Introduction-“India Heyday” Jamieson Greer reaction

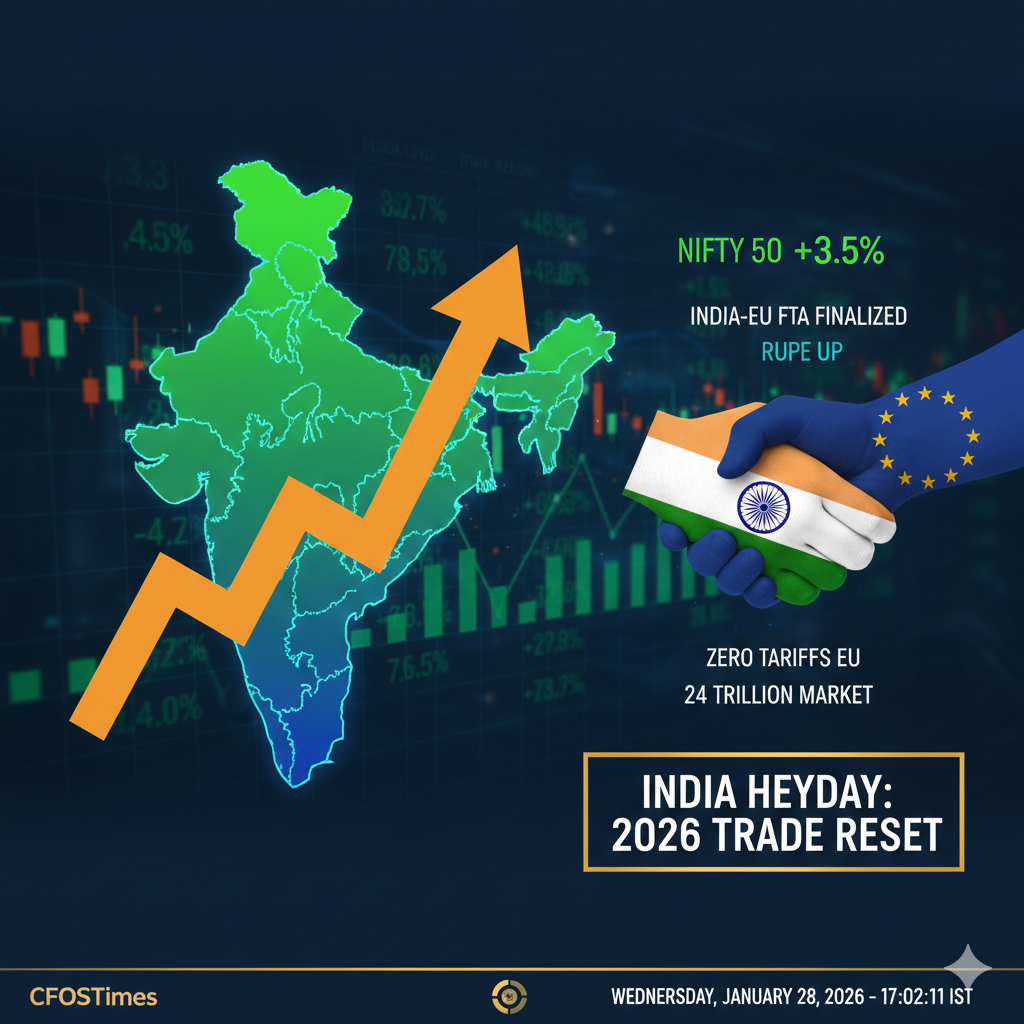

In the final hours of a historic trade week, the Trump administration has delivered a stunning verdict on the newly minted India-EU FTA. In an exclusive interview with Fox Business today, U.S. Trade Representative Jamieson Greer conceded that India is the undisputed winner of the “Mother of All Deals,” predicting an economic “heyday” for the subcontinent.

The “India Heyday” Jamieson Greer reaction comes as a strategic pivot for Washington. While the U.S. continues to hold its own 25% penal tariffs on New Delhi, Greer’s admission signals that the U.S. may be forced to recalibrate its “America First” strategy to compete with Europe’s new zero-duty access to the Indian market.

Table of Contents

1. The “Heyday” Factor: Low-Cost Labor Meets Open Markets

Greer’s primary observation was that the India-EU pact combines India’s massive low-cost labor pool with a sudden, duty-free outlet into a $17 trillion European market. “I think on net, India is going to have a heyday with this,” Greer stated. For Indian exporters, this effectively bypasses the high-tariff “moat” the U.S. had built around its own borders in 2025.

2. Scott Bessent: The Path to Tariff Withdrawal-India Heyday Jamieson Greer

The “heyday” isn’t just about Europe. Treasury Secretary Scott Bessent confirmed today that the U.S. penal tariffs have achieved their goal. According to Bessent, Indian refinery purchases of Russian oil have “collapsed” from nearly 20% of their mix back down to pre-war levels.

“The tariffs are still on, but I would imagine there is a path to take them off,” Bessent noted, calling the outcome a “huge success.”

3. The “Mobility” Win: Beyond Goods to People

A surprising element of the Greer reaction was his focus on immigration and worker mobility. Greer noted that EU Commission President Ursula von der Leyen’s inclusion of “mobility rights” for Indian talent gives India a structural advantage that the U.S. currently restricts under its current H-1B caps.

4. Moody’s “Credit Positive” Confirmation

Backing Greer’s “heyday” sentiment, Moody’s Ratings updated its outlook for India this afternoon to “Credit Positive.” The agency cited the FTA’s ability to restore competitiveness for Indian textiles and gems—sectors that had been reeling under the 50% combined U.S. duties throughout late 2025.

5. The “Globalization” Divergence

The Greer reaction also exposed a deep rift between Washington and Brussels. Greer criticized the EU for “doubling down on globalization” at a time when the U.S. is trying to fix its internal supply chain problems. This suggests that while India wins, the U.S.-EU relationship may be entering its most volatile phase yet.

FAQ: Navigating the India Trade Reset-India Heyday Jamieson Greer

What exactly did Jamieson Greer say? Greer stated that India “comes out on top” in the deal with the EU, primarily due to increased market access and additional mobility (immigration) rights for Indian workers.

When will the U.S. remove the 25% tariffs on India? Scott Bessent has suggested a “pathway” is open now that Russian oil imports have collapsed, but no official date has been set. Analysts expect a staged withdrawal by Q3 2026.

Which sectors will lead the “Heyday”? Textiles, Apparel, and Leather are the immediate winners, as they transition from a 12% EU duty to 0%, making them 15-20% cheaper than Chinese competitors in Europe.

Final Verdict for CFOs

The India Heyday Jamieson Greer reaction confirms that India has successfully played both sides of the Atlantic. By cutting Russian oil to please Washington and signing a zero-duty deal with Brussels, New Delhi has cleared its path for a record-breaking 2026.

Disclaimer

The information provided on CFOSTimes is for informational and educational purposes only. It does not constitute professional financial, investment, or legal advice. Market conditions, government policies (including the India-EU FTA and U.S. tariff updates), and trade regulations are subject to rapid change. Readers are encouraged to consult with a certified financial advisor or legal expert before making any business or investment decisions based on the content of this article.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “India Heyday Jamieson Greer Expects a Global Trade Reset-5 Important Reasons”