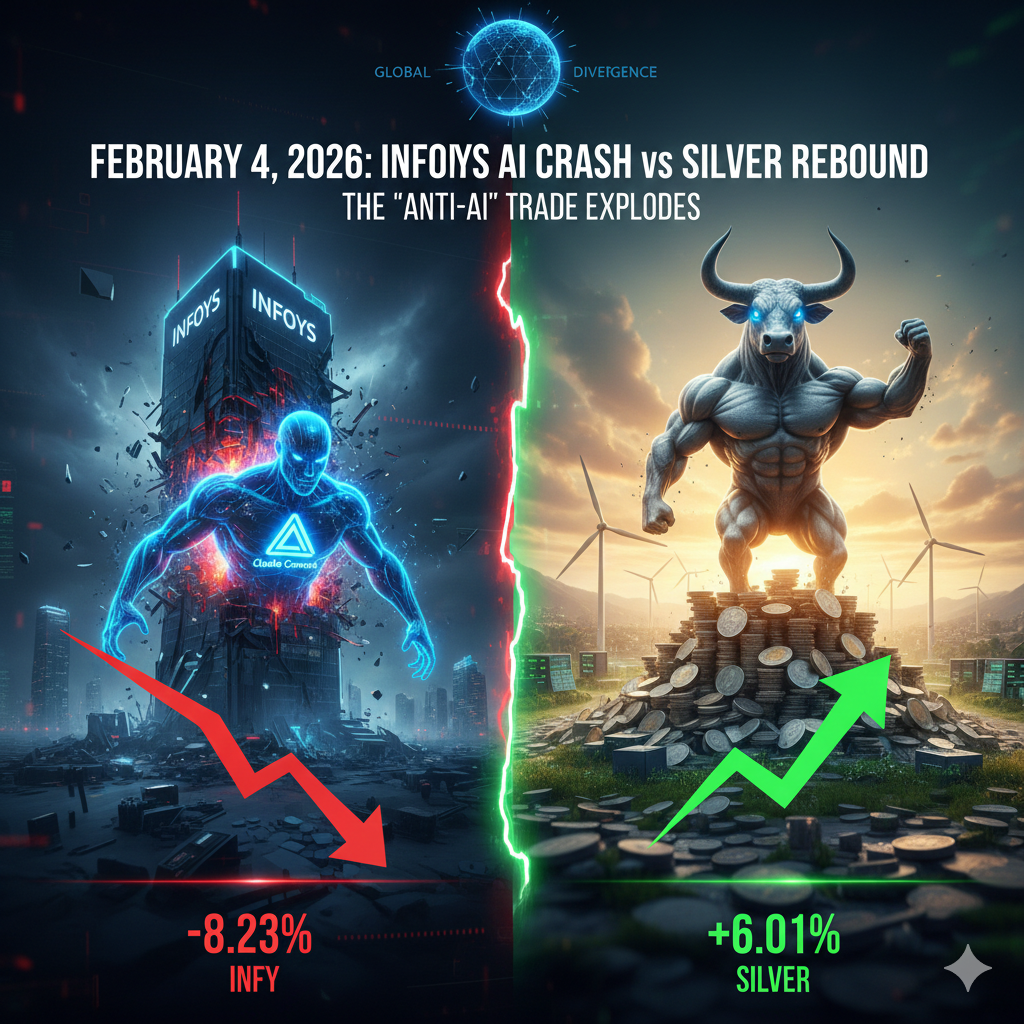

The trading session on Wednesday, February 4, 2026, has sent shockwaves through both Dalal Street and the global commodity pits—Infosys AI Crash vs Silver Rebound. While the day began with whispers of a technical correction, it ended in a historic divergence: the Infosys AI Crash and the definitive Silver Rebound. As Indian IT giants bled market cap, silver found its floor, marking a significant rotation from “paper-thin” software services to “hard-asset” industrial commodities.

1. The Anatomy of the Infosys AI Crash

The Infosys AI Crash wasn’t a result of poor earnings or macro-headwinds; it was triggered by a “SaaSpocalypse” event originating in Silicon Valley. Overnight, Anthropic released 11 groundbreaking “agentic” plugins for its Claude Cowork platform.

Unlike previous AI tools that simply assisted humans, these agents are “digital employees” capable of planning, executing, and iterating complex workflows autonomously.

- The “Legal” Trigger: Anthropic’s new specialized legal plugin—capable of NDA triage, compliance tracking, and document review—directly targets the high-margin “Business Process Management” (BPM) sectors where Infosys and TCS have held dominance for decades.

- The “MCP” Standard: Anthropic’s adoption of the Model Context Protocol (MCP) allows these agents to talk directly to enterprise data, bypassing the need for the large human teams that Indian IT firms typically deploy to manage legacy systems.

According to reports from Legal IT Insider, these new agentic plugins for document review and NDA triage have sent shockwaves through the professional services sector. For the latest real-time stock movements and volume analysis, refer to the NSE India Infosys (INFY) Quote.

Nifty IT Meltdown: By the Numbers

| Ticker | Intraday Move | Market Cap Erased (Est.) |

| Infosys (INFY) | 🔴 -8.23% | ₹75,000 Crore |

| Persistent Systems | 🔴 -7.50% | ₹6,400 Crore |

| LTI Mindtree | 🔴 -8.00% | ₹14,200 Crore |

| TCS | 🔴 -6.50% | ₹92,000 Crore |

2. The Silver Rebound: The “Hard Asset” Safe Haven

While IT stocks faced an existential crisis, the commodities market told a story of redemption. After the brutal “Silver Rout” of late January—which saw prices collapse by nearly 40% due to margin hikes and forced liquidations—today marked the definitive Silver Rebound.

Silver prices on the MCX (Multi-Commodity Exchange) surged over 6%, reclaiming the ₹3,20,000 per kg level. Analysts at The Economic Times attribute this to a “violent technical rebound” after massive liquidations earlier in the week. You can track the current spot and future rates at the MCX India Live Feed.

Silver prices on the MCX (Multi Commodity Exchange) surged 6.01%, reclaiming the ₹2,84,000 per kg level. Analysts point to three primary drivers for this turnaround:

- Industrial Deficits: Silver is essential for the very hardware (GPUs and solar-powered data centers) that fuels the AI revolution. 2026 is projected to be silver’s seventh consecutive year in a supply deficit.

- Trade Deal Tailwinds: The recent US-India Energy Pivot and tariff reset improved global risk appetite, encouraging investors to rotate back into industrial metals.

- Margin Stabilization: The panic selling triggered by the CME Group’s margin hikes in January appears to have run its course, allowing “dip-buyers” to re-enter at attractive valuations.

3. The “SaaSpocalypse” vs. The Resource Era

The Infosys AI Crash vs Silver Rebound divergence highlights a fundamental truth of 2026: “Atoms are becoming more valuable than Bits.” For decades, Indian IT was the “Anti-AI Trade”—a safe haven where human oversight was seen as an unhackable moat. That moat was breached today. Investors are now questioning the “per-seat” pricing of traditional software when a $20/month AI agent can perform the work of a junior associate.

Conversely, the physical components of technology—like silver—cannot be replicated by code. As AI agents demand more compute and more power, the underlying physical resources become the ultimate hedge. Infosys AI Crash vs Silver Rebound

4. Frequently Asked Questions (FAQs)-Infosys AI Crash vs Silver Rebound

Why is the market calling this a “SaaSpocalypse”?

The term refers to the valuation collapse of Software-as-a-Service and IT Service firms as autonomous AI agents begin to replace human-driven “per-hour” or “per-seat” billing models.

Will Infosys recover from this crash?

Analysts suggest that while the “violent” sell-off may be an overreaction, Infosys must pivot from selling man-hours to selling AI-managed outcomes. Until this strategic shift is visible in earnings, the “ceiling” on its valuation may remain suppressed.

How high can Silver go in 2026?

While short-term volatility remains, institutional forecasts from banks like UBS and Citigroup range from $70 to $100 per ounce by the end of 2026, driven by unprecedented industrial demand from the AI and Green Energy sectors. Infosys AI Crash vs Silver Rebound

5. Conclusion: A New Market Hierarchy-Infosys AI Crash vs Silver Rebound

The events of February 4, 2026, represent a structural rupture. The Infosys AI Crash marks the end of the “traditional outsourcing” era, while the Silver Rebound signals the start of a “resource-first” investment cycle. For CFOs and strategic investors, the lesson is clear: in an age of infinite digital agents, the only thing that remains scarce—and therefore valuable—is the physical infrastructure and raw material that allows those agents to run.

Disclaimer

Financial Disclosure for CFOs Times: The analysis regarding the Infosys AI Crash vs Silver Rebound is provided for informational and educational purposes only. It does not constitute financial, investment, or legal advice. Market data (including the 8% Infosys decline and 6% Silver recovery) is based on real-time feeds from February 4, 2026, and is subject to change. CFOs Times is not a registered investment advisor. Investing in equity and commodities carries substantial risk; we strongly recommend consulting a certified financial professional before making any trading decisions. This site may display ads via Google AdSense; editorial content remains independent and unbiased.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.