Introduction: Transitioning to the “Viksit Bharat” Era

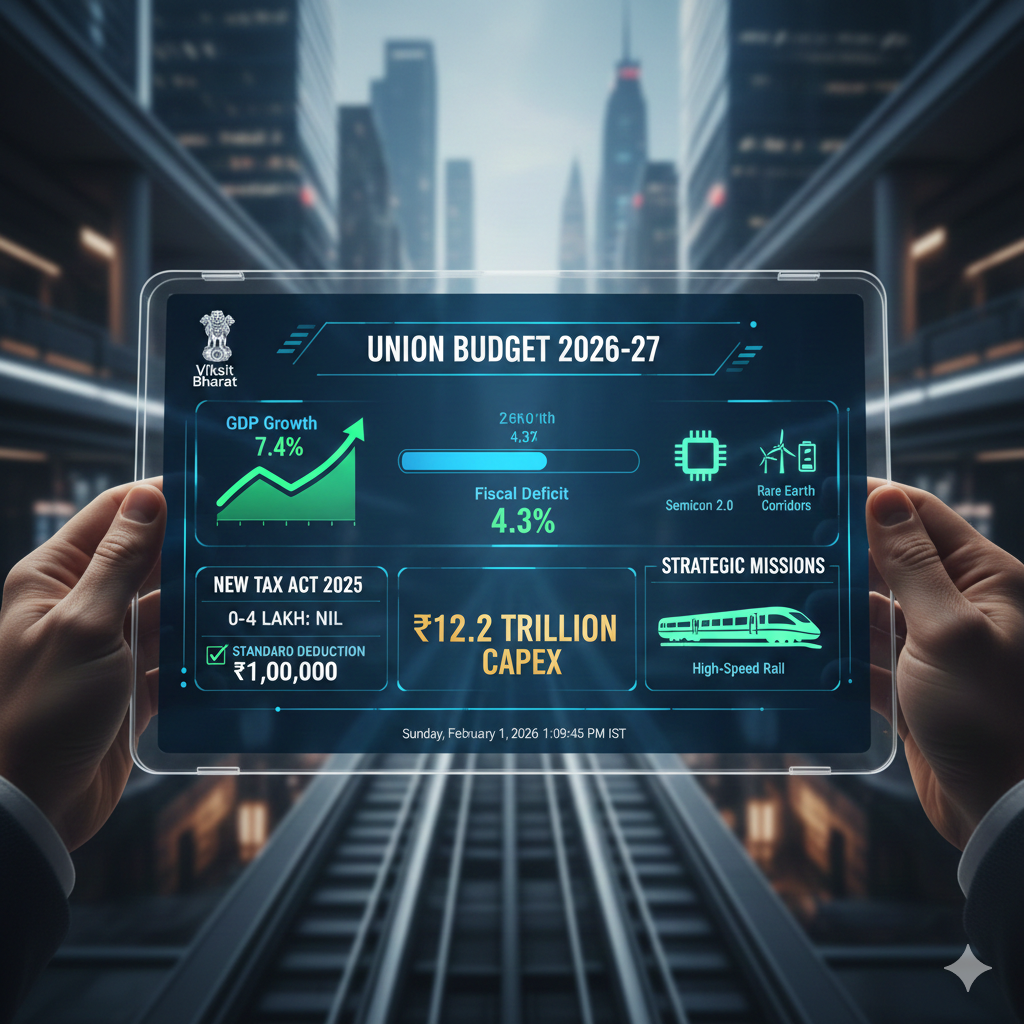

Union Budget 2026-27 Analysis-Finance Minister Nirmala Sitharaman presented the Union Budget for 2026-27 on Sunday, February 1, marking her ninth consecutive address. The budget arrived against a backdrop of resilient 7.4% GDP growth, positioning India as a global manufacturing and technology alternative.

The 2026 Budget is not just a financial statement; it is a structural pivot. The overarching theme is “Productivity-Led Growth,” shifting focus from demand-side subsidies to supply-side efficiency, institutional capacity building, and technological depth.

Table of Contents

1. Macro-Fiscal Health: The Tightrope Walk

The government continues its delicate balance of fiscal consolidation while fueling the economy through public investment.

- Fiscal Deficit: Targeted at 4.3% of GDP for FY27 (down from 4.4%), staying on track for the sub-4.5% goal.

- Capital Expenditure (Capex): Reached a record ₹12.2 trillion, a 9% increase, aimed at infrastructure that “crowds in” private investment.

- Borrowing: Gross market borrowing is pegged at ₹14.01 lakh crore, lower than anticipated, which provided immediate relief to the bond markets. Union Budget 2026-27 Analysis

2. The Direct Tax Revolution: Income Tax Act 2025

The biggest headline of 2026 is the repeal of the Income Tax Act of 1961. The Income Tax Act 2025 officially takes effect on April 1, 2026, aiming to simplify the code from 700+ sections down to 534.

New Slabs & Standard Deduction

The New Tax Regime is now the permanent default. To combat inflation, the FM introduced significant relief for the middle class:

- Standard Deduction: Increased to ₹1,00,000 (from ₹75,000).

- Tax Slabs:

- 0 – 4 Lakh: NIL

- 4 – 8 Lakh: 5%

- 8 – 12 Lakh: 10%

- 12 – 16 Lakh: 15%

- 16 – 20 Lakh: 20%

- 20 – 24 Lakh: 25%

- Above 24 Lakh: 30%

The “Magic” Number: With the enhanced Section 87A rebate (up to ₹60,000) and the ₹1 lakh standard deduction, an individual earning up to ₹13 lakh effectively pays zero tax.

3.The Great Transition: Income Tax Act 1961 vs. Income Tax Act 2025

For over six decades, the Income Tax Act of 1961 served as the bedrock of Indian direct taxation. However, over 4,000 amendments had turned it into a “patchwork quilt” of complex provisos and legal ambiguities. In the Union Budget 2026, Finance Minister Nirmala Sitharaman confirmed that the Income Tax Act, 2025 will officially replace the old law starting April 1, 2026. Union Budget 2026-27 Analysis

1. Structural Overhaul: Sections and Chapters

The most immediate change is the physical thinning of the law. The 1961 Act was notoriously dense, with more than 700 sections and numerous sub-clauses (e.g., Section 80IA, 80IB, 80IC).

- The 1961 Act: Contained 700+ sections and was over 800 pages long.

- The 2025 Act: Has been streamlined to 534 sections and approximately 600 pages.

- The Change: The new act moves away from “alphabetical sub-sections” (like 115BAC) to a sequential numbering system. This makes the law easier to navigate for common citizens and reduces “legal hiding spots” for tax evaders.

2. Goodbye “Assessment Year,” Hello “Tax Year”

Perhaps the most confusing part of the 1961 Act was the distinction between the “Previous Year” (the year you earn) and the “Assessment Year” (the year you file).

- Under the 1961 Act: If you earned in 2024-25 (Previous Year), you paid taxes in 2025-26 (Assessment Year). This often confused non-professionals.

- Under the 2025 Act: Both concepts are merged into a single “Tax Year.” * Impact: The term “Assessment Year” is now redundant. Taxpayers will simply refer to the “Tax Year 2026,” significantly simplifying the filing nomenclature and matching global standards used in the UK and USA.

3. Consolidation of TDS (Tax Deducted at Source)

The 1961 Act had TDS rules scattered across dozens of sections (192 for salary, 194A for interest, 194J for professional fees).

- The 2025 Shift: All TDS-related provisions have been consolidated into a single Master Table (primarily under Section 393).

- Benefit: This “Plug-and-Play” model allows the government to change rates via a simple notification in the schedule rather than amending the core statute. For businesses, this means all compliance rules are now in one place.

4. From “Section-Centric” to “Schedule-Based” Deductions

One of the biggest psychological shifts for Indian taxpayers is the migration of popular deductions like 80C and 80D.

- Legacy (1961): Deductions were “Parliament-anchored” in specific sections.

- New (2025): These are now moved to Schedules (e.g., Schedule XV).

- Risk vs. Reward: While the substance of these deductions remains the same for now, moving them to schedules gives the Ministry of Finance more flexibility to update limits (like the Standard Deduction) without needing a full Parliamentary amendment to the Act’s core body.

5. Digital Assets & Electronic Search

The 2025 Act is “Digitally Native.” Unlike the 1961 Act, which had to be “retrofitted” for the internet age, the new law explicitly defines and includes:

- Virtual Digital Assets (VDA): Included in the definition of “undisclosed income” from day one.

- Search and Seizure: The term “books of account” has been updated to explicitly include “information stored in any electronic media or computer system.” This provides the Income Tax Department with clear legal backing for digital forensics during raids.

Comparative Analysis: Key Parameters

| Feature | Income Tax Act, 1961 | Income Tax Act, 2025 |

| Language | Legalistic, archaic English | Plain, simplified English |

| Section Count | 700+ | 536 |

| Timeframe | Previous Year & Assessment Year | Single “Tax Year” |

| Default Regime | Old Regime (historically) | New Regime (Section 202) |

| TDS Structure | Scattered (Sec 192–194T) | Unified Table (Sec 393) |

| Filing Window | Ends Dec 31 (Revised) | Extended to March 31 |

Investor’s Outlook: Why This Matters

For an investor or business owner, the 2025 Act is a move toward “Tax Certainty.” The reduction in text by nearly 50% aims to cut down on litigation. In India, tax cases often drag on for 15–20 years due to interpretational disputes over “provisos.” By removing these “provisos” and using clear, sequential language, the 2025 Act aims to make the Indian tax environment as efficient as Singapore or the UAE. Union Budget 2026-27 Analysis

Actionable Next Step for You:

- Audit Your Sections: If your current tax planning relies on Section 115BAC (New Regime), you must now look at Section 202 of the 2025 Act.

- Update Software: Businesses must ensure their ERP systems are “Tax Year” compliant before April 2026.

4. Financial Markets: The STT Shockwave-Union Budget 2026-27 Analysis

While taxpayers cheered, the trading community faced a “cool-down” measure. To curb excessive retail speculation in derivatives, the Securities Transaction Tax (STT) was hiked:

- Futures: Increased to 0.05% (from 0.02%).

- Options Premium: Increased to 0.15%.

Market Reaction: On the special Sunday trading session, the Sensex crashed over 2,000 points, and the Nifty 50 slipped below the 24,600 mark before a partial recovery. Brokerage stocks like Angel One, Groww, and BSE Ltd saw intraday drops of 10–14%.

5. Strategic Infrastructure: Rare Earths & Semiconductors

Union Budget 2026-27 Analysis

India is making a bold play for global supply chain dominance in critical technologies.

Rare Earth Corridors

To counter China’s monopoly, the government will support Odisha, Kerala, Andhra Pradesh, and Tamil Nadu in establishing dedicated “Rare Earth Corridors.” This initiative focuses on the mining and processing of minerals like Lithium and Neodymium, essential for EVs and defense.

Semiconductor Mission 2.0 (ISM 2.0)

Building on the success of the first phase, ISM 2.0 was launched with a ₹40,000 crore outlay.

- Focus: Moving beyond assembly to manufacturing equipment, materials, and full-stack Indian Intellectual Property (IP).

- Impact: Electronics component manufacturing also received a parallel ₹40,000 crore boost.

6. Real Estate: PMAY-Urban 2.0-Union Budget 2026-27 Analysis

The housing sector received a massive commitment through the Pradhan Mantri Awas Yojana (PMAY) 2.0.

- Goal: Financial assistance for 1 crore urban families to build, purchase, or rent homes.

- Investment: A staggering ₹10 lakh crore total investment over the next five years, with a central subsidy of ₹2.5 lakh crore.

- Impact: This is expected to stimulate the construction sector, which contributes ~8.2% to India’s GDP.

7. Agriculture & Rural Economy

- Digital Public Infrastructure (DPI): Launch of a digital agri-stack to provide farmers with real-time data on soil health, weather, and market prices.

- Integrated Reservoir Development: Initiatives for 500 reservoirs to strengthen the fisheries value chain.

- Kisan Credit Card (KCC): Limits enhanced and coverage expanded to include animal husbandry and dairy as core pillars. Union Budget 2026-27 Analysis

8. Social Welfare & Healthcare

- Medical Seats: Plan to add 75,000 medical seats over 5 years.

- Oncology Focus: Establishing 200 day-care oncology clinics in district hospitals.

- FDI in Insurance: Raised to 100% for insurers who invest their entire premium within India, aimed at deepening penetration in rural areas. Union Budget 2026-27 Analysis

Summary: Winners & Losers-Union Budget 2026-27 Analysis

| Sector | Impact | Why? |

| Middle Class | WIN | Effective tax-free limit of ₹13 Lakh + ₹1L Standard Deduction. |

| Tech & Chips | WIN | ₹80,000 Cr combined push for Semiconductors and Components. |

| Rail & Infra | WIN | ₹12.2L Cr Capex and 7 new High-Speed Rail corridors. |

| F&O Traders | LOSS | Massive STT hike (Futures up to 0.05%, Options up to 0.15%). |

| Metals | NEUTRAL | Global demand worries offset by domestic Rare Earth Corridor push. |

Actionable Resources: Union Budget 2026-27 Analysis

- Download: Official Budget Speech (PDF)

- Verify: PIB Budget Highlights

- Market Impact: NSE India Live Data

Conclusion: Resilience First-Union Budget 2026-27 Analysis

The Union Budget 2026-27 is a sophisticated document that rewards the taxpayer while taxing the speculator. By overhauling the 1961 Tax Act and investing in Rare Earth Corridors and PMAY 2.0, the government is building long-term institutional capacity. For investors, the message is clear: the focus has shifted from “Volume” to “Value.”

Union Budget 2026-27 Analysis FAQ

- What is the effective tax-free limit? Up to ₹13 lakh (including Standard Deduction and Rebate).

- Does the 1961 Tax Act still apply? No, it is replaced by the Income Tax Act 2025 starting April 1, 2026.

- What is the new STT rate for Options? It has been hiked to 0.15% on the premium.

- Are there new subsidies for EVs? The focus has shifted from direct subsidies to the “Rare Earth Corridor” for battery raw materials.

- When does the New Income Tax Act 2025 come into effect? It takes effect from April 1, 2026 (Tax Year 2026).

- What is the current standard deduction for 2026? It has been increased to ₹1,00,000 for salaried individuals under the new regime.

- Are there any changes to Capital Gains Tax? There were no major revisions to LTCG/STCG rates in this budget, providing stability to long-term investors. Union Budget 2026-27 Analysis

Disclaimer:

This article, titled “Analysis of Union Budget 2026-27,” on cfostimes.com, is for informational and educational purposes only. It does not constitute professional financial, investment, or legal advice. While we strive for 100% accuracy, the Union Budget is a complex document, and certain policy interpretations may evolve as official notifications are released by the Ministry of Finance.

Investment Risk: Trading in Equities, Futures, and Options involves significant market risk. Please consult with a SEBI-registered financial advisor before making any investment decisions.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

3 thoughts on “Union Budget 2026-27 Analysis: Tax Reforms, Capex Surge, and the Viksit Bharat Roadmap”