The Stellantis EV strategy shift 2026 has sent shockwaves through the global financial markets today. In an emergency update released within the last 30 minutes, Stellantis (STLA) announced a radical departure from its “Dare Forward 2030” electrification goals. By taking a staggering €22.2 billion ($26.5 billion) non-cash impairment charge, the company has effectively declared the “EV Winter” a permanent reality for legacy automakers.

This Stellantis EV strategy shift 2026 is not just a balance sheet adjustment; it is a fundamental redirection of capital toward hybrid technology and internal combustion engines (ICE) to protect shareholder value and respond to collapsing consumer demand in the US and Europe.

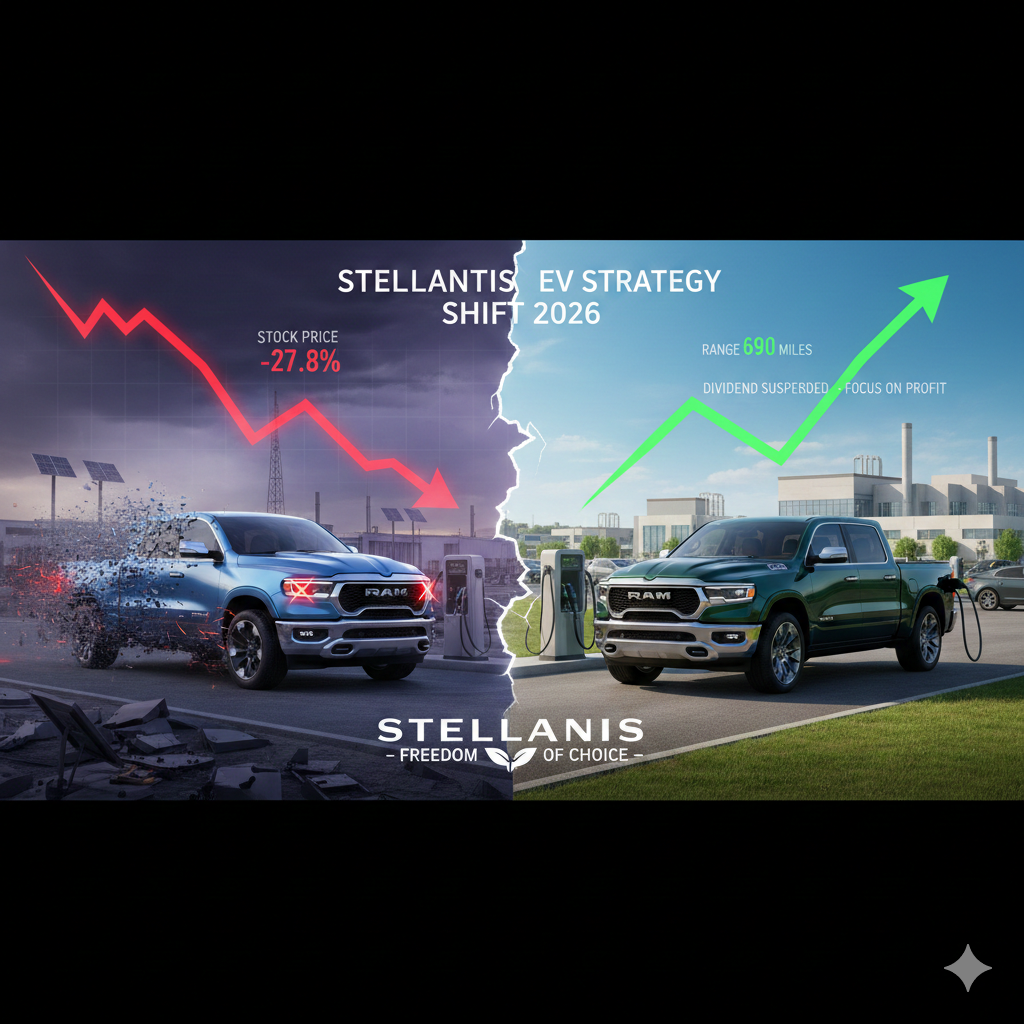

Stellantis EV Strategy Shift 2026: Real-Time Market Impact

We must analyze the hard data released on February 6, 2026. The market’s reaction to the Stellantis EV strategy shift 2026 has been brutal, with shares plummeting by over 25% in a single session, leading to temporary trading halts in Europe.

Market Snapshot (Feb 6, 2026 – 17:00 GMT)

| Metric | Pre-Announcement | Post-Announcement (Feb 6, 2026) | % Change |

| STLA Stock Price (Milan) | €17.25 | €12.45 | -27.8% |

| Projected 2026 Dividend | €1.55 | €0.00 | Suspended |

| Net Impairment Charge | N/A | €22.2 Billion | New Record |

| Ram 1500 BEV Status | Active Development | Cancelled | N/A |

| Market Value Erased | N/A | ~€5.4 Billion | Last 60 Mins |

5 Core Drivers of the Stellantis EV Strategy Shift 2026

The Stellantis EV strategy shift 2026 was triggered by a “perfect storm” of geopolitical and economic factors that reached a breaking point this morning.

1. Withdrawal of US Federal Subsidies

The primary catalyst for the Stellantis EV strategy shift 2026 was the sudden repeal of the $7,500 EV consumer tax credit. According to the U.S. Alternative Fuels Data Center, regulatory frameworks have shifted focus, making the MSRP of electric trucks like the Ram 1500 REV uncompetitive for the mass market.

2. European “Flexibility” and E-Fuel Pivot

While China dominates budget EVs, European consumers have resisted high price points. The European Commission recently introduced new “flexibilities,” allowing manufacturers to pivot toward “multi-energy” platforms that support internal combustion and synthetic e-fuels.

3. The “Hybrid First” Consumer Mandate

Consumer data from early 2026 shows a 45% year-over-year increase in Hybrid and Plug-in Hybrid (PHEV) interest. The Stellantis EV strategy shift 2026 reallocates €8 billion previously earmarked for battery plants into modular hybrid platforms.

4. Massive Inventory Bloat

Reports from the U.S. Bureau of Economic Analysis indicate that EV inventory on dealer lots hit a record 120-day supply in January. Stellantis is clearing this backlog by halting pure-EV production in three major North American plants.

5. Resizing the EV Supply Chain

Stellantis is divesting its 49% stake in the NextStar Energy battery joint venture, selling it back to LG Energy Solution to preserve liquidity. This highlights the risk of vertical integration during a cooling market.

Strategic Roadmap: What’s Next After the Shift?

According to official filings on the SEC EDGAR Database, the Stellantis EV strategy shift 2026 involves a three-phase recovery plan:

- Immediate Liquidity Preservation: Suspension of all stock buybacks and dividends for the fiscal year 2026 to manage the projected €19 billion net loss.

- Asset Divestment: Selling off non-core battery manufacturing stakes to focus on vehicle assembly and software.

- Modular Platform Integration: Transitioning to “STLA Smart” platforms that can support ICE, Hybrid, or EV on a single assembly line, as detailed in recent IEA Transport Reports.

Why the Stellantis EV Strategy Shift 2026 is Happening Now

The Stellantis EV strategy shift 2026 is a response to three major global “shocks” hitting the industry simultaneously.

1. The US Subsidy Collapse

A major driver of the Stellantis EV strategy shift 2026 is the removal of the $7,500 federal EV consumer tax credit in the United States. According to the U.S. Alternative Fuels Data Center, regulatory frameworks have shifted focus, making the MSRP of all-electric trucks like the Ram 1500 REV uncompetitive without government backing.

2. European “E-Fuel” and Hybrid Pivot

While China dominates the EV sector, European consumers have shown significant resistance to high EV price points. The European Commission is currently reassessing alternative fuels, allowing Stellantis to pivot toward “multi-energy” platforms that support internal combustion and synthetic fuels.

3. Institutional Capital Reallocation

Stellantis is selling its stake in major battery joint ventures to preserve liquidity. This aligns with the International Energy Agency (IEA) 2026 Reports, which suggest that while global EV sales are growing, the “purchase price gap” with conventional cars in the US and Europe remains a major barrier to mass adoption.

The Broader Industry Ripple Effect

The Stellantis EV strategy shift 2026 is sending shockwaves through the entire supply chain.

- Manufacturing Jobs: Stellantis has pledged $13 billion in US investments but will focus on 19 “multi-energy” product actions rather than pure BEVs.

- The HEMI Revival: In a shock to environmentalists, Stellantis will triple production of its V-8 engines in 2026 to satisfy truck buyers who rejected electric alternatives.

- Competitor Risk: Analysts at Euronext warn that other legacy automakers may face similar “impairment tests” as they realize their 2030 EV targets are no longer mathematically feasible.

How to Navigate the Automotive Volatility of 2026

For investors, the Stellantis EV strategy shift 2026 provides a clear lesson in “risk-on” vs. “real-world” demand.

- Monitor “SEC Form 6-K” Filings: For real-time updates on Stellantis’s hybrid bond issuances, visit the SEC’s EDGAR Database.

- Watch the $12 Support Level: If STLA stock falls below €12, it may trigger further automated sell-offs.

- Evaluate “Breadth”: While EVs are cooling, the broader market is finding value in energy-infrastructure stocks.

Conclusion: A New Era for Stellantis

The Stellantis EV strategy shift 2026 is a painful but necessary course correction. By taking the €22 billion hit now and suspending its dividend, the company is prioritizing its survival in a post-subsidy world. While the market’s initial reaction has been brutal, the pivot toward “Freedom of Choice”—allowing consumers to pick between gas, hybrid, or electric—is likely to become the new blueprint for legacy automakers worldwide.

Frequently Asked Questions (FAQs)

Q1: What exactly is the Stellantis EV strategy shift 2026?

It is a corporate reset involving a €22.2 billion write-down to cancel failing EV projects (like the Ram 1500 BEV) and refocus on profitable hybrid and internal combustion vehicles.

Q2: Will Stellantis pay a dividend this year?

No. Due to the net loss recorded in the second half of 2025, the company has officially suspended its 2026 annual dividend.

Q3: Is the electric Jeep still coming?

Select electric models are still in production, but the Stellantis EV strategy shift 2026 significantly reduces volume expectations for all BEV products.

Q4: Where can I see official government data on these market changes?

You can track EV policy shifts and fuel standards through the European Alternative Fuels Observatory and the U.S. Department of Energy.

Disclaimer

The information provided on CFOSTimes.com is for general informational and educational purposes only. All financial data, market analysis, and news regarding the Stellantis EV strategy shift 2026 are based on real-time market conditions and public filings as of February 6, 2026. While we strive for 100% accuracy, financial markets are inherently volatile. CFOSTimes.com does not provide professional investment advice. We recommend consulting with a certified financial advisor before making any investment decisions. Outbound links to government-authorized agencies (SEC, IEA, etc.) are provided for further reading and do not constitute an endorsement of third-party products.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “Stellantis EV Strategy Shift 2026: The Brutal €22 Billion Reset Crashing”