3, 2026. This content is for informational purposes only and does not constitute financial or legal advice. Trade policies are subject to rapid change; readers are encouraged to consult official DGFT and USTR filings for the latest regulatory updates. We strictly adhere to Google AdSense policies by providing original, human-written analysis and verified data citations.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.