Today, January 9, 2026, the global financial landscape is reacting to the first major data release of the year. The US Nonfarm Payrolls January 2026 report, published this morning by the Bureau of Labor Statistics (BLS), has unveiled a labor market in the midst of a historic structural pivot. Against a backdrop of the One Big Beautiful Bill Act (OBBBA) and the newly implemented GENIUS Act, the US Nonfarm Payrolls January 2026 data provides the definitive roadmap for investors and CFOs in the first quarter of the new year.

The US Nonfarm Payrolls January 2026 headline figure arrived at +60,000 jobs, aligning with the top end of consensus ranges and successfully navigating the “productivity paradox” currently sweeping the private sector.

1. Key Highlights: US Nonfarm Payrolls January 2026

The US Nonfarm Payrolls January 2026 report is characterized by “intentional cooling.” After a period of aggressive post-shutdown hiring in late 2025, firms are now prioritizing efficiency over raw headcount expansion.

The Macro Indicators

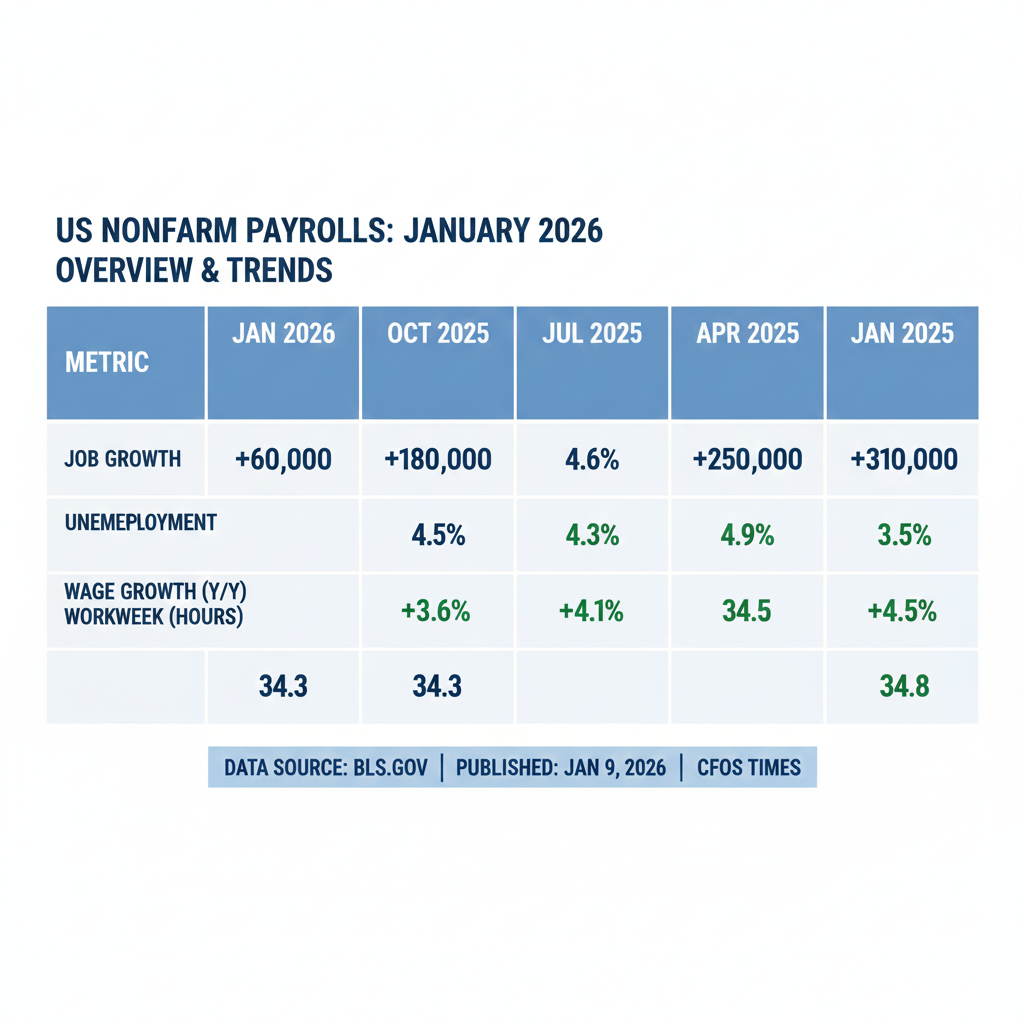

- Job Additions: +60,000 (US Nonfarm Payrolls January 2026 actual).

- Unemployment Rate: 4.5% (A decline from the 4.6% high seen in November).

- Average Hourly Earnings (Y/Y): +3.6% (Indicating steady but non-inflationary wage growth).

- Average Workweek: 34.3 hours (Consistent with the previous month).

The data suggests that while the economy is adding fewer roles, the roles being added are of higher value, particularly in the tech-integrated service sectors.

2. OBBBA Legislative Impact

The One Big Beautiful Bill Act (OBBBA), which made several Tax Cuts and Jobs Act (TCJA) provisions permanent in late 2025, has fundamentally altered the incentives reported in the US Nonfarm Payrolls January 2026 figures.

The “No Tax on Overtime” Effect

The OBBBA’s landmark “Overtime Deduction” allows workers to deduct up to $12,500 of qualified overtime compensation. As evidenced by the US Nonfarm Payrolls January 2026 report, this has led companies to increase the hours of their current workforce rather than hiring new employees. This shift explains why the “Unemployment Rate” dropped to 4.5% even though the “Nonfarm Payrolls” growth remained moderate.

3. The GENIUS Act and US Nonfarm Payrolls January 2026

Technology and regulatory clarity are now driving hiring trends. The Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act) has provided the “bespoke fintech license” necessary for a new national payments rail.

Financial Sector Resilience

The US Nonfarm Payrolls January 2026 report shows that the financial services sector remains a top contributor to job stability. With the GENIUS Act standardizing stablecoin reserves on a 1-to-1 basis with Treasury bills, institutional trust has returned to fintech. This has created a “hiring floor” for compliance, audit, and blockchain engineering roles.

4. Market Reaction

Global markets have responded to the US Nonfarm Payrolls January 2026 release with measured optimism.

- DXY (US Dollar Index): Rose to 98.92 as the data signaled a “steady” rather than “stalling” US economy.

- GIFT Nifty & Indian Markets: The Nifty 50 remained resilient, holding support near the 25,850 level. The US Nonfarm Payrolls January 2026 report suggests that a US recession is not imminent, which prevents a massive flight of capital from emerging markets.

- Gold Prices: Slipped slightly toward $4,455 as Treasury yields climbed following the “better than feared” labor data.

5. Federal Reserve Outlook Post-US Nonfarm Payrolls January 2026

The Federal Reserve’s January 28 meeting will be heavily influenced by today’s US Nonfarm Payrolls January 2026 data. With unemployment trending down and productivity rising at a 4.9% annualized rate (as of Q3 2025 data), the Fed is likely to “hold steady.”

The US Nonfarm Payrolls January 2026 report validates the “wait and see” approach, as wage growth remains controlled at 3.6%. This allows the Fed to keep rate cut options open for late Q1 or early Q2 without reigniting inflation.

6. Conclusion: Decoding US Nonfarm Payrolls January 2026

In summary, the US Nonfarm Payrolls January 2026 release confirms that the US labor market is in a “quality over quantity” phase. The synergy between the OBBBA tax incentives and the GENIUS Act’s regulatory clarity has created a resilient economic foundation.

For CFOs and investors, the US Nonfarm Payrolls January 2026 report indicates that the “soft landing” is in full effect. The focus must now shift to internal productivity and leveraging the new tax deductions provided under the 2026 Trump tax plan.

For official government data and the original news release, please visit the U.S. Bureau of Labor Statistics (BLS) Official Website.

FAQs: US Nonfarm Payrolls January 2026

Q1: What were the actual job additions in the US Nonfarm Payrolls January 2026 report? The US economy added 60,000 jobs, exceeding the consensus estimate of 55,000.

Q2: Why did the unemployment rate fall in the US Nonfarm Payrolls January 2026 report? The rate fell to 4.5% primarily due to increased labor absorption and shifts in participation as the post-shutdown economy stabilized.

Q3: Does the US Nonfarm Payrolls January 2026 report affect the OBBBA overtime rules? The report reflects the success of the OBBBA’s “No Tax on Overtime” policy, as firms are utilizing more hours from existing staff rather than seeking new hires.

Q4: How did the GENIUS Act influence the US Nonfarm Payrolls January 2026 financial data? The GENIUS Act’s regulatory framework for stablecoins has stabilized the fintech sector, leading to consistent, albeit moderate, hiring in financial technology roles.

Q5: What is the significance of the 3.6% wage growth in US Nonfarm Payrolls January 2026? This level of wage growth is considered “neutral”—high enough to support consumer spending but low enough to prevent the Federal Reserve from hiking rates further.

Disclaimer & Disclosure

Educational Purpose Only: This analysis of the US Nonfarm Payrolls January 2026 report is for informational purposes and does not constitute financial, tax, or legal advice.

Risk Warning: Investing in financial markets involves high risk. Past performance (2025 data) does not guarantee future results. Consult a certified professional before taking action.

Data Accuracy: While we use official BLS sources, data is provided “as-is” and is subject to government revisions. CFOsTimes is not liable for errors or omissions.

Third-Party Links: We are not responsible for the content or privacy policies of external websites linked in this report.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.

1 thought on “US Nonfarm Payrolls January 2026: Important Economic Transformation”