Introduction

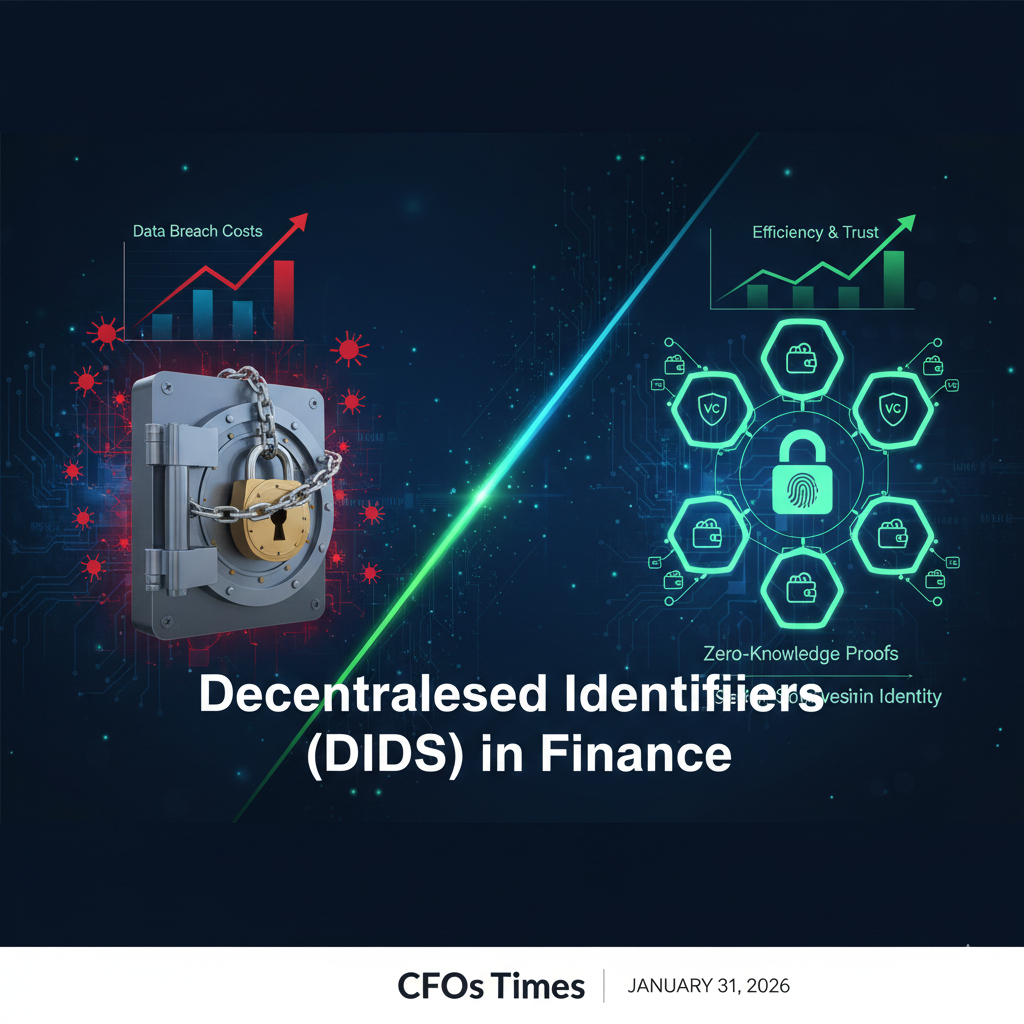

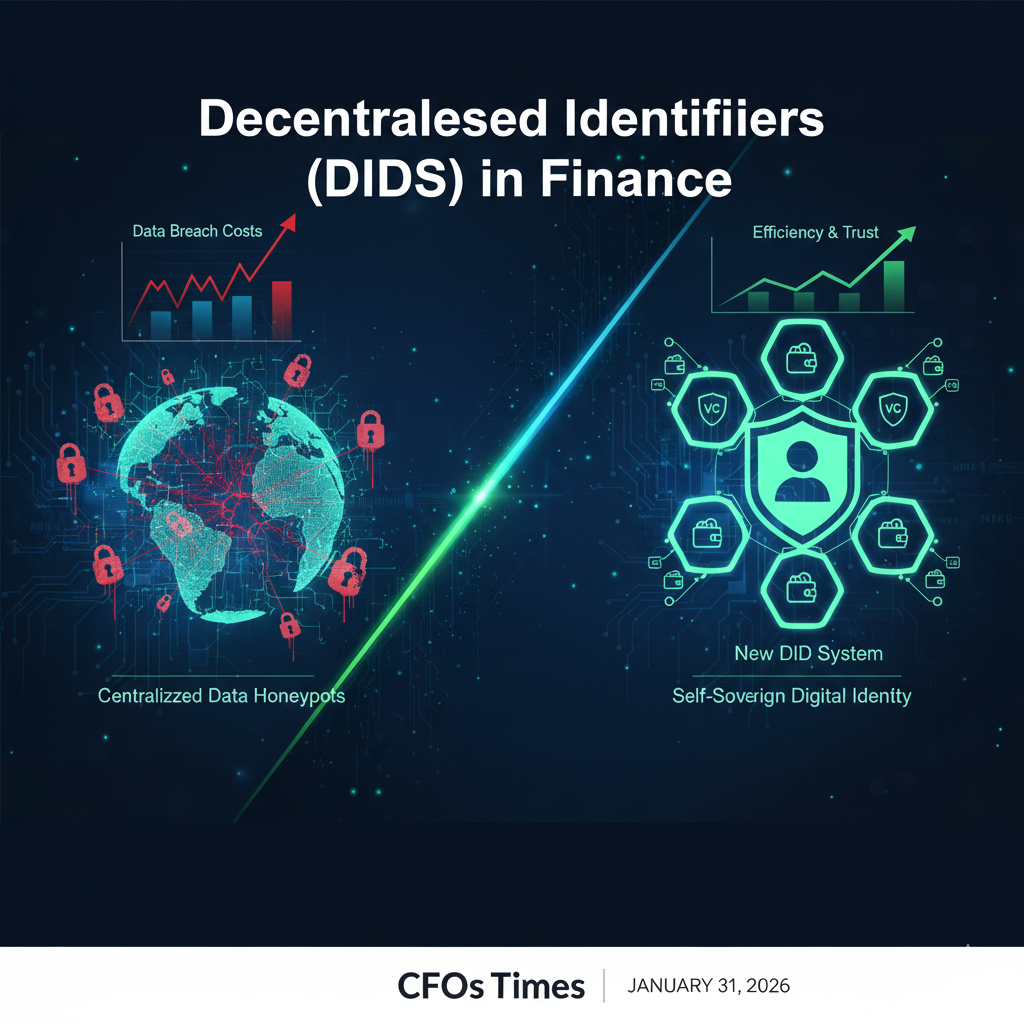

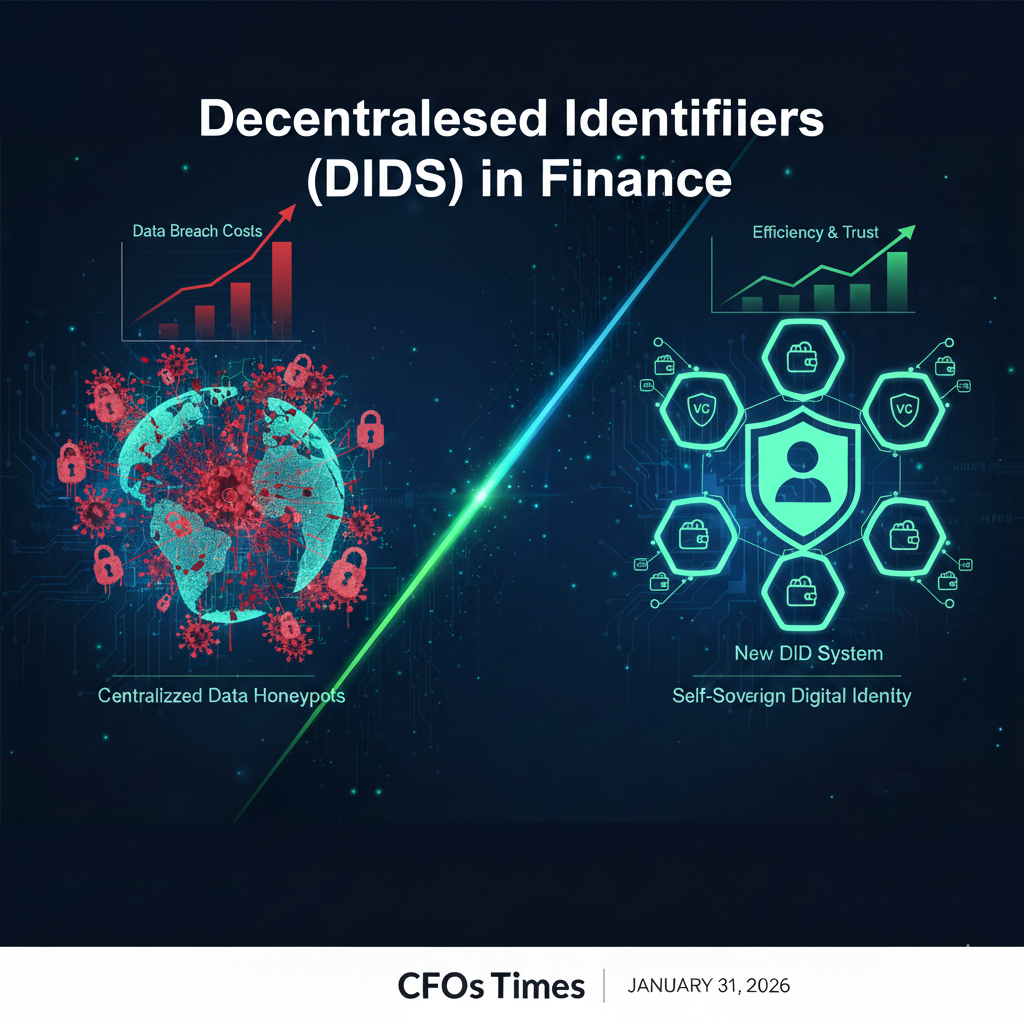

As we navigate the fiscal complexities of 2026, a silent revolution is restructuring the plumbing of global banking: the rise of Decentralized Identifiers (DIDs) in Finance. Traditional identity systems, built on fragile, centralised silos, are failing under the weight of AI-driven deepfake fraud and tightening regulations such as the EU’s eIDAS 2.0 and India’s Digital Personal Data Protection (DPDP) Act.

For the modern CFO, Decentralized Identifiers (DIDs) in Finance represent the shift from “identifying” a customer to “verifying” a relationship without the liability of storing toxic personal data. This guide provides the definitive roadmap for implementing DIDs to slash KYC costs, eliminate identity-theft risk, and achieve 100% regulatory alignment.

1. Decentralized Identifiers (DIDs) in Finance: Defining the 2026 Standard

A Decentralized Identifier (DID) is a new type of globally unique identifier that enables verifiable, self-sovereign digital identity. Unlike a bank account number or a Social Security Number, a DID is owned by the user, not the institution.

The Architecture of Trust

In the 2026 financial ecosystem, DIDs function as a “digital passport” that remains in the user’s control. When a customer interacts with your firm, they don’t hand over a scan of their passport; they present a Verifiable Credential (VC)—a cryptographically signed proof of their identity.

2. Why CFOs are Mandating DIDs in 2026

The transition to Decentralized Identifiers (DIDs) in Finance is driven by three inescapable economic pressures:

A. Radical Cost Reduction in KYC/AML

The average cost of a manual KYC check in 2025 hovered around $50-$100. With DIDs, verification is instantaneous and machine-readable. By leveraging credentials already verified by government agencies or other trusted banks, CFOs can reduce onboarding costs by up to 85%.

B. Mitigation of “Data Toxicity”

Storing sensitive PII (Personally Identifiable Information) is now a balance-sheet liability. DIDs allow banks to verify eligibility (e.g., “Is this user a resident of the UK?”) without actually holding the user’s address data, significantly lowering insurance premiums and cybersecurity risk.

C. Compliance with Global “Zero-Trust” Regulations

Financial regulators, including the Financial Action Task Force (FATF), have moved toward “Zero-Trust” frameworks. DIDs are the only identity standard that natively supports the privacy-by-design requirements of modern banking laws.

3. Implementation Roadmap: Deploying DIDs in Your Enterprise

| Phase | Strategic Action | Financial Impact |

| Q1: Audit | Mapping PII data silos and identifying “high-friction” onboarding points. | Identifying cost-leakage in manual verification. |

| Q2: Integration | Adopting W3C-compliant DID methods (e.g., did:ion or did:indy). | Reduction in “Drop-off” rates during customer sign-up. |

| Q3: Ecosystem | Issuing Verifiable Credentials for your own services (e.g., “Premier Status”). | New revenue streams from “Identity-as-a-Service.” |

4. Decentralized Identifiers (DIDs) in Finance: Solving the Deepfake Crisis

In early 2026, the proliferation of “Perfect Deepfakes” rendered video-call KYC obsolete. Decentralized Identifiers (DIDs) in Finance solve this by replacing visual verification with cryptographic proof. Even if an attacker perfectly mimics a customer’s face, they cannot replicate the private key stored in the customer’s secure hardware enclave.

Technical Note: According toW3C Standards, DIDs use $Elliptic Curve Cryptography (ECC)$ to ensure that identity claims are immutable and mathematically irrefutable.

5. Frequently Asked Questions (FAQs)

1. Are Decentralized Identifiers (DIDs) in Finance legal?

Yes. In fact, they are increasingly required. Major jurisdictions, including the EU and Singapore, have passed “Digital Trust” laws that recognize DIDs and Verifiable Credentials as legally binding identity proofs.

2. Do DIDs require a public blockchain?

Not necessarily. While some DIDs use public ledgers (like Bitcoin or Ethereum), many financial institutions use “Private DID” methods or “Peer-to-Peer DIDs” that do not require a public ledger, satisfying data sovereignty concerns.

3. How do DIDs impact the customer experience?

DIDs enable “One-Click Onboarding.” Once a user has a DID wallet, they can open accounts at new institutions in seconds, as their identity is already “pre-verified” by their existing network.

4. Can DIDs be revoked?

Absolutely. If a credential (like a professional license or credit score) changes, the Issuer can publish a revocation status to the DID document, ensuring that only current data is used for financial decisions.

Conclusion

The adoption of Decentralized Identifiers (DIDs) in Finance is no longer a “tech-innovation” project; it is a core survival strategy for 2026 and beyond. By moving away from centralized identity “honeypots” and toward a self-sovereign, cryptographic model, CFOs can simultaneously improve security, enhance the user experience, and ensure absolute regulatory compliance. The “Trust Gap” is closing—ensure your institution is on the right side of the divide.

Disclaimer

Editorial Note: This guide on Decentralized Identifiers (DIDs) in Finance is for informational purposes only. CFOs Times does not provide legal or financial investment advice. All technical implementations should be audited by certified cybersecurity and legal experts to ensure compliance with local regulations like GDPR, DPDP, and eIDAS.

The information on CFOs Times regarding Decentralised Identifiers (DIDs) in Finance is for educational purposes only. We are a journalistic platform, not a registered investment advisor (RIA) or legal counsel. Implementing DID protocols involves significant regulatory and technical risks. Always consult with a certified professional before making enterprise-level fiscal or data-governance decisions.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.