Entering 2026, the financial landscape has shifted. While inflation has stabilized compared to the mid-2020s peaks, interest rates remain higher than the historical lows of the previous decade. This unique economic environment changes the calculus for debt repayment. The decision between the Debt Snowball vs Avalanche Method is no longer just about preference—it is about strategic financial survival.

This ultimate guide will break down the mathematics, the psychology, and the 2026-specific factors you need to consider to become debt-free this year.

The 2026 Financial Landscape: Why Your Strategy Matters

Before diving into the methods, it is crucial to understand the playing field. In 2026, borrowers are facing “sticky” interest rates. Credit card APRs remain elevated, and variable-rate loans are more costly than they were five years ago.

- The Cost of Waiting: With higher APRs, the “cost of carrying debt” is steeper. This gives the Avalanche method (mathematical efficiency) a significant edge in 2026.

- The Inflation Factor: As daily costs remain high, monthly cash flow is tight. This gives the Snowball method (freeing up minimum payments quickly) a strong psychological and practical argument.

Choosing the right path depends on whether you are fighting a mathematical battle (high interest) or a behavioral one (need for motivation).

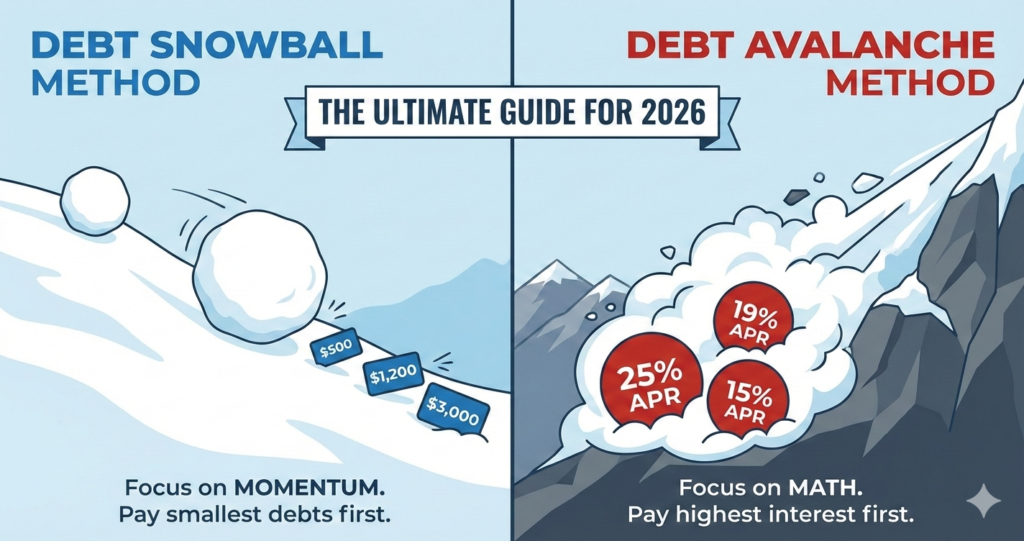

What is the Debt Snowball Method?

The Debt Snowball Method prioritizes momentum. You ignore interest rates entirely and focus on the size of the balance. This strategy was popularized by financial experts who argue that personal finance is 20% head knowledge and 80% behavior.

How It Works

- List your debts from smallest balance to largest balance.

- Pay minimums on everything except the smallest debt.

- Attack the smallest debt with every extra dollar you can find.

- Roll it over: Once the smallest debt is gone, take the money you were paying on it (plus the minimum) and apply it to the next smallest debt.

- Repeat until debt-free.

The 2026 Verdict on Snowball

Pros:

- Immediate Wins: In a stressful 2026 economy, clearing a $500 medical bill in month one provides a massive psychological relief.

- Cash Flow Flexibility: By eliminating individual debts quickly, you remove their minimum monthly payments, giving you more breathing room in your monthly budget sooner.

Cons:

- Higher Cost: You will mathematically pay more in interest over time because you might be ignoring a 29% APR credit card to pay off a 5% APR personal loan just because the loan balance is smaller.

What is the Debt Avalanche Method?

The Debt Avalanche Method prioritizes mathematics. It is designed to minimize the amount of interest you pay to lenders, getting you out of debt with the most money left in your pocket.

How It Works

- List your debts from highest interest rate (APR) to lowest interest rate.

- Pay minimums on everything except the debt with the highest APR.

- Attack the highest APR debt with every extra dollar.

- Roll it over: Once the highest interest debt is killed, move the funds to the next highest rate.

- Repeat.

The 2026 Verdict on Avalanche

Pros:

- Maximum Savings: With 2026 credit card rates averaging over 20%, this method can save you thousands of dollars compared to the Snowball.

- Faster Exit: Mathematically, this method always results in becoming debt-free sooner because you are neutralizing the compound interest working against you.

Cons:

- Delayed Gratification: If your highest interest debt is also your largest balance (e.g., a $15,000 credit card balance), it may take months or years to see the first debt completely disappear. This requires immense discipline.

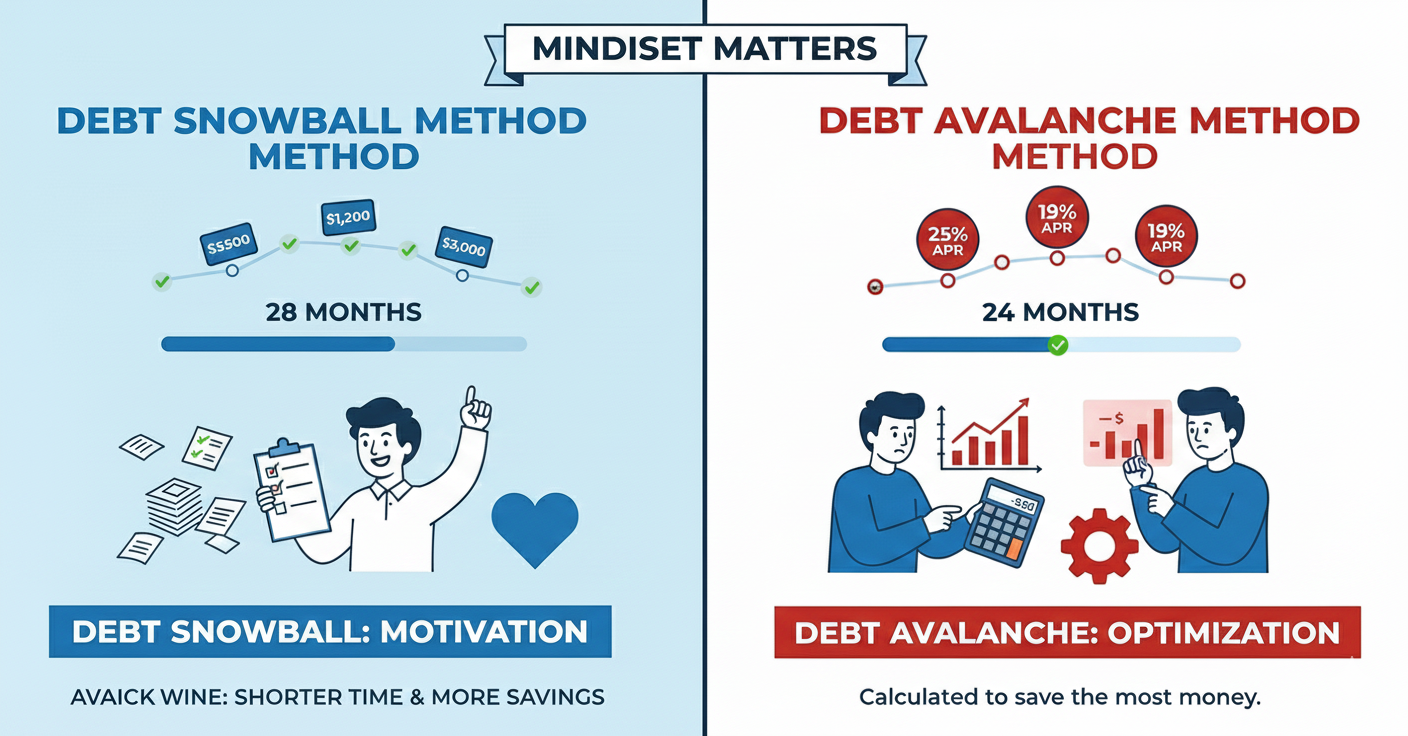

Debt Snowball vs Avalanche Method: A Direct Comparison

To help you visualize the difference, here is a comparison based on a typical 2026 debt profile.

| Feature | Debt Snowball | Debt Avalanche |

| Primary Focus | Behavior & Motivation | Math & Interest Savings |

| Ordering Strategy | Smallest to Largest Balance | Highest to Lowest Interest Rate |

| Psychological Benefit | Quick wins build momentum (“I can do this!”) | Knowledge that you are saving money (“I’m efficient!”) |

| Total Interest Paid | Higher | Lower (Mathematically Optimal) |

| Duration to Debt Free | Slightly Longer | Shortest Possible Time |

| Best For… | People who lose motivation easily or have tight cash flow. | Analytical people who hate paying interest to banks. |

Which Method Wins in 2026? Debt Snowball vs Avalanche Method

The “best” method is the one you will actually stick to. However, we can look at specific scenarios relevant to the current year.

Choose Avalanche If:

- You have high-interest Credit Card debt: If you are carrying balances with 25%+ APR, the Avalanche is almost mandatory. The interest accumulation at these rates is destructive to wealth building.

- You are logically driven: If seeing a spreadsheet showing $2,000 in saved interest motivates you more than crossing a small debt off a list, this is your path.

Choose Snowball If:

- You are burned out: If you feel overwhelmed by the number of bills arriving in the mail, Snowball reduces that number fastest.

- Your interest rates are similar: If all your debts are within 2-3% APR of each other, the mathematical advantage of Avalanche is negligible. Take the psychological win of the Snowball.

Step-by-Step Action Plan for 2026–Debt Snowball vs Avalanche Method

Regardless of the method you choose, the execution steps remain consistent.

1. The Audit

Log into every account. Do not guess. Write down the Current Balance, Interest Rate, and Minimum Monthly Payment.

- Resource: Use the Consumer Financial Protection Bureau’s Debt Worksheet to organize your liabilities.

2. The Cut

To make either method work, you need “snowball” or “avalanche” money—funds above the minimum payments.

- Audit your subscriptions (streaming, software, boxes).

- Call service providers to negotiate rates (internet, insurance).

- Tip: In 2026, many gig economy apps have matured. Consider a short-term side hustle dedicated 100% to debt repayment.

3. The Automation

Willpower is a finite resource; automation is forever.

- Set up autopay for the minimum payments on all debts to avoid late fees.

- Manually push the extra payments to your target debt (Smallest for Snowball, Highest Rate for Avalanche) immediately on payday.

4. The Monitoring

Track your progress visually. A physical chart on the fridge or a digital spreadsheet can provide the dopamine hit needed to keep going.

Frequently Asked Questions (FAQs)–Debt Snowball vs Avalanche Method

Q: Can I switch between methods?

A: Yes. Many people start with the Snowball to clear 2-3 small annoying debts and build confidence, then switch to the Avalanche to tackle the larger, high-interest beasts. This is often called a “Hybrid Approach.” Debt Snowball vs Avalanche Method

Q: Should I consolidate my debt instead?

A: Consolidation can lower your interest rate, which helps, but it doesn’t pay off the debt for you. It simplifies the payments. Be careful not to run up the credit cards again after consolidating.

- Resource: Read about consolidation risks at USA.gov’s Debt Advice page.

Q: How does student loan forgiveness affect this?

A: As of 2026, federal student loan policies may have shifted. Always check the official status of your loans before aggressively paying them off if forgiveness is pending. Generally, private student loans (which are rarely forgiven) should be included in your Avalanche/Snowball plan.

- Resource: Verify your loan status at StudentAid.gov.

Q: Is it better to invest or pay off debt in 2026?

A: Compare the guaranteed return of debt payoff (e.g., saving 22% interest) vs. the potential return of the market (historically 8-10%). Paying off high-interest debt is usually the safer, more profitable bet. However, always ensure you are getting any employer 401(k) match first—that is free money. Debt Snowball vs Avalanche Method

Conclusion–Debt Snowball vs Avalanche Method

The debate of Debt Snowball vs Avalanche Method ultimately comes down to knowing yourself. In 2026, with interest rates punishing those who wait, the most important action is to start today.

If you need a quick win to believe it’s possible, grab the Snowball. If you want to crush the banks mathematically, trigger the Avalanche. Debt Snowball vs Avalanche Method

Personal Debt Payoff Calculator

Create a customized plan to become debt-free faster-Debt Snowball vs Avalanche Method

Your Debts

Payoff Strategy

Avalanche Method

Pay highest interest first (save money)

Snowball Method

Pay smallest balance first (build momentum)

💡 Tip

Avalanche method saves more on interest, while Snowball method provides quicker wins to stay motivated.-Debt Snowball vs Avalanche Method

Disclaimer

This Is Not Financial Advice. The information in this article on CFOsTimes.com is for general educational purposes only and does not constitute financial, investment, or tax advice. Investing involves risk, including the possible loss of principal. Everyone’s financial situation is unique, so before making any investment decisions, consider speaking with a licensed financial advisor or tax professional in your country.

Dr. Dinesh Kumar Sharma is an award-winning Chief Financial Officer and Director of Finance with over 25 years of expertise in strategic planning and digital transformation. Recognized as a five-time CFO of the Year, he specializes in leveraging Generative AI and Microsoft Copilot to optimize financial forecasting and cost management. Dr. Sharma holds a Doctorate in Management (Finance) and has successfully scaled organizations from INR 1 billion to INR 7 billion. He is dedicated to providing transparent, data-driven insights for modern decision-makers at CFOs Times.