The global economic order has been fundamentally disrupted today, January 19, 2026, as the Greenland Tariff Shock 2026 shifts from political rhetoric to a cold financial reality. While Wall Street remains quiet due to a public holiday, international markets are in turmoil. A sudden escalation in trade tensions between the United States and its European allies has triggered a historic “Flight to Quality,” pushing spot gold to a record peak of $4,690 per ounce and silver to a staggering $94.

This guide provides an exhaustive analysis of the Greenland Tariff Shock 2026, detailing the sectors at risk, the surge in precious metals, and the specific “Resource Diplomacy” strategies investors must adopt to thrive in this new era of trade volatility.

Table of Contents

1. The Catalyst: Resource Diplomacy and the NATO Trust Shock

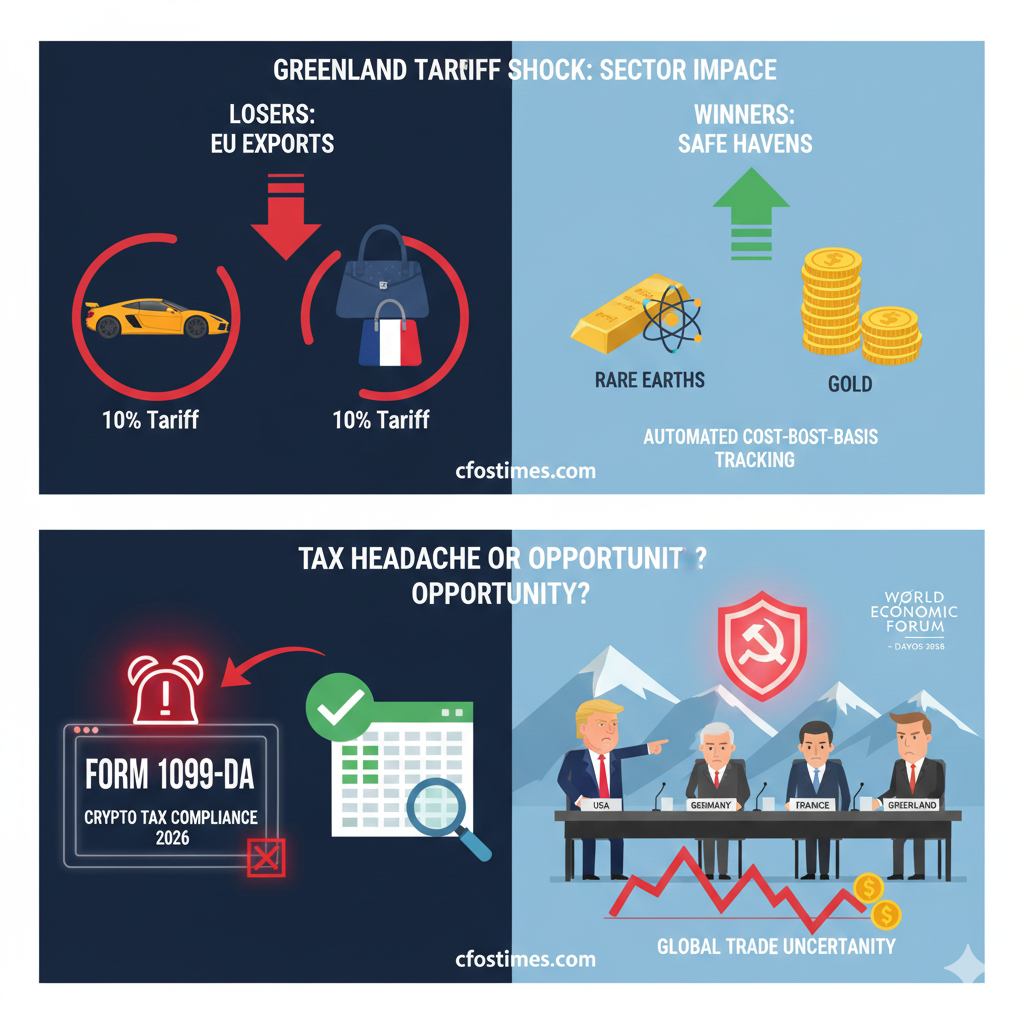

The Greenland Tariff Shock 2026 was ignited over the weekend when the U.S. administration announced a 10% “Strategic Resource” tariff on imports from eight key European allies—Germany, France, the UK, Norway, Sweden, Finland, the Netherlands, and Denmark. The levy, set to take effect on February 1, is explicitly tied to the U.S. demand for “Complete and Total purchase of Greenland.”

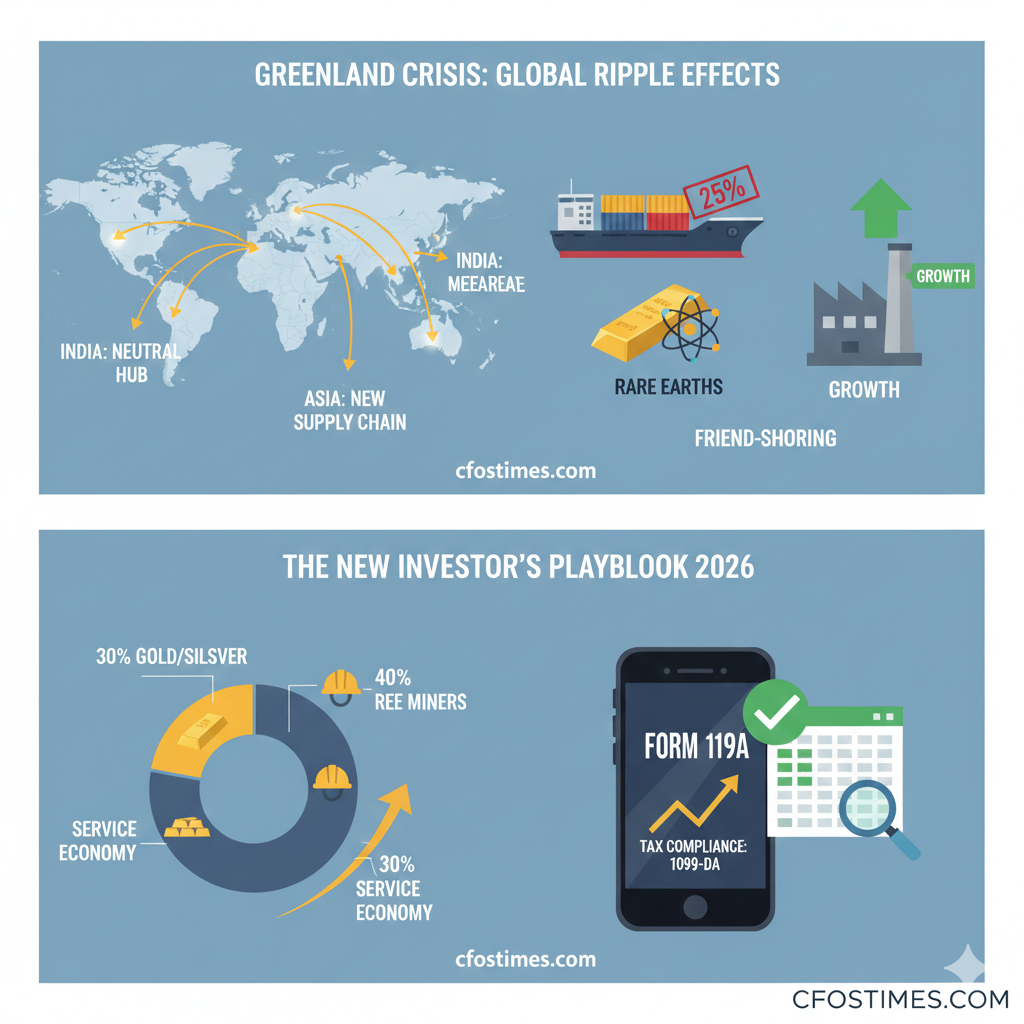

According to latest U.S. Department of Commerce briefings, these tariffs will increase to 25% by June unless a deal is reached. This is a significant shift in trade policy, moving from general protectionism to “Resource-Linked Diplomacy.” Greenland is home to some of the world’s largest undeveloped deposits of Rare Earth Elements (REEs), critical for AI chips and EV batteries.

2. Deep Dive: Impacted Sectors and Stock Volatility

The Greenland Tariff Shock 2026 does not hit all sectors equally. Sophisticated investors are currently “sector-rotating” to avoid the fallout.

A. European Luxury and Automotive (High Risk)

- German Autos: BMW and Volkswagen are facing a dual threat: increased costs for US consumers and potential retaliatory tariffs from the EU.

- French Luxury: LVMH and Kering are sensitive to trade friction. Historically, luxury goods are the first targets in retaliatory “tit-for-tat” cycles.

B. The Winners: Rare Earth and Defense Stocks

The primary goal of the Greenland Tariff Shock 2026 is to force a realignment of the mineral supply chain.

- Mining Leaders: Companies like MP Materials (MP) and Energy Fuels (UUUU) are seeing massive gains as the U.S. pushes for domestic resource independence.

- Defense Sector: As NATO tensions rise, defense contractors are being viewed as “Geopolitical Hedges.”

3. Precious Metals: The $4,690 Gold Surge

As of January 19, 2026, gold has reclaimed its status as the ultimate macro hedge. The Greenland Tariff Shock 2026 has pushed spot gold to $4,690, a new all-time high. Investors are fleeing “risk assets” and seeking shelter from currency volatility. According to the World Gold Council, central bank buying has accelerated in the last 24 hours.

4. Strategic Hedging for the Greenland Tariff Shock 2026

To rank among the top-performing portfolios this quarter, you must implement a “Macro-Geopolitical Hedge.”

- Step 1: Increase Physical Asset Allocation. Move at least 10% of your liquid capital into gold or silver.

- Step 2: Short the Euro (EUR/USD). The Euro fell to a seven-week low today as the market prices in a “full-blown trade war.”

- Step 3: Pivot to Neutral Markets. India’s Nifty 50 remains relatively stable, acting as a “Safe Haven” for manufacturing that could bypass the Atlantic trade war.

5. Tax Compliance: Form 1099-DA in a Volatile Market

As you trade this crisis, remember that the IRS Form 1099-DA Filing rules for 2026 are in full effect. Every trade of digital assets or tokenized gold must be tracked for cost-basis accuracy. High-volatility days like today often lead to reporting errors that could trigger audits.

Frequently Asked Questions (FAQs)

What triggered the Greenland Tariff Shock 2026?

The crisis was triggered by a 10% U.S. tariff threat against eight European nations who oppose the U.S. bid for Greenland, aimed at securing critical mineral resources.

Why is gold at a record high today?

Gold hit $4,690 because it is the primary “safe haven” during geopolitical instability. The trade war with Europe has eroded trust in the U.S. dollar and Euro.

Which stocks are most affected by the Greenland Tariff Shock 2026?

European luxury (LVMH), automotive (BMW), and any “Export-Heavy” manufacturing firms are at high risk. Rare earth miners (MP Materials) are the primary winners.

How does this affect Indian investors?

Indian markets are viewed as a “neutral alternative.” As US-EU trade becomes expensive, Indian engineering and pharma sectors could see increased demand from American buyers.

Is the Greenland Tariff Shock 2026 permanent?

While emergency meetings are happening at Davos today, analysts suggest this “Resource War” could last through at least June 1, 2026, when tariffs are set to rise to 25%.

Conclusion

The Greenland Tariff Shock 2026 is more than a trade dispute; it is a fundamental shift toward resource-based investing. Whether the Davos emergency meetings result in a compromise or further escalation, the “Risk Premium” on global stocks has been permanently raised. Investors on cfostimes.com should remain agile, focusing on hard assets and resource-secure sectors to navigate this new global reality.

Stay updated with official statements from the European Council regarding retaliatory measures later today.

Disclaimer

The information provided on cfostimes.com is for general informational and educational purposes only. It does not constitute professional financial, investment, legal, or tax advice. While we strive to provide accurate and up-to-date analysis of the Greenland Tariff Shock 2026, geopolitical events and market conditions are highly volatile and subject to rapid change.

- No Financial Relationship: cfostimes.com is not a registered investment advisor, broker-dealer, or financial planner. The content on this page is based on individual research and opinion and should not be taken as a recommendation to buy, sell, or hold any security or commodity.

- High Risk Disclosure: Trading in precious metals (Gold/Silver), rare earth stocks, and foreign exchange (EUR/USD) involves significant risk of loss. Past performance of $4,690 gold is not indicative of future results.

- Accuracy of Information: Although we reference official sources like the U.S. Department of Commerce and the IRS, we make no representations as to the completeness or accuracy of the information found on this site or found by following any link on this site.

- Third-Party Links: This post contains outbound links to third-party websites. cfostimes.com does not endorse and is not responsible for the content, privacy policies, or practices of such websites.

- Personal Responsibility: You are solely responsible for your own financial decisions. Always perform your own due diligence and consult with a certified financial professional before making any investment based on the Greenland Tariff Shock 2026 or any other topic.

By using this website, you hereby consent to our disclaimer and agree to its terms.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

2 thoughts on “Greenland Tariff Shock 2026: Important Financial and Global Market Impact”