Introduction: The $22 Billion Inflection Point

As of January 24, 2026, the global financial “plumbing” has reached a historic milestone. Data from RWA.xyz confirms that the total value of on-chain Tokenized Real-World Assets (RWA) has surpassed $22.59 billion.

While the early 2020s were defined by retail crypto speculation, 2026 is defined by institutional utility. From the halls of the Davos 2026 summit to the trading floors of Wall Street, the narrative has shifted from if assets will move on-chain to how fast they can be integrated into corporate balance sheets. This guide provides the strategic framework for CFOs and institutional investors to navigate this multi-trillion-dollar transition.

Table of Contents

1. What are Tokenized Real-World Assets RWA

Tokenization is the process of converting ownership rights of a physical or traditional financial asset—such as real estate, government bonds, private credit, or gold—into a digital token on a blockchain.

The 2026 Definition of “Programmable Value”

In 2026, RWA tokens are no longer just static digital receipts. They are programmable instruments. Through the use of advanced smart contracts, a tokenized share in a commercial building now automatically:

- Distributes pro-rata rental income in real-time.

- Enforces jurisdictional compliance (KYC/AML) at the protocol level.

- Enables instant collateralization in decentralized lending markets.

2. Why 2026 is the “Year of the Token”

Three critical pillars have converged this month to trigger an explosion in RWA adoption:

I. Regulatory De-Risking: The CLARITY and GENIUS Acts

The passage of the U.S. Digital Asset Market Clarity Act has provided the “rules of the road” that institutional legal teams demanded. Simultaneously, the Genius Act has prompted global jurisdictions—specifically Singapore, Dubai, and the EU—to accelerate their own frameworks, ensuring that tokenized assets are treated as legal securities with clear investor protections.

II. Institutional Migration: The BlackRock Effect

BlackRock’s BUIDL fund has officially become the “gold standard” for tokenized liquidity. By moving over $2 billion into tokenized U.S. Treasuries, BlackRock has proven that public blockchains are ready for enterprise-grade production. As noted in the BlackRock 2026 Investment Outlook, tokenization is now a core pillar of their “digital-first” asset management strategy.

III. Market Infrastructure Maturity

The successful NYSE listing of BitGo (Ticker: BTGO) on January 22, 2026, signaled that the infrastructure for RWA—custody, settlement, and insurance—is now a mature, multi-billion-dollar industry.

3. Top RWA Sectors Dominating 2026

The RWA market is not a monolith. Different asset classes are scaling at different velocities:

| Asset Class | On-Chain Value (Jan 2026) | Key Advantage | Top Platform |

| U.S. Treasuries | $9.20 Billion | “Risk-free” yield for digital cash. | Ondo Finance |

| Real Estate | $3.50 Billion | Fractional ownership and 24/7 trading. | Propy / RealT |

| Commodities | $4.10 Billion | Instant exposure to gold/silver. | Paxos (PAXG) |

| Private Credit | $2.80 Billion | Higher yields for institutional lenders. | Maple Finance |

The Rise of Tokenized Commodities

With silver prices hitting historic highs of $100/oz this week, tokenized silver has seen a 400% surge in volume. Institutional investors are using RWA platforms to gain silver exposure without the 15-20% physical premiums currently found in local bullion markets. Tokenized Real-World Assets RWA: 2026 Investment Guide

4. Strategic Benefits for the Modern CFO

For corporate treasurers, RWA tokenization offers more than just “efficiency.” It offers a fundamental shift in capital management.

Operational Cost Reduction: Automating dividend distributions and tax reporting via code can reduce administrative overhead by up to 40%.

T+0 Settlement: Unlike traditional markets that take 48 hours (T+2) to settle, tokenized assets settle in seconds. This eliminates “counterparty risk” and frees up billions in dormant capital.

Enhanced Collateral Mobility: In 2026, you can use your tokenized real estate or government bonds as collateral for a low-interest loan in USDC or JPM Coin instantly, without selling the underlying asset.

5. Managing the Risks: Security and Fragmentation

Despite the optimism at Davos 2026, RWA investment is not without challenges.

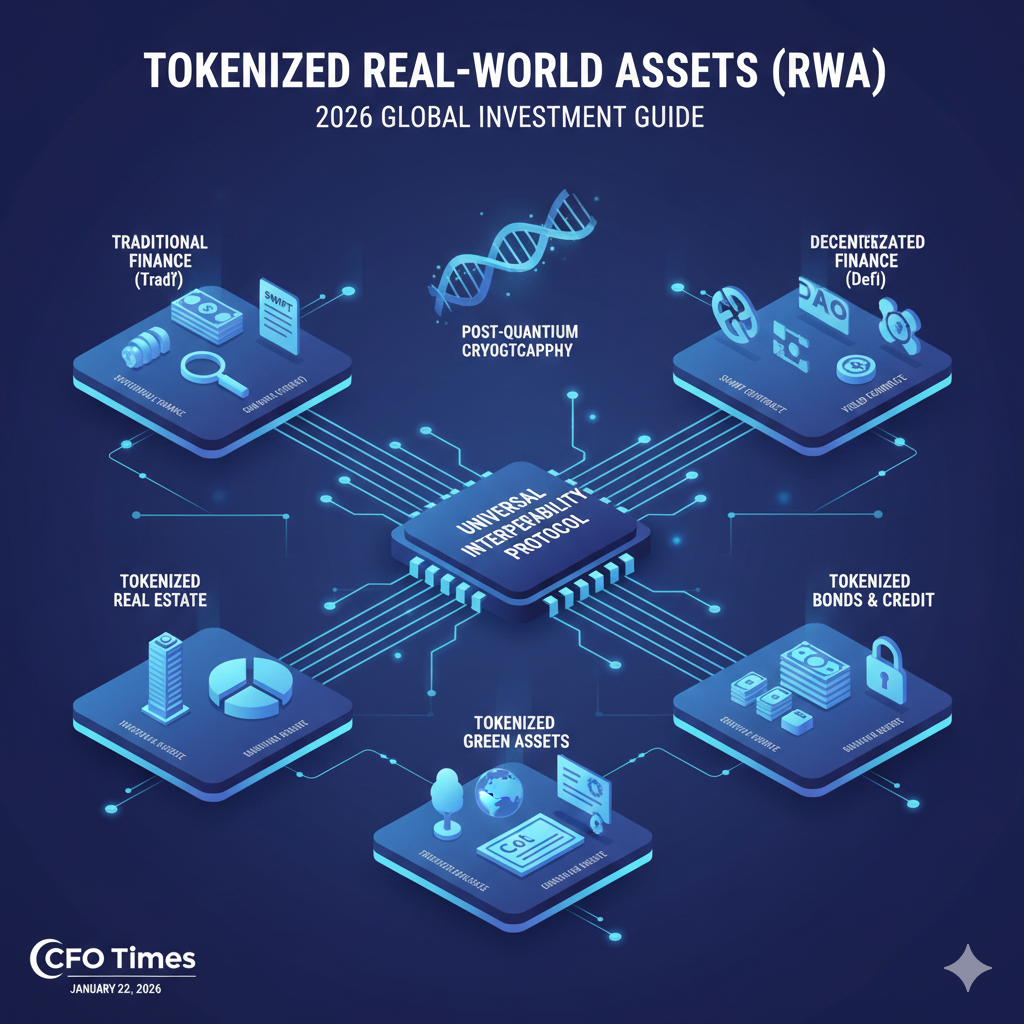

The Fragmentation Problem

Currently, tokenized assets are spread across different “liquidity islands”—Ethereum, Solana, and Avalanche. To solve this, the industry is moving toward Cross-Chain Interoperability Standards (like Chainlink’s CCIP) to ensure that a token minted on one chain can be traded or used as collateral on another.

Post-Quantum Security

As we head deeper into 2026, “Quantum-Resistant Cryptography” has become a mandatory requirement for RWA platforms. The IMF has recently issued guidelines urging platforms to migrate to quantum-secure signatures to protect the trillions in expected tokenized value.

6. FAQ: Tokenized Real-World Assets RWA

How do I start investing in RWAs?

In 2026, most major brokerages and “Neobanks” (like Revolut or Fidelity) have RWA portals. Most require a one-time KYC verification to access “whitelisted” tokens.

Are tokenized assets legal in the US?

Yes. Under the 2025/2026 regulatory shift, tokenized assets are generally treated as digital securities. They are regulated under existing SEC frameworks but with streamlined reporting requirements for DLT-based instruments.

What is the minimum investment for RWA?

Fractionalization allows for entry points as low as $10 to $100, making previously “exclusive” assets like London real estate or private equity funds accessible to all.

Conclusion: The End of Illiquidity

The transition to Tokenized Real-World Assets (RWA) is the most significant upgrade to the “financial plumbing” of the world in five decades. As we look at the data from January 24, 2026, the conclusion is clear: the wall between “traditional finance” and “digital assets” has finally crumbled. For the readers of CFOs Times, the future of ownership is digital, fractional, and liquid.

Disclaimer

Financial Risk Warning: The information provided on cfostimes.com regarding Tokenized Real-World Assets (RWA) is for educational purposes only. It does not constitute financial, legal, or investment advice. Tokenized assets are high-risk and can be subject to total loss. AdSense Compliance: This site uses cookies to personalize your experience. We do not promote unregulated financial products or guarantee returns. All claims are backed by publicly available data from the World Economic Forum and SEC.gov as of January 2026.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “Tokenized Real-World Assets RWA: 2026 Investment Guide”